Question: Please find intrinsic value using the DCF Model using FFO Perpetuity (P): Can be used for initial and terminal values. Gordon Growth (GG): Can be

Please find intrinsic value using the DCF Model using FFO

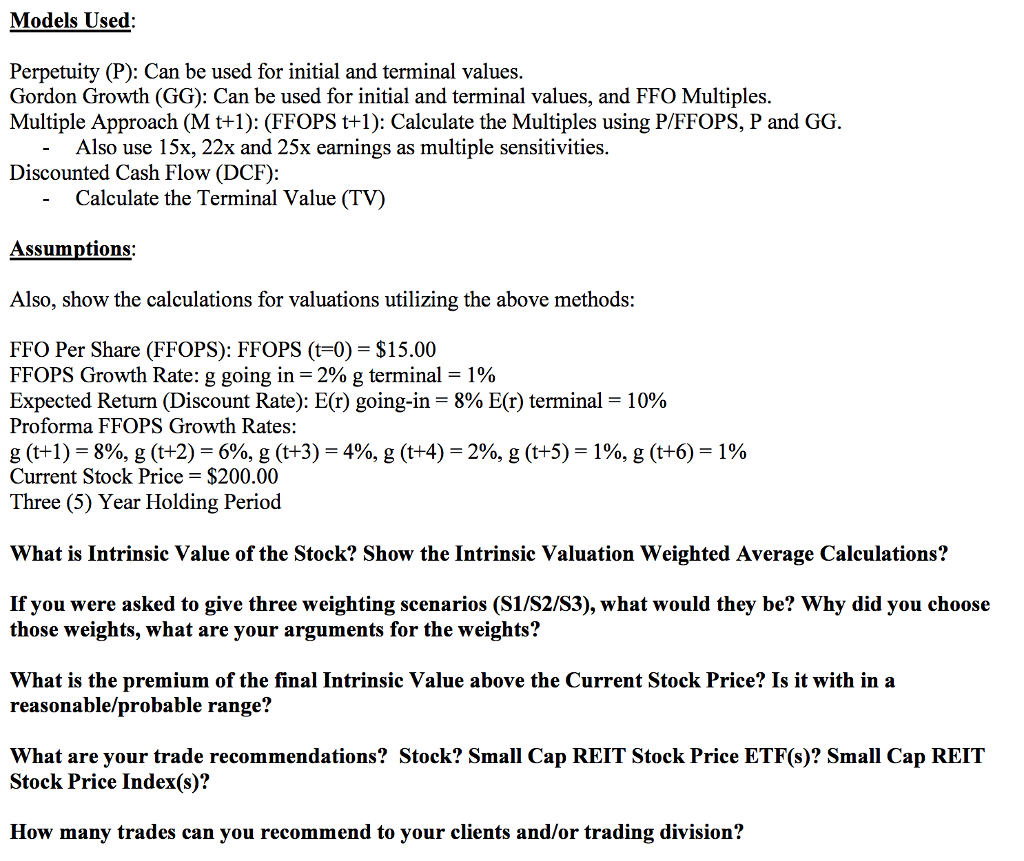

Perpetuity (P): Can be used for initial and terminal values. Gordon Growth (GG): Can be used for initial and terminal values, and FFO Multiples. Multiple Approach (Mt + 1): (FFOPS t + 1): Calculate the Multiples using P/FFOPS, P and GG. -Also use 15x, 22x and 25x earnings as multiple sensitivities. Discounted Cash Flow (DCF): Calculate the Terminal Value (TV) Also, show the calculations for valuations utilizing the above methods: FFO Per Share (FFOPS): FFOPS (t = 0) = $15.00 FFOPS Growth Rate: g going in = 2% g terminal = 10% Expected Return (Discount Rate): E (r) going-in = 8% E (r) terminal = 10% Proforma FFOPS Growth Rates: g (t + 1) = 8%, g (t + 2) = 6%, g (t + 3) = 4%, g (t + 4) = 2%, g (t + 5) = 1%, g (t + 6) = 1% Current Stock Price = $200.00 Three (5) Year Holding Period What is Intrinsic Value of the Stock? Show the Intrinsic Valuation Weighted Average Calculations? If you were asked to give three weighting scenarios (S1/S2/S3), what would they be? Why did you choose those weights, what are your arguments for the weights? What is the premium of the final Intrinsic Value above the Current Stock Price? Is it with in a reasonable/probable range? What are your trade recommendations? Stock? Small Cap REIT Stock Price ETF (s)? Small Cap REIT Stock Price Index (s)? How many trades can you recommend to your clients and/or trading division

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts