Question: *** PLEASE GIVE A DETAILED ANSWER, THANK YOU ! *** Dr. Midas Welby opened a psychiatry practice on March 1,2022 . He operates this practice

*** PLEASE GIVE A DETAILED ANSWER, THANK YOU ! ***

*** PLEASE GIVE A DETAILED ANSWER, THANK YOU ! ***

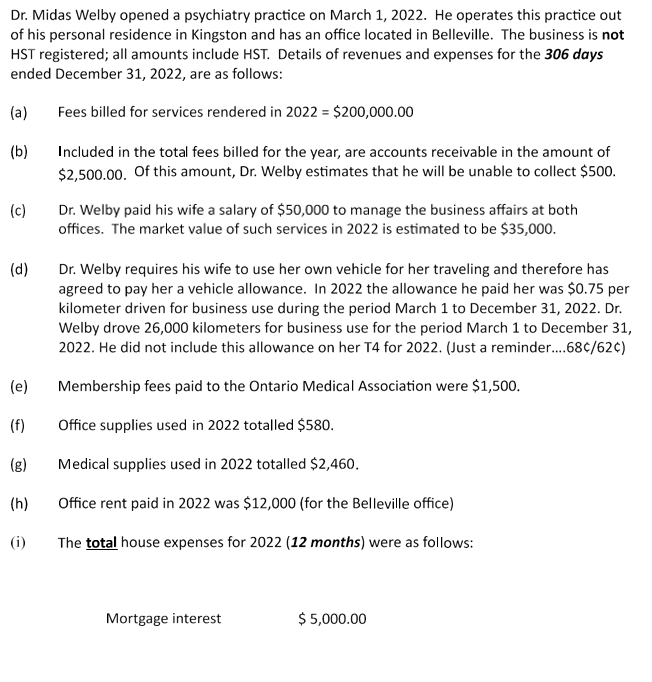

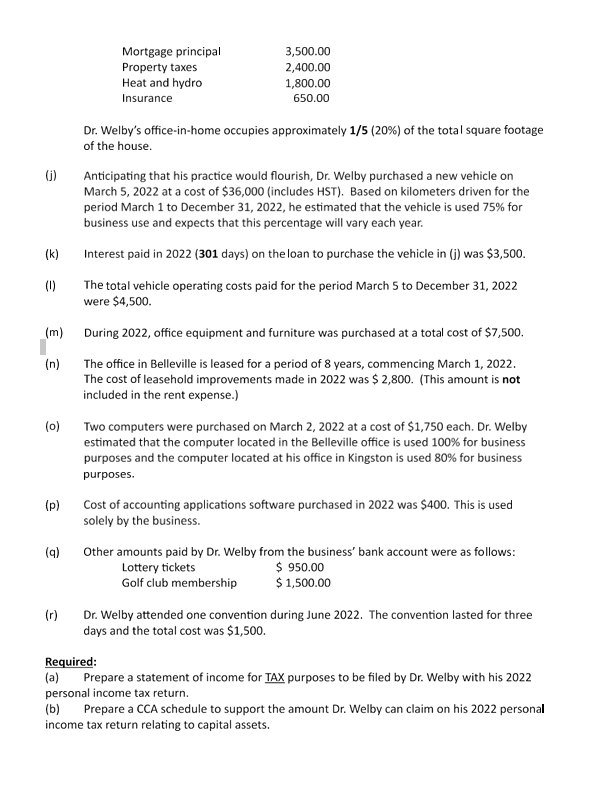

Dr. Midas Welby opened a psychiatry practice on March 1,2022 . He operates this practice out of his personal residence in Kingston and has an office located in Belleville. The business is not HST registered; all amounts include HST. Details of revenues and expenses for the 306 days ended December 31, 2022, are as follows: (a) Fees billed for services rendered in 2022=$200,000.00 (b) Included in the total fees billed for the year, are accounts receivable in the amount of $2,500.00. Of this amount, Dr. Welby estimates that he will be unable to collect $500. (c) Dr. Welby paid his wife a salary of $50,000 to manage the business affairs at both offices. The market value of such services in 2022 is estimated to be $35,000. (d) Dr. Welby requires his wife to use her own vehicle for her traveling and therefore has agreed to pay her a vehicle allowance. In 2022 the allowance he paid her was $0.75 per kilometer driven for business use during the period March 1 to December 31, 2022. Dr. Welby drove 26,000 kilometers for business use for the period March 1 to December 31 , 2022. He did not include this allowance on her T4 for 2022. (Just a reminder....68c/62C) (e) Membership fees paid to the Ontario Medical Association were $1,500. (f) Office supplies used in 2022 totalled $580. (g) Medical supplies used in 2022 totalled $2,460. (h) Office rent paid in 2022 was $12,000 (for the Belleville office) (i) The total house expenses for 2022 (12 months) were as follows: Dr. Welby's office-in-home occupies approximately 1/5 (20\%) of the total square footage of the house. (j) Anticipating that his practice would flourish, Dr. Welby purchased a new vehicle on March 5, 2022 at a cost of $36,000 (includes HST). Based on kilometers driven for the period March 1 to December 31, 2022, he estimated that the vehicle is used 75% for business use and expects that this percentage will vary each year. (k) Interest paid in 2022 (301 days) on the loan to purchase the vehicle in (j) was $3,500. (I) The total vehicle operating costs paid for the period March 5 to December 31,2022 were $4,500. (m) During 2022, office equipment and furniture was purchased at a total cost of $7,500. (n) The office in Belleville is leased for a period of 8 years, commencing March 1, 2022. The cost of leasehold improvements made in 2022 was $2,800. (This amount is not included in the rent expense.) (o) Two computers were purchased on March 2, 2022 at a cost of $1,750 each. Dr. Welby estimated that the computer located in the Belleville office is used 100% for business purposes and the computer located at his office in Kingston is used 80% for business purposes. (p) Cost of accounting applications software purchased in 2022 was $400. This is used solely by the business. (q) Other amounts paid by Dr. Welby from the business' bank account were as follows: Lottery tickets $950.00 Golf club membership $1,500.00 (r) Dr. Welby attended one convention during June 2022. The convention lasted for three days and the total cost was $1,500. Required: (a) Prepare a statement of income for TAX purposes to be filed by Dr. Welby with his 2022 personal income tax return. (b) Prepare a CCA schedule to support the amount Dr. Welby can claim on his 2022 personal income tax return relating to capital assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts