Question: Please help figuring out the formula for this! I need to find the operating cash flow for this project in years 1-10 as well as

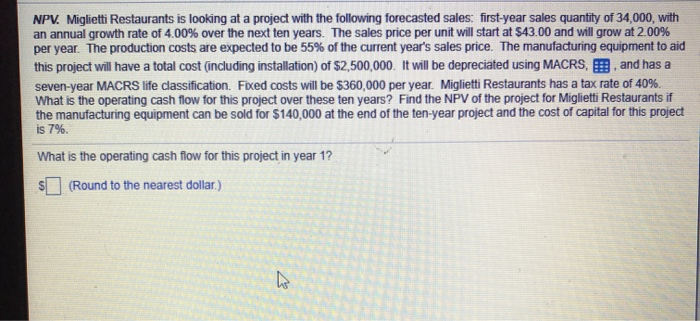

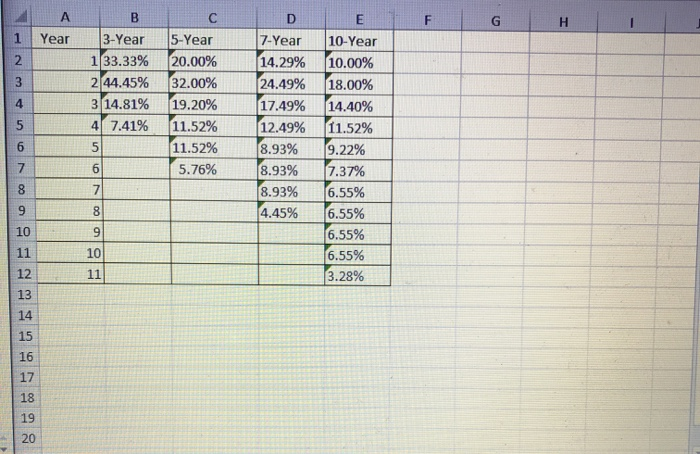

NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 34,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $43.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,500,000. It will be depreciated using MACRS, E. and has a seven-year MACRS life classification. Fixed costs will be $360,000 per year. Miglietti Restaurants has a tax rate of 40%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project is 7% What is the operating cash flow for this project in year 1? (Round to the nearest dollar.) A B E F G H Year 1 2. 2 3 3-Year 133.33% 2.44.45% 314.81% 4 7.41% 4 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% D 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 5 6 5 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% 7 6 8 7 9 8 10 9 11 10 11 12 13 14 15 16 17 18 19 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts