Question: PLEASE GIVE CORRECT ANSWERS AND COMPLETE WORK Exercise 14-12 For its fiscal year ending October 31, 2017 aas Corporation reports the following partial data shown

PLEASE GIVE CORRECT ANSWERS AND COMPLETE WORK

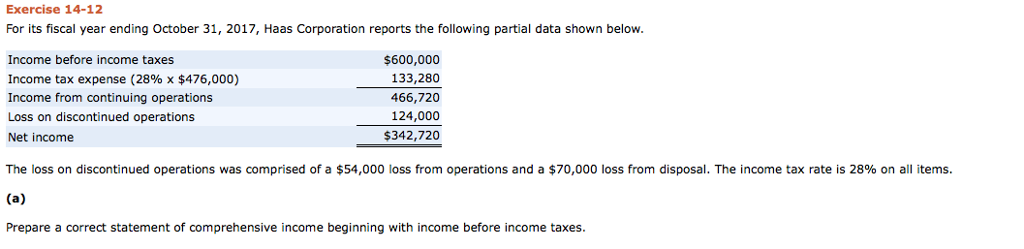

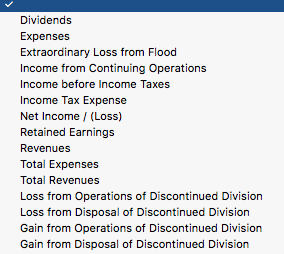

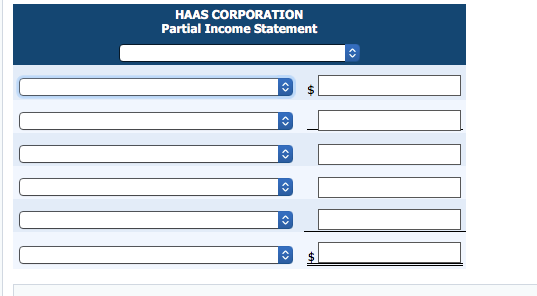

Exercise 14-12 For its fiscal year ending October 31, 2017 aas Corporation reports the following partial data shown below. Income before income taxes $600,000 133,280 Income tax expense (28% x $476,000) Income from continuing operations 466,720 124,000 Loss on discontinued operations $342,720 Net income The loss on discontinued operations was comprised of a $54,000 loss from operations and a $70,000 loss from disposal. The income tax rate is 28% on all items. (a) Prepare a correct statement of comprehensive income beginning with income before income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts