Question: Please help me Alexi files her tax return 32 days after the due date. Along with the return, she remits a check for $7,300, which

Please help me

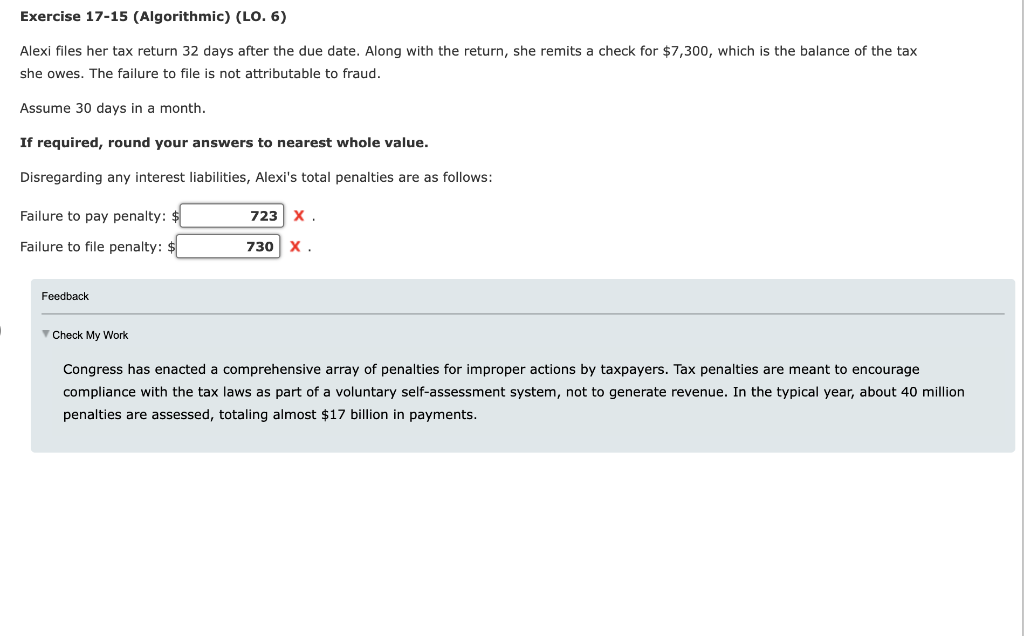

Alexi files her tax return 32 days after the due date. Along with the return, she remits a check for $7,300, which is the balance of the tax she owes. The failure to file is not attributable to fraud. Assume 30 days in a month. If required, round your answers to nearest whole value. Disregarding any interest liabilities, Alexi's total penalties are as follows: Failure to pay penalty: $X. Failure to file penalty: $ Feedback Check My Work compliance with the tax laws as part of a voluntary self-assessment system, not to generate revenue. In the typical year, about 40 million penalties are assessed, totaling almost $17 billion in payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts