Question: Please give correct answer for good rate. Asap Determining the target leverage. You judge that a firm has an operating proft margin of6.5% in a

Please give correct answer for good rate. Asap

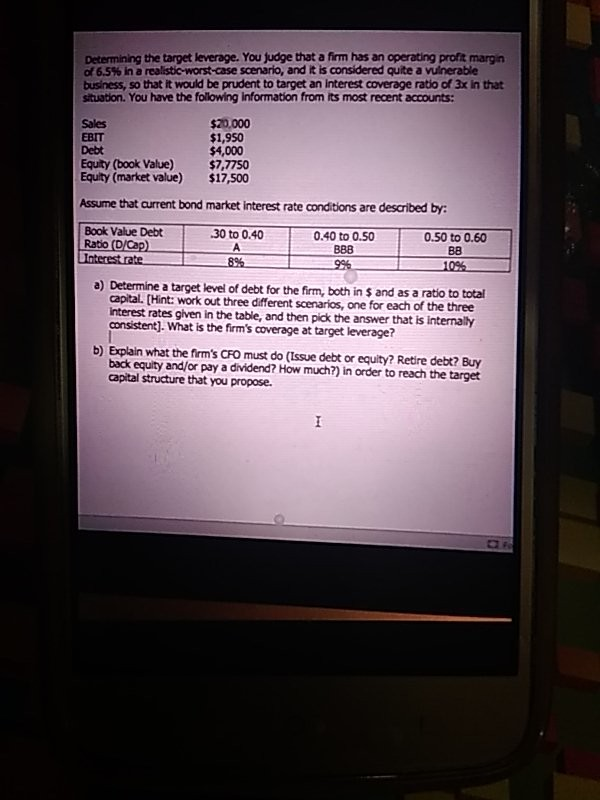

Determining the target leverage. You judge that a firm has an operating proft margin of6.5% in a realistic-worst-ase scenario, and itisconsidered quite a vulnerable business, so that it would be prudent to target an interest coverage ratio of 3x in that tuation. You have the following information from its most recent accounts Sales EBIT Debt Equity (book Value)$7,7750 Equity (market value) $17,500 $20,000 $1,950 $4,000 Assume that current bond market interest rate conditions are described by: Book Value Debt Ratio (D/Cap 30 to 0.40 0.40 to 0.50 B88 0.50 to 0.60 B8 8%. a) Determine a target level of debt for the firm, both in $ and as a ratio to total capital. (Hint: work out three different scenarios, one for each of the three interest rates given in the table, and then pick the answer that is internally consistent]. What is the firm's coverage at target leverage? b) Explain what the firm's CFO must do (Issue debt or equity? Retire debt? Buy back equity and/or pay a dividend? How much?) in order to reach the target capital structure that you propose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts