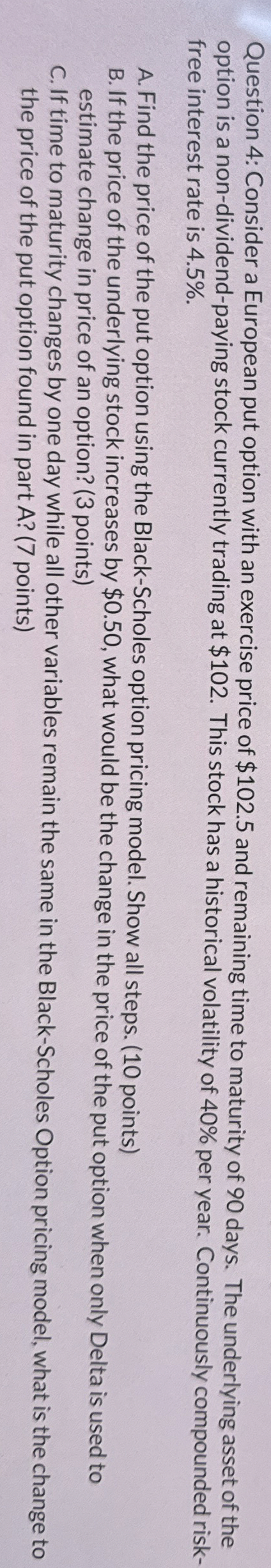

Question: PLEASE GIVE EXACT EXCEL STEPS. Question 4 : Consider a European put option with an exercise price of $ 1 0 2 . 5 and

PLEASE GIVE EXACT EXCEL STEPS.

Question : Consider a European put option with an exercise price of $ and remaining time to maturity of days. The underlying asset of the option is a nondividendpaying stock currently trading at $ This stock has a historical volatility of per year. Continuously compounded riskfree interest rate is

A Find the price of the put option using the BlackScholes option pricing model. Show all steps. points

B If the price of the underlying stock increases by $ what would be the change in the price of the put option when only Delta is used to estimate change in price of an option? points

C If time to maturity changes by one day while all other variables remain the same in the BlackScholes Option pricing model, what is the change to the price of the put option found in part points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock