Question: please focus on question 20 seeing as the question before it was answered. all info needed is at the top The U.S. multinational manufacturing firm,

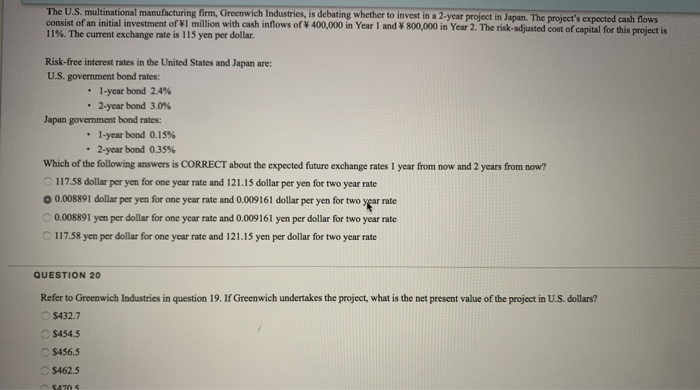

The U.S. multinational manufacturing firm, Greenwich Industries, is debating whether to invest in a 2-year project in Japan. The project's expected cash flows consist of an initial investment of $1 million with cash inflows of 400,000 in Year 1 and 800,000 in Year 2. The risk-adjusted cost of capital for this project is 11%. The current exchange rate is 115 yen per dollar. Risk-free interest rates in the United States and Japan are: U.S. government bond rates: 1-year bond 2.4% 2-year bond 3.0% Japan government bond rates: 1-year bond 0.15% 2-year bond 0.35% Which of the following answers is CORRECT about the expected future exchange rates 1 year from now and 2 years from now? 117.58 dollar per yen for one year rate and 121.15 dollar per yen for two year rate 0.008891 dollar per yen for one year rate and 0.009161 dollar per yen for two year rate 0.008891 yen per dollar for one year rate and 0.009161 yen per dollar for two year rate 117.58 yen per dollar for one year rate and 121.15 yen per dollar for two year rate QUESTION 20 Refer to Greenwich Industries in question 19. If Greenwich undertakes the project, what is the net present value of the project in U.S. dollars? $432.7 $454.5 $456.5 S462.5 -SA05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts