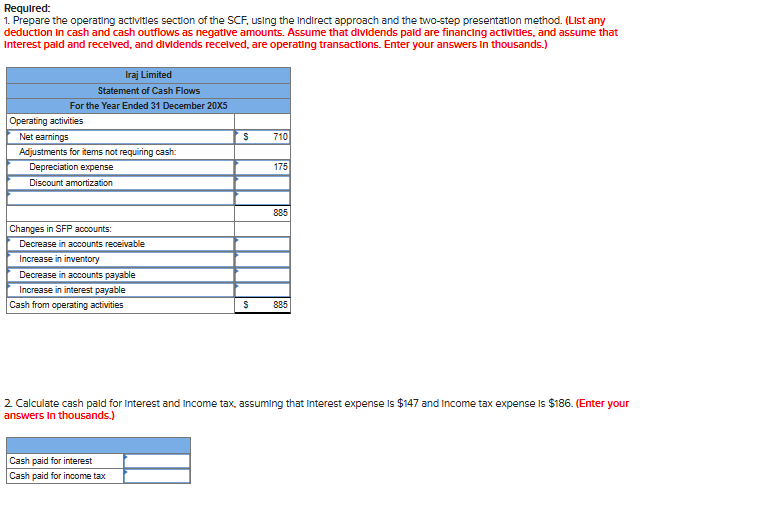

Question: Please form in the same way as question if possible. thank you. Required: Prepare the operating activitles section of the SCF , using the Indirect

Please form in the same way as question if possible. thank you. Required:

Prepare the operating activitles section of the SCF using the Indirect approach and the twostep presentation method. List any

deduction in cash and cash outflows as negative amounts. Assume that dividends paid are financing activities, and assume that

interest pald and recelved, and dividends recelved, are operating transactions. Enter your answers in thousands.

Calculate cash paid for Interest and income tax, assuming that Interest expense is $ and Income tax expense is $Enter your

answers in thousands.Selected accounts from the SFP of Iraj Ltd at December X and X are presented below, in thousands. Iraj reported earnings of $ in X and depreciation expense was $ Bonds of $ par value were issued during the period for $ and a discount of $ was originally recorded.

As at December XX

Accounts receivable $ $

Inventory

Accounts payable

Interest payable

Deferred income tax liability

Bonds payable

Discount on bonds payable

Required:

Prepare the operating activities section of the SCF using the indirect approach and the twostep presentation method. List any deduction in cash and cash outflows as negative amounts. Assume that dividends paid are financing activities, and assume that interest paid and received, and dividends received, are operating transactions. Enter your answers in thousands.

Calculate cash paid for interest and income tax, assuming that interest expense is $ and income tax expense is $Enter your answers in thousands.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock