Question: please find my attached question and need solution by steps... Best regards Question two: on the 1 July 2013, Alma Lid purchased 40% of the

please find my attached question and need solution by steps... Best regards

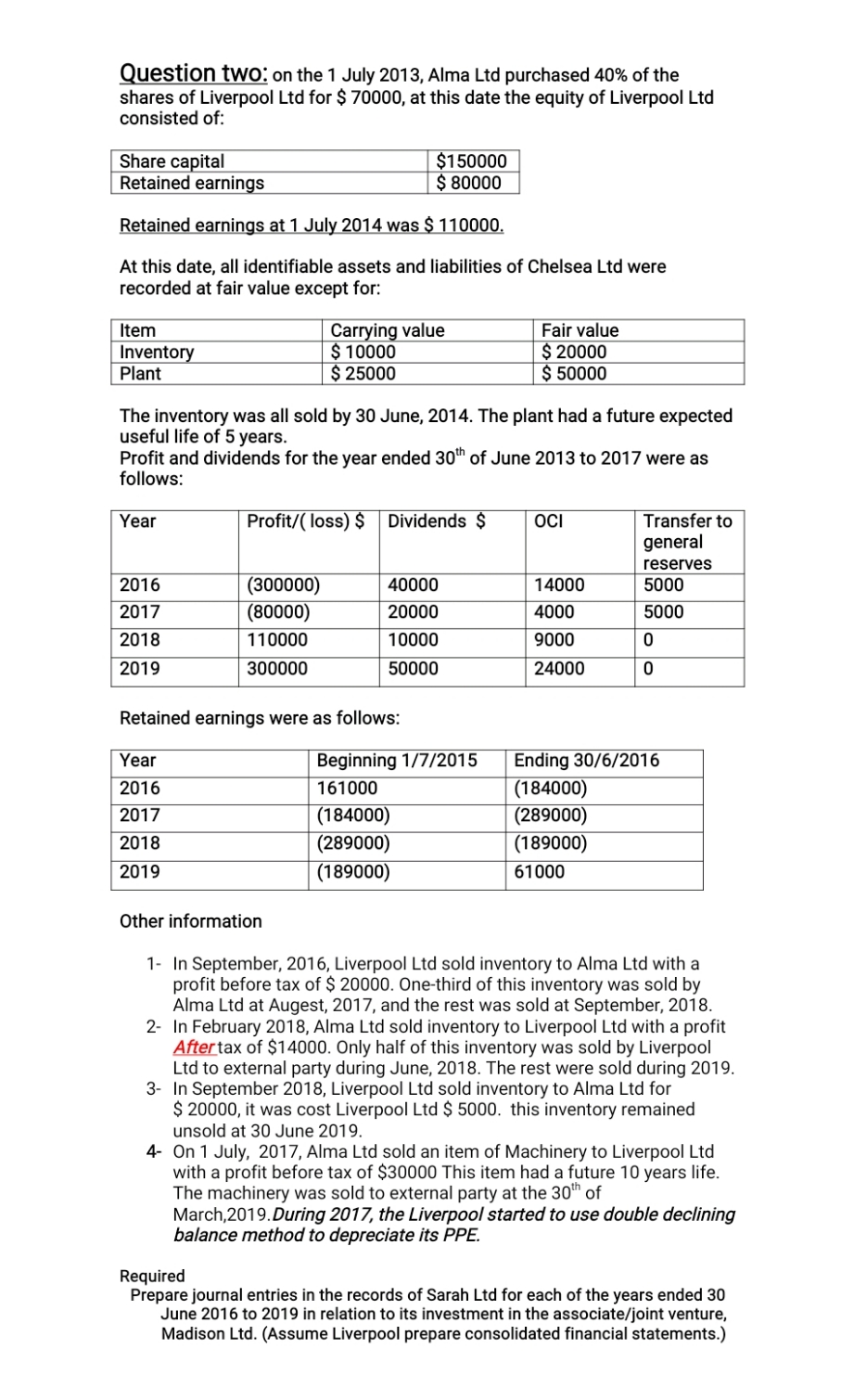

Question two: on the 1 July 2013, Alma Lid purchased 40% of the shares of Liverpool Lid for $ 70000, at this date the equity of Liverpool Ltd consisted of: Share capital $150000 Retained earnings $ 80000 Retained earnings at 1 July 2014 was $ 110000. At this date, all identifiable assets and liabilities of Chelsea Ltd were recorded at fair value except for: Item Carrying value Fair value Inventory $ 10000 $ 20000 Plant $ 25000 $ 50000 The inventory was all sold by 30 June, 2014. The plant had a future expected useful life of 5 years. Profit and dividends for the year ended 30" of June 2013 to 2017 were as follows: Year Profit/( loss) $ Dividends $ OCI Transfer to general reserves 2016 (300000) 40000 14000 5000 2017 (80000) 20000 4000 5000 2018 110000 10000 9000 0 2019 300000 50000 24000 0 Retained earnings were as follows: Year Beginning 1/7/2015 Ending 30/6/2016 2016 161000 (184000) 2017 (184000) (289000) 2018 (289000) (189000) 2019 (189000) 61000 Other information 1- In September, 2016, Liverpool Ltd sold inventory to Alma Lid with a profit before tax of $ 20000. One-third of this inventory was sold by Alma Lid at Augest, 2017, and the rest was sold at September, 2018. 2- In February 2018, Alma Lid sold inventory to Liverpool Ltd with a profit Aftertax of $14000. Only half of this inventory was sold by Liverpool Ltd to external party during June, 2018. The rest were sold during 2019. 3- In September 2018, Liverpool Lid sold inventory to Alma Lid for $ 20000, it was cost Liverpool Lid $ 5000. this inventory remained unsold at 30 June 2019. 4- On 1 July, 2017, Alma Lid sold an item of Machinery to Liverpool Ltd with a profit before tax of $30000 This item had a future 10 years life. The machinery was sold to external party at the 30" of March,2019. During 2017, the Liverpool started to use double declining balance method to depreciate its PPE. Required Prepare journal entries in the records of Sarah Lid for each of the years ended 30 June 2016 to 2019 in relation to its investment in the associate/joint venture, Madison Ltd. (Assume Liverpool prepare consolidated financial statements.)