Question: Please fully answer this case study by part. Answer the requirements separately. Be clear and straightforward. use your own words Analysis Case 19-7 EPS LO19-5

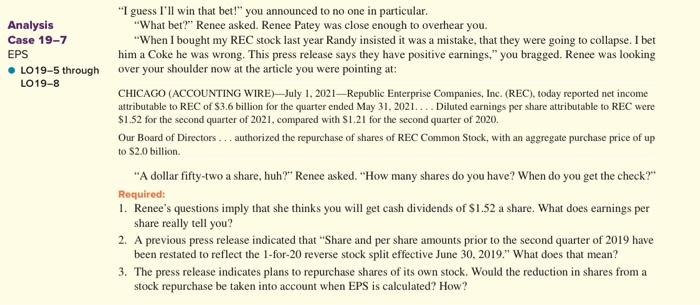

Analysis Case 19-7 EPS LO19-5 through LO19-8 "I guess I'll win that bet!" you announced to no one in particular. "What bet?" Renee asked. Renee Patey was close enough to overhear you. "When I bought my REC stock last year Randy insisted it was a mistake, that they were going to collapse. I bet him a Coke he was wrong. This press release says they have positive earnings," you bragged. Renee was looking over your shoulder now at the article you were pointing at: CHICAGO (ACCOUNTING WIRE) July 1, 2021-Republic Enterprise Companies, Inc. (REC), today reported net income attributable to REC of $3.6 billion for the quarter ended May 31, 2021.... Diluted earnings per share attributable to REC were $1.52 for the second quarter of 2021, compared with $1.21 for the second quarter of 2020. Our Board of Directors... authorized the repurchase of shares of REC Common Stock, with an aggregate purchase price of up to $2.0 billion. "A dollar fifty-two a share, huh?" Renee asked. "How many shares do you have? When do you get the check?" Required: 1. Renee's questions imply that she thinks you will get cash dividends of $1.52 a share. What does earnings per share really tell you? 2. A previous press release indicated that "Share and per share amounts prior to the second quarter of 2019 have been restated to reflect the 1-for-20 reverse stock split effective June 30, 2019." What does that mean? 3. The press release indicates plans to repurchase shares of its own stock. Would the reduction in shares from a stock repurchase be taken into account when EPS is calculated? How

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts