Question: Please give a clear explaination how to do this. I have provided the answer but need to knopw how to do this. NOTE: I have

Please give a clear explaination how to do this. I have provided the answer but need to knopw how to do this. NOTE: I have seen the one that is already posted on CHEGG but I am still not clear so please don't copy that one

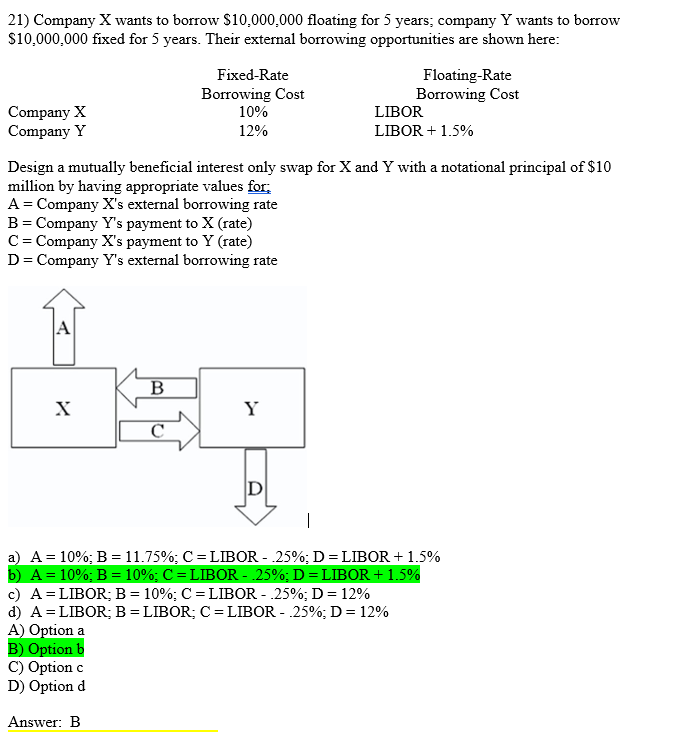

21) Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown here: Fixed-Rate Floating-Rate Borrowing Cost Borrowing Cost Company X 10% LIBOR Company Y 12% LIBOR + 1.5% Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for, A = Company X's external borrowing rate B = Company Y's payment to X (rate) C = Company X's payment to Y (rate) D= Company Y's external borrowing rate A B Y 1 a) A = 10%; B = 11.75%;C=LIBOR -.25%;D=LIBOR +1.5% b) A = 10%: B = 10%; C = LIBOR - 25%:D=LIBOR + 1.5% c) A = LIBOR; B = 10%: C = LIBOR -.25%;D= 12% d) A = LIBOR: B=LIBOR; C = LIBOR - .25%; D = 12% A) Option a B) Option b C) Optionc D) Option d Answer: B 21) Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown here: Fixed-Rate Floating-Rate Borrowing Cost Borrowing Cost Company X 10% LIBOR Company Y 12% LIBOR + 1.5% Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for, A = Company X's external borrowing rate B = Company Y's payment to X (rate) C = Company X's payment to Y (rate) D= Company Y's external borrowing rate A B Y 1 a) A = 10%; B = 11.75%;C=LIBOR -.25%;D=LIBOR +1.5% b) A = 10%: B = 10%; C = LIBOR - 25%:D=LIBOR + 1.5% c) A = LIBOR; B = 10%: C = LIBOR -.25%;D= 12% d) A = LIBOR: B=LIBOR; C = LIBOR - .25%; D = 12% A) Option a B) Option b C) Optionc D) Option d Answer: B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts