Question: Please find missing info #1, #2, and #3. Thank you! Consider the following two assets: Asset A's expected return is 10% and return standard deviation

Please find missing info #1, #2, and #3. Thank you!

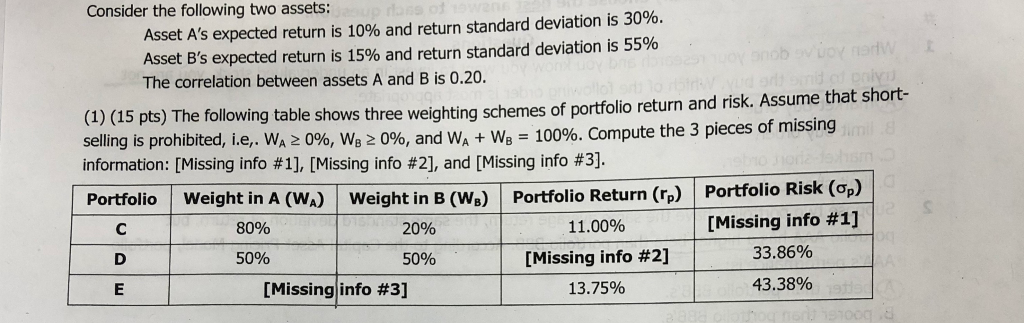

Consider the following two assets: Asset A's expected return is 10% and return standard deviation is 30%. Asset B's expected return is 15% and return standard deviation is 55% The correlation between assets A and B is 0.20. (1) (15 pts) Th selling is prohibited, ie, . W,2 0%, wo2 096, and Wa + wB- information: [Missing info #1], [Missing info #2], and [Missing info #3]. e following table shows three weighting schemes of portfolio return and risk. Assume that short- 100%. Compute the 3 pieces of missing Portfolio Weight in A (W) Weight in B (Ws) Portfolio Return (r,) Portfolio Risk (op) [Missing info #1] 33.86% 43.38% | 11.00% [Missing info #2] 13.75% 8090 20% 50% 50% [Missing info #31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts