Question: Please find solution for me and thank you Document4 - Word 9 Search Iphton Louis IL ert Draw Design Layout References Mailings Review View Help

Please find solution for me and thank you

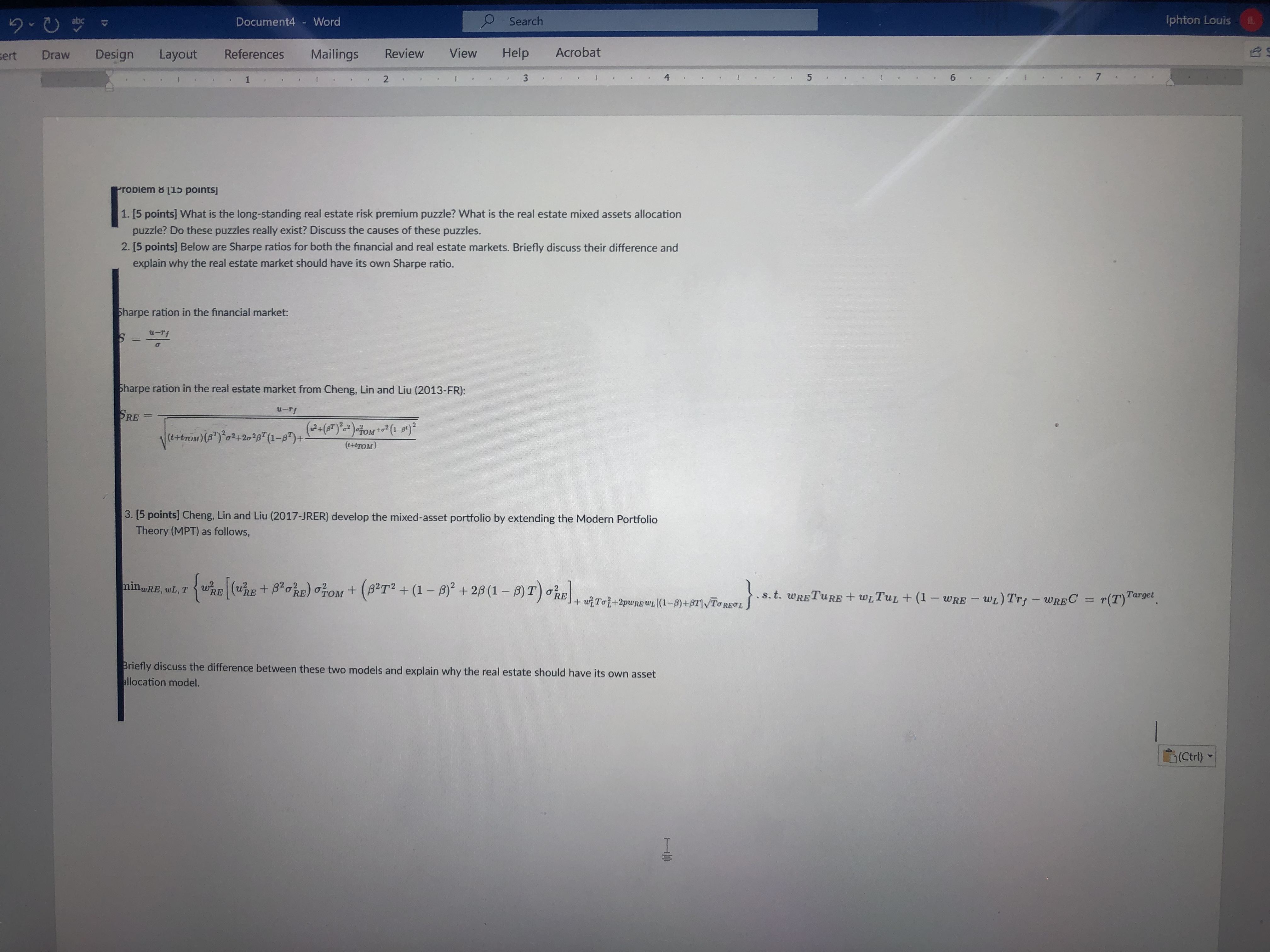

Document4 - Word 9 Search Iphton Louis IL ert Draw Design Layout References Mailings Review View Help Acrobat 3 . 4 . Problem 8 [15 points] 1. [5 points] What is the long-standing real estate risk premium puzzle? What is the real estate mixed assets allocation puzzle? Do these puzzles really exist? Discuss the causes of these puzzles. 2. [5 points] Below are Sharpe ratios for both the financial and real estate markets. Briefly discuss their difference and explain why the real estate market should have its own Sharpe ratio. Sharpe ration in the financial market S = Sharpe ration in the real estate market from Cheng, Lin and Liu (2013-FR): PRE- U- TS 1 ( * + tron ) ( 87 ) 202 + 2028* ( 1 - BT ) + (w? + ( BT)-62 ).TOM to 2 ( 1-84 ) (*+(TOM) 3. [5 points] Cheng, Lin and Liu (2017-JRER) develop the mixed-asset portfolio by extending the Modern Portfolio Theory (MPT) as follows , minuRE , WL, T WRE | ( URE + BORE) From + ( BRI2 + ( 1 - 1) 2 + 2 8 ( 1 - B)I ) HE + wi To1+ 2PREWLl(1-B)+ BTIVTOREOL]" .s. t. WRE TURE + WITus + (1 - WRE - WL) Try - WREC = r(T) Target Briefly discuss the difference between these two models and explain why the real estate should have its own asset allocation model. (Ctrl)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts