Question: please find what i would be for these problems. thanks! aitdal Estimated Estimated capital required annual receipts annual disbursements ife years) 12 Investment 300,000 140,000

please find what i would be for these problems. thanks!

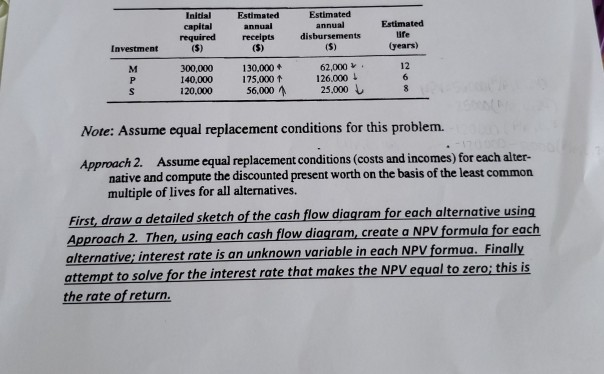

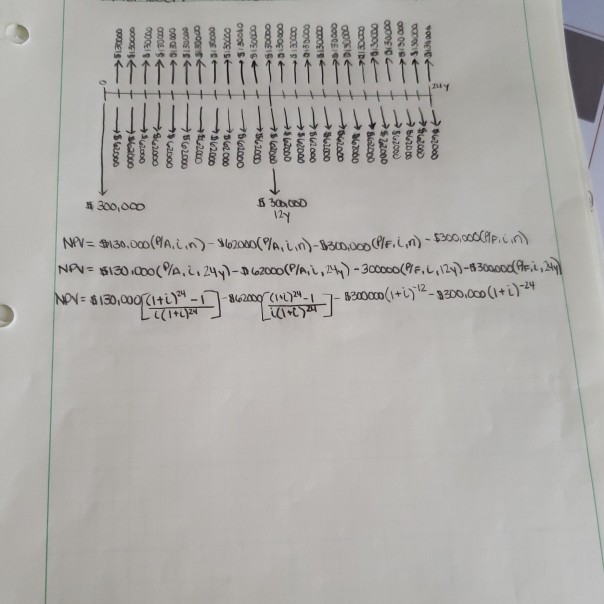

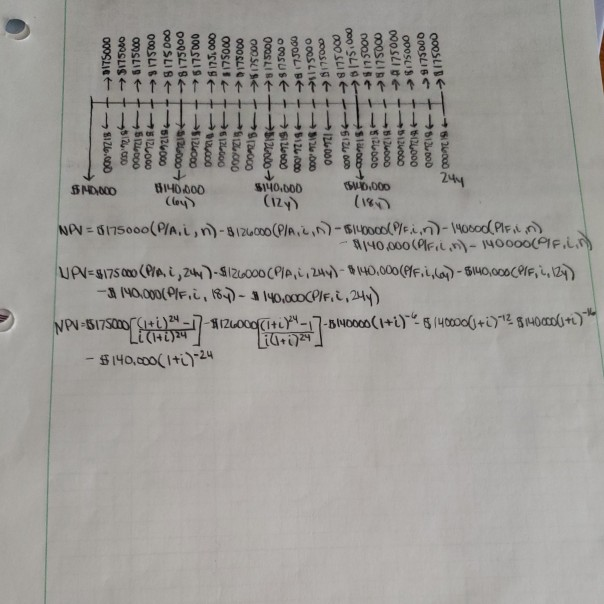

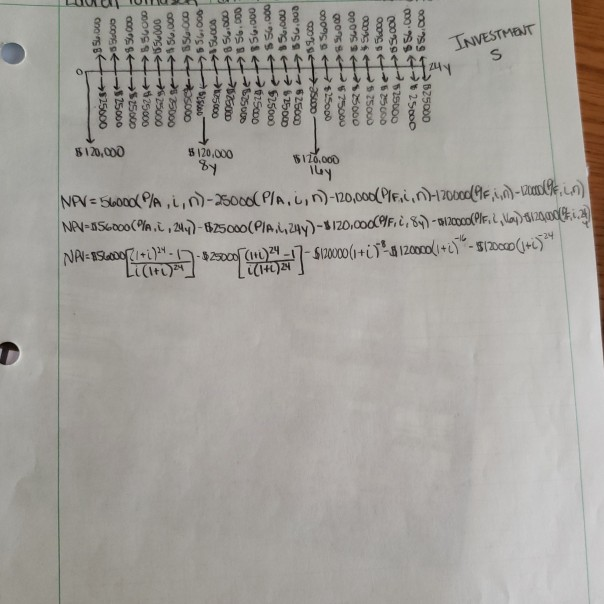

aitdal Estimated Estimated capital required annual receipts annual disbursements ife years) 12 Investment 300,000 140,000 130,000 175,000 62,000. 126.000 120.000 6,00025,000 Note: Assume equal replacement conditions for this problem. Approach 2. Assume equal replacement conditions (costs and incomes) for each alter- native and compute the discounted present worth on the basis of the least common multiple of lives for all alternatives. t, draw a detailed sketch of the cash flow diagram for each alternative using Approach 2. Then, using each cash flow diagram, create a NPV formula for each alternative; interest rate is an unknown variable in each NPV formua. Finall attempt to solve for the interest rate that makes the NPV equal to zero: this is the rate of return. aiy 3000 30.00 12 I40000 Cizy) -g NO000(OF, , t8q)-yo.ooodMr. , ay) 140,c0o(ti)24 120,000 110.000 luy 120.00 24 aitdal Estimated Estimated capital required annual receipts annual disbursements ife years) 12 Investment 300,000 140,000 130,000 175,000 62,000. 126.000 120.000 6,00025,000 Note: Assume equal replacement conditions for this problem. Approach 2. Assume equal replacement conditions (costs and incomes) for each alter- native and compute the discounted present worth on the basis of the least common multiple of lives for all alternatives. t, draw a detailed sketch of the cash flow diagram for each alternative using Approach 2. Then, using each cash flow diagram, create a NPV formula for each alternative; interest rate is an unknown variable in each NPV formua. Finall attempt to solve for the interest rate that makes the NPV equal to zero: this is the rate of return. aiy 3000 30.00 12 I40000 Cizy) -g NO000(OF, , t8q)-yo.ooodMr. , ay) 140,c0o(ti)24 120,000 110.000 luy 120.00 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts