Question: Please find my attached question and need solution by steps... Best regards Question one: on the 1 July 2013, Alma Ltd purchased 40% of the

Please find my attached question and need solution by steps... Best regards

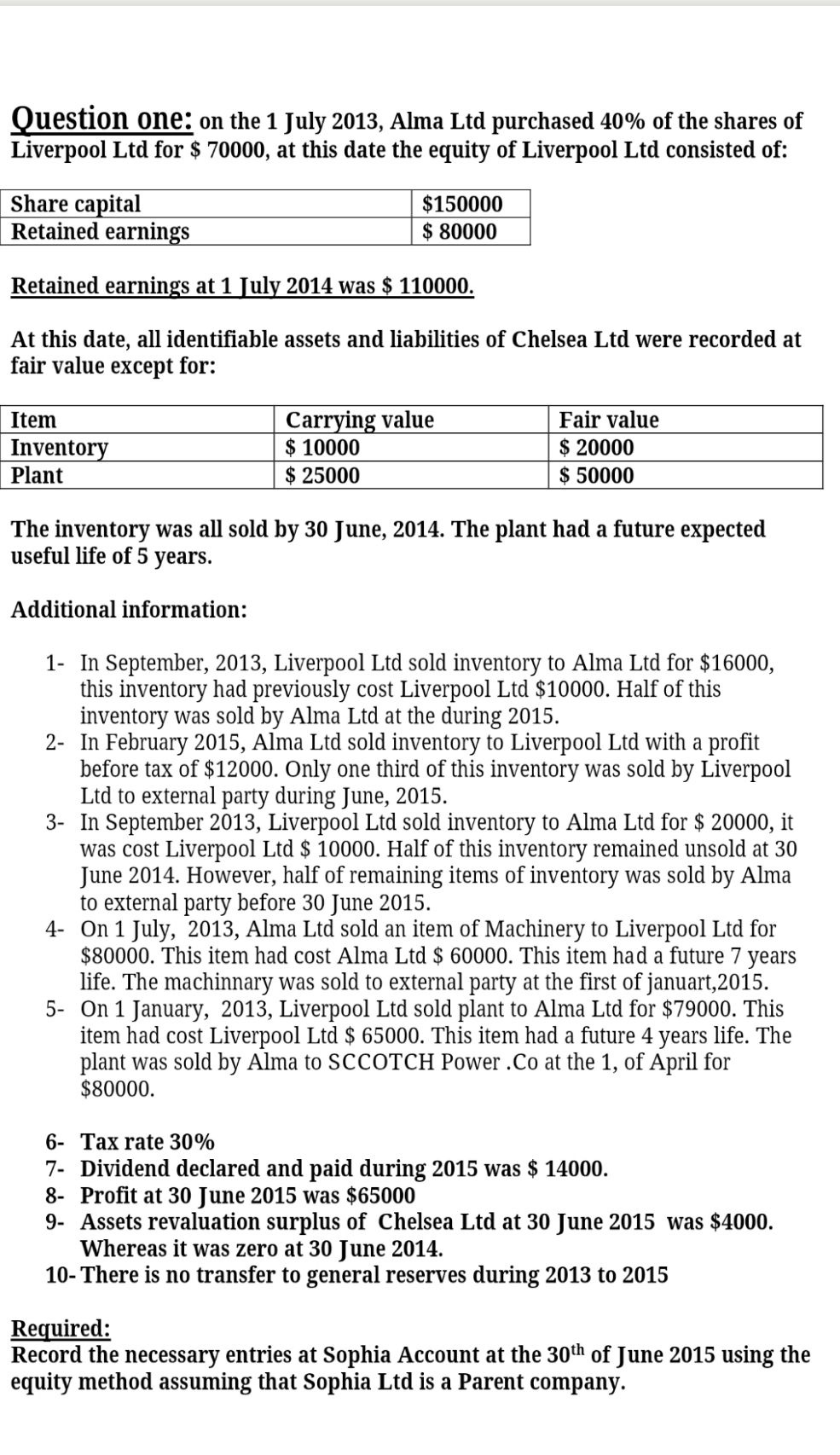

Question one: on the 1 July 2013, Alma Ltd purchased 40% of the shares of Liverpool Ltd for $ 70000, at this date the equity of Liverpool Ltd consisted of: Share capital $150000 Retained earnings $ 80000 Retained earnings at 1 July 2014 was $ 110000. At this date, all identifiable assets and liabilities of Chelsea Ltd were recorded at fair value except for: Item Carrying value Fair value Inventory $ 10000 $ 20000 Plant $ 25000 $ 50000 The inventory was all sold by 30 June, 2014. The plant had a future expected useful life of 5 years. Additional information: 1- In September, 2013, Liverpool Lid sold inventory to Alma Lid for $16000, this inventory had previously cost Liverpool Lid $10000. Half of this inventory was sold by Alma Lid at the during 2015. 2- In February 2015, Alma Ltd sold inventory to Liverpool Ltd with a profit before tax of $12000. Only one third of this inventory was sold by Liverpool Ltd to external party during June, 2015. 3- In September 2013, Liverpool Lid sold inventory to Alma Lid for $ 20000, it was cost Liverpool Lid $ 10000. Half of this inventory remained unsold at 30 June 2014. However, half of remaining items of inventory was sold by Alma to external party before 30 June 2015. 4- On 1 July, 2013, Alma Ltd sold an item of Machinery to Liverpool Lid for $80000. This item had cost Alma Ltd $ 60000. This item had a future 7 years life. The machinnary was sold to external party at the first of januart, 2015. 5- On 1 January, 2013, Liverpool Ltd sold plant to Alma Lid for $79000. This item had cost Liverpool Ltd $ 65000. This item had a future 4 years life. The plant was sold by Alma to SCCOTCH Power . Co at the 1, of April for $80000. 6- Tax rate 30% 7- Dividend declared and paid during 2015 was $ 14000. 8- Profit at 30 June 2015 was $65000 9- Assets revaluation surplus of Chelsea Ltd at 30 June 2015 was $4000. Whereas it was zero at 30 June 2014. 10-There is no transfer to general reserves during 2013 to 2015 Required: Record the necessary entries at Sophia Account at the 30th of June 2015 using the equity method assuming that Sophia Ltd is a Parent company