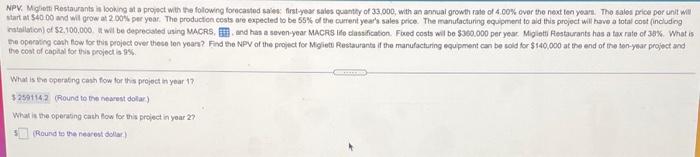

Question: Please find the operating cash flow for this project for years 2-10 (I have already figured out year 1) Also please answer What is the

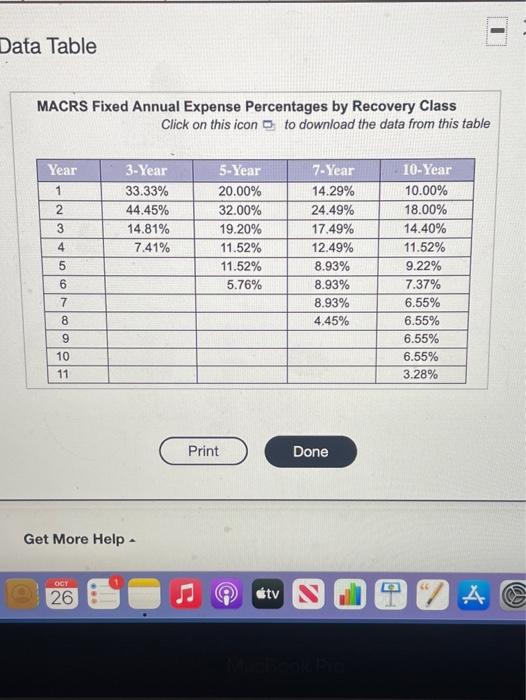

NPK Mohe Restaurants is looking at a project with the following forecasted first year sales quantity of 33.000, with an annual growth rate of 4.00% over the next ten years. The sales price por unit will start at $40.00 and will grow 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including ratellation of $2,100,000 will be deprecated using MACRS, and has a seven-year MACRS ilification Foxed costs will be $300.000 per year Milot Rostaurants has a tax rate of 30% What is the operating cash flow for this project over these ten years? Find the NPV of the project for Mights Restaurante if the manufacturing equipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project What is the operating cash flow for this project in year 17 $2501142 Round to the nearest dotar) What is the operating cath low for this project in your 2? 3. Round to the nearest dolar) Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 1 2 3 3-Year 33.33% 44.45% 14.81% 7.41% 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 4 OVA 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4,45% 5 6 7 8 9 10 11 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% Print Done Get More Help - OCT 26 tv A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts