Question: Please first replicate the balance sheet in the excel file and then make cell reference when calculating the ratios. What are your thoughts on the

Please first replicate the balance sheet in the excel file and then make cell reference when calculating the ratios.

What are your thoughts on the Hernandezs liquidity ratio? How might they address any issues you see?

(See attached photos to make file and use info for question)

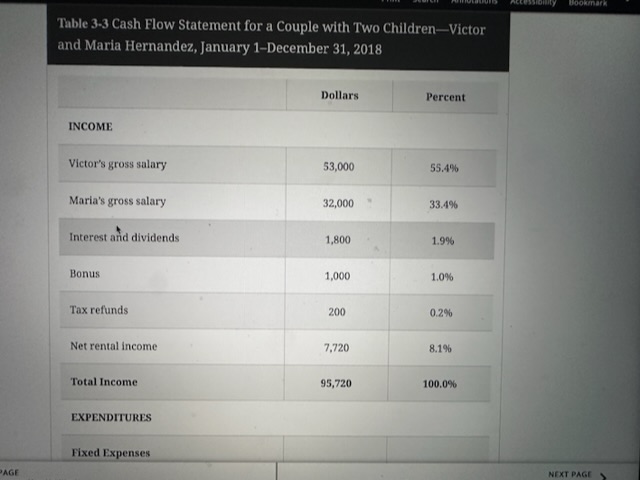

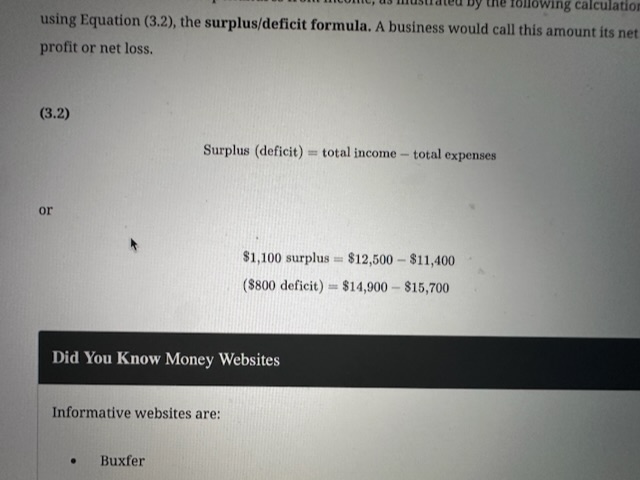

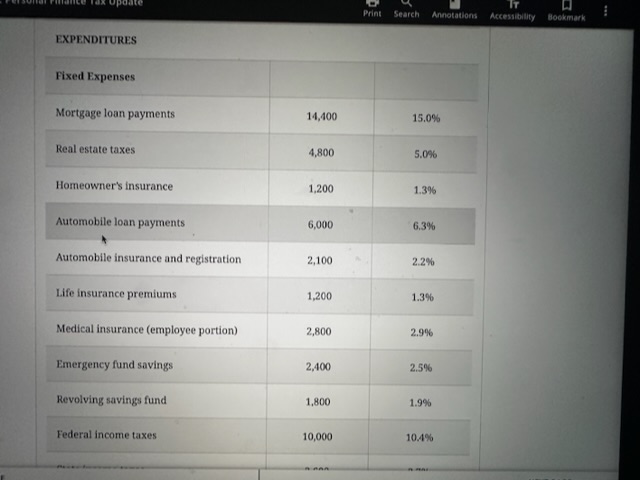

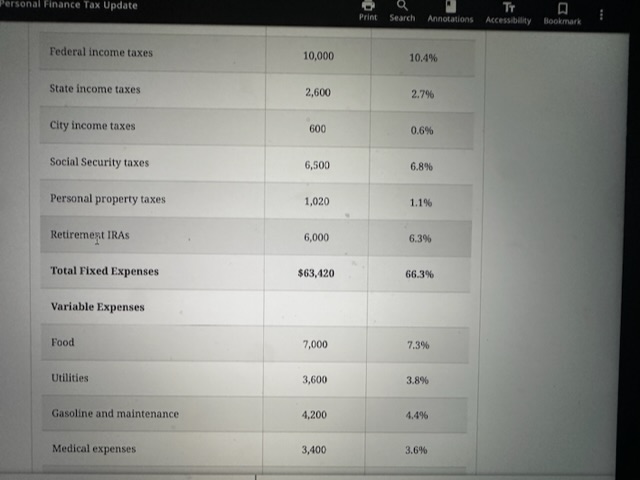

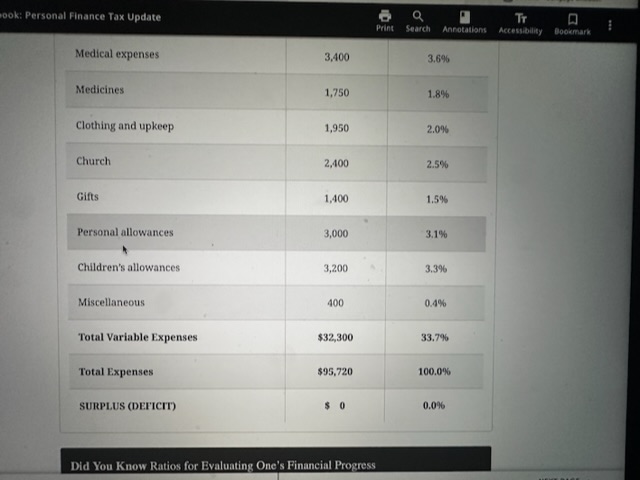

Table 3-3 Cash Flow Statement for a Couple with Two Children-Victor ook: Personal Finance Tax Update \begin{tabular}{|l|l|l|} \hline Medical expenses & 3,400 & 3.6% \\ \hline Medicines & 1,750 & 1.8% \\ \hline Clothing and upkeep & 1,950 & 2.0% \\ \hline Church & 2,400 & 2.5% \\ \hline Gifts & 1,400 & 1.5% \\ \hline Personal allowances & 3,000 & 3.1% \\ \hline Children's allowances & 3,200 & 3.3% \\ \hline Miscellaneous & 400 & 0.4% \\ \hline Total Variable Expenses & $32,300 & 33.7% \\ \hline Total Expenses & $95,720 & 100.0% \\ \hline SurPLus (DEricrn & $0 & 0.0 \\ \hline \end{tabular} Did You Know Ratios for Evaluating One's Financial Progress EXPENDITURES Personal Finance Tax Update Federal income taxes 10,000 10.4% State income taxes 2,600 2.7% City income taxes Social Security taxes Personal property taxes 600 0.6% Retiremegst IRAs Total Fixed Expenses 6,500 6.8% 1,020 1.1% Variable Expenses Food 6,000 6.3% $63,420 66.3% Dookmark Areess bility Table 3-3 Cash Flow Statement for a Couple with Two Children-Victor ook: Personal Finance Tax Update \begin{tabular}{|l|l|l|} \hline Medical expenses & 3,400 & 3.6% \\ \hline Medicines & 1,750 & 1.8% \\ \hline Clothing and upkeep & 1,950 & 2.0% \\ \hline Church & 2,400 & 2.5% \\ \hline Gifts & 1,400 & 1.5% \\ \hline Personal allowances & 3,000 & 3.1% \\ \hline Children's allowances & 3,200 & 3.3% \\ \hline Miscellaneous & 400 & 0.4% \\ \hline Total Variable Expenses & $32,300 & 33.7% \\ \hline Total Expenses & $95,720 & 100.0% \\ \hline SurPLus (DEricrn & $0 & 0.0 \\ \hline \end{tabular} Did You Know Ratios for Evaluating One's Financial Progress EXPENDITURES Personal Finance Tax Update Federal income taxes 10,000 10.4% State income taxes 2,600 2.7% City income taxes Social Security taxes Personal property taxes 600 0.6% Retiremegst IRAs Total Fixed Expenses 6,500 6.8% 1,020 1.1% Variable Expenses Food 6,000 6.3% $63,420 66.3% Dookmark Areess bility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts