Question: Please format answer in format asked 5 of 4 MMMM Corporation produced cleaning equipment at a cost of $380,000 for the Callahan Auto Parts factory

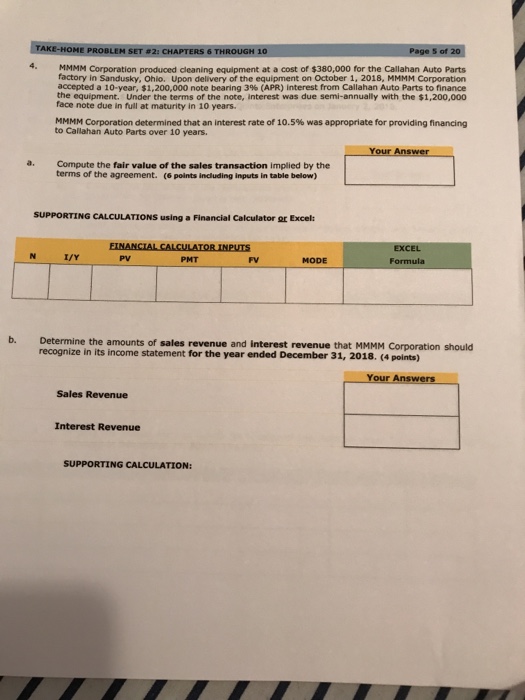

5 of 4 MMMM Corporation produced cleaning equipment at a cost of $380,000 for the Callahan Auto Parts factory in Sandusky, Ohio. Upon delivery of the equipment on October 1, 2018, MMMM Corporation accepted a 10-year, $1,200,000 note bearing 3% (APR) interest from Callahan Auto Parts to finance the equipment. Under the terms of the note, interest was due semi-annually with the $1,200,000 face note due in full at maturity in 10 years. MMMM Corporation determined that an interest rate of 10.5% was appropriate for providing financing to Callahan Auto Parts over 10 years. our Answer a. Compute the fair value of the sales transaction implied by the terms of the agreement. (6 points including inputs in table below) SUPPORTING CALCULATIONS using a Financial Calculator or Excel: I/Y PV PMT Formula FV MODE b. Determine the amounts of sales revenue and interest revenue that MMMM Corporation should recognize in its income statement for the year ended December 31, 2018. (4 points) Sales Revenue Interest Revenue SUPPORTING CALCULATION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts