Question: Use rhe information given to complete the journal entry Journal entry worksheet Record entry for cash collected from accounts receivable. Note: Enter debits before credits.

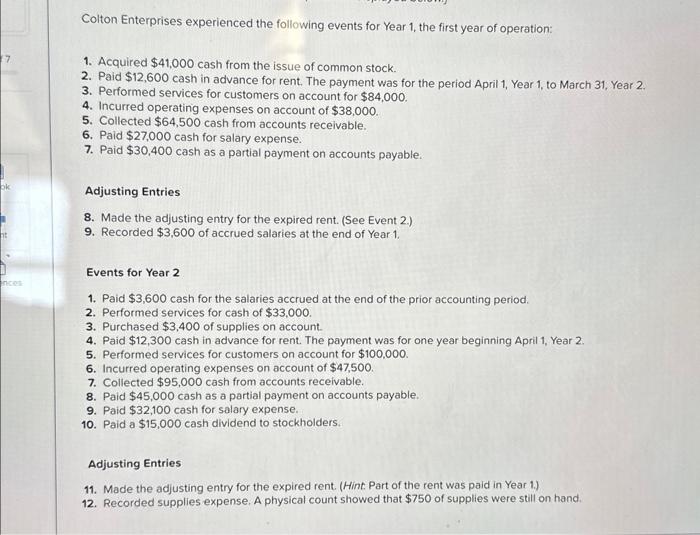

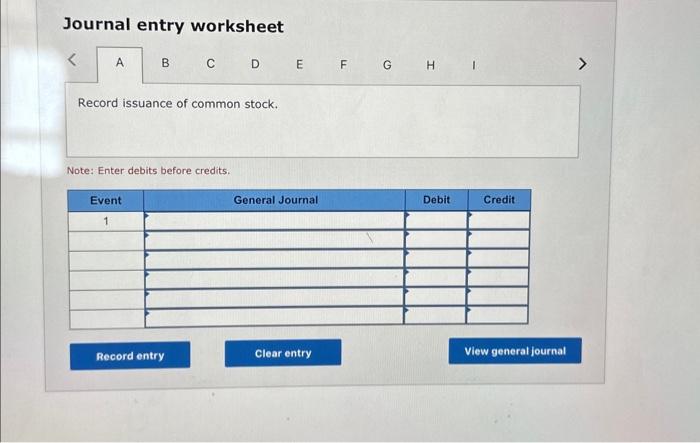

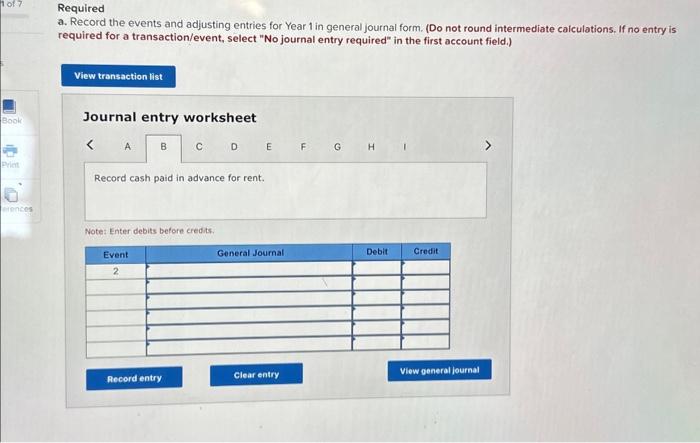

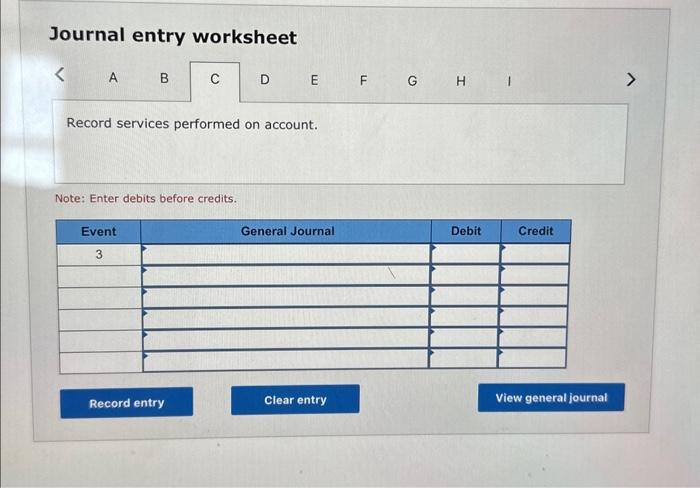

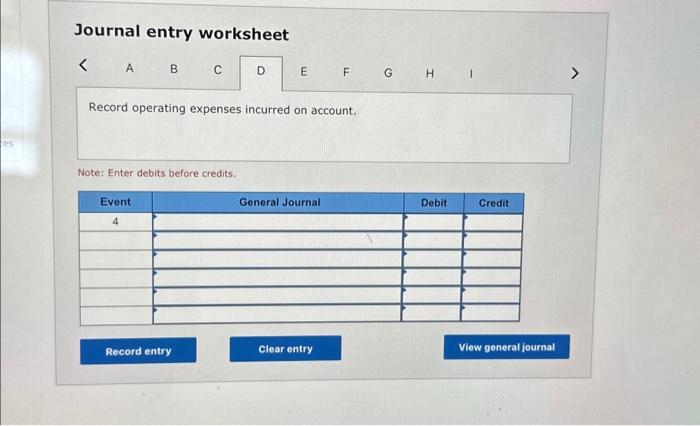

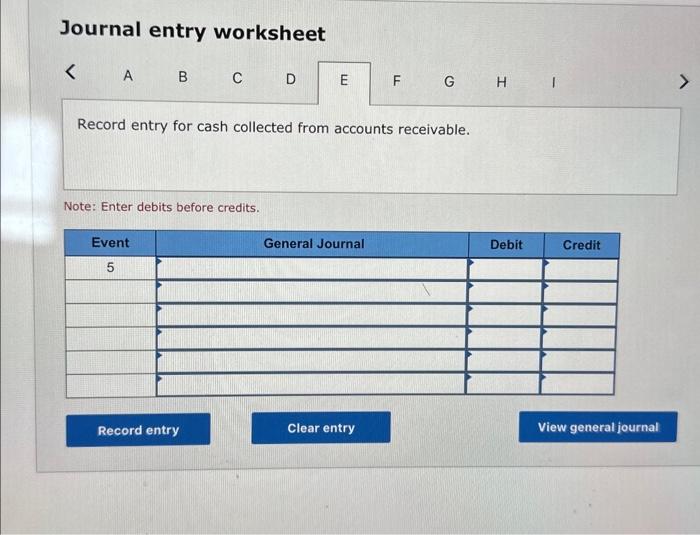

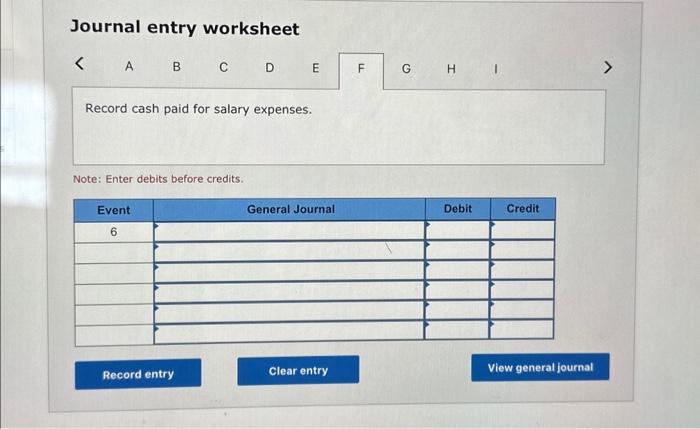

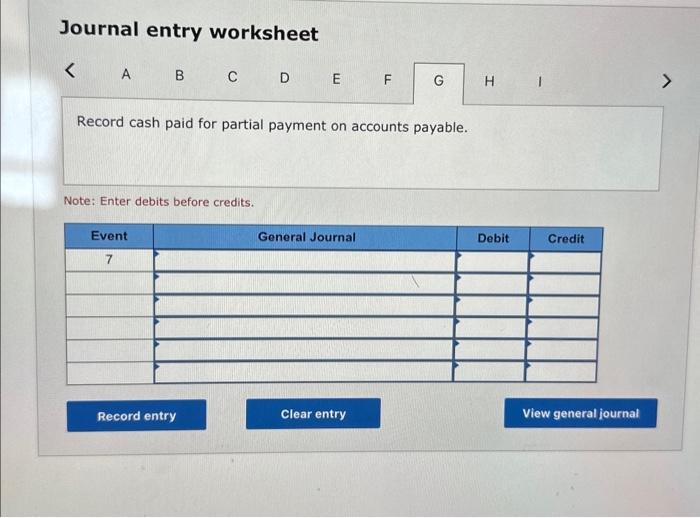

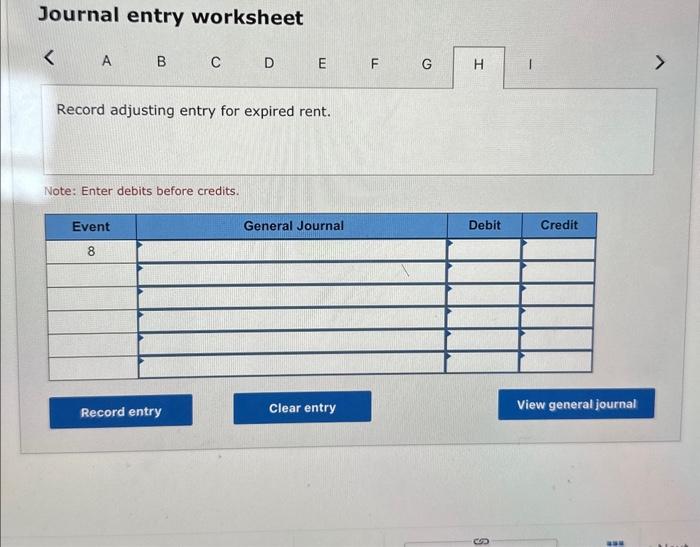

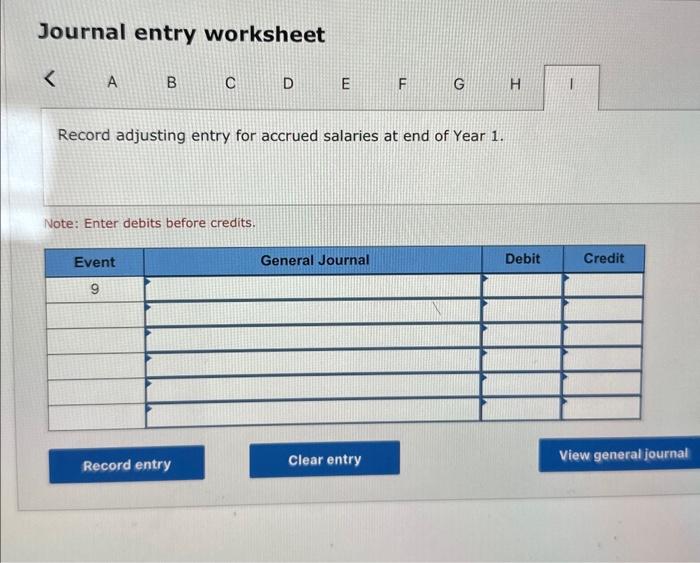

Journal entry worksheet Record entry for cash collected from accounts receivable. Note: Enter debits before credits. Journal entry worksheet B D Record cash paid for salary expenses. Note: Enter debits before credits. Journal entry worksheet Record adjusting entry for accrued salaries at end of Year 1. Note: Enter debits before credits. Journal entry worksheet Record services performed on account. Note: Enter debits before credits. Journal entry worksheet Record operating expenses incurred on account. Note: Enter debits before credits. Colton Enterprises experienced the following events for Year 1, the first year of operation: 1. Acquired $41,000 cash from the issue of common stock. 2. Paid $12,600 cash in advance for rent. The payment was for the period April 1, Year 1, to March 31 , Year 2. 3. Performed services for customers on account for $84,000. 4. Incurred operating expenses on account of $38,000. 5. Collected $64,500 cash from accounts receivable. 6. Paid $27,000 cash for salary expense. 7. Paid $30,400 cash as a partial payment on accounts payable. Adjusting Entries 8. Made the adjusting entry for the expired rent. (See Event 2.) 9. Recorded $3,600 of accrued salaries at the end of Year 1 . Events for Year 2 1. Paid $3,600 cash for the salaries accrued at the end of the prior accounting period. 2. Performed services for cash of $33,000. 3. Purchased $3,400 of supplies on account. 4. Paid $12,300 cash in advance for rent. The payment was for one year beginning April 1, Year 2. 5. Performed services for customers on account for $100,000. 6. Incurred operating expenses on account of $47,500. 7. Collected $95,000 cash from accounts receivable. 8. Paid $45,000 cash as a partial payment on accounts payable. 9. Paid $32,100 cash for salary expense. 10. Paid a $15,000 cash dividend to stockholders. Adjusting Entries 11. Made the adjusting entry for the expired rent. (Hint. Part of the rent was paid in Year 1.) 12. Recorded supplies expense. A physical count showed that $750 of supplies were still on hand. Journal entry worksheet Record cash paid for partial payment on accounts payable. Note: Enter debits before credits. a. Record the events and adjusting entries for Year 1 in general journal form. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter gebits pepore crents. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record adjusting entry for expired rent. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts