Question: please give full answer. This subject is Asset management. 1. A certain fluidized-bed combustion vessel has an investment cost of $100,000, a life of 10

please give full answer. This subject is Asset management.

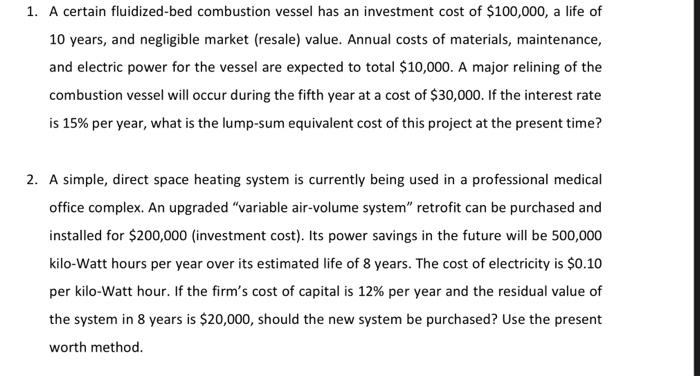

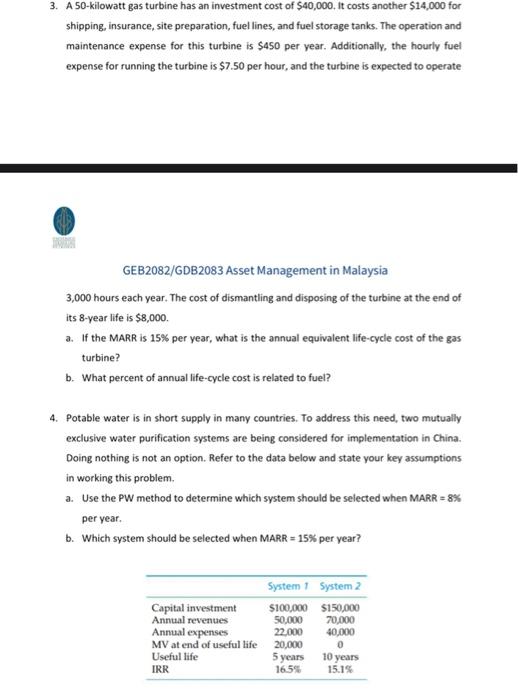

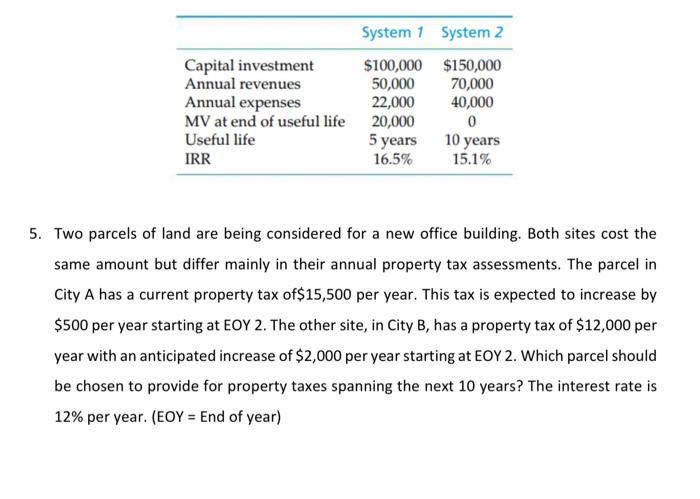

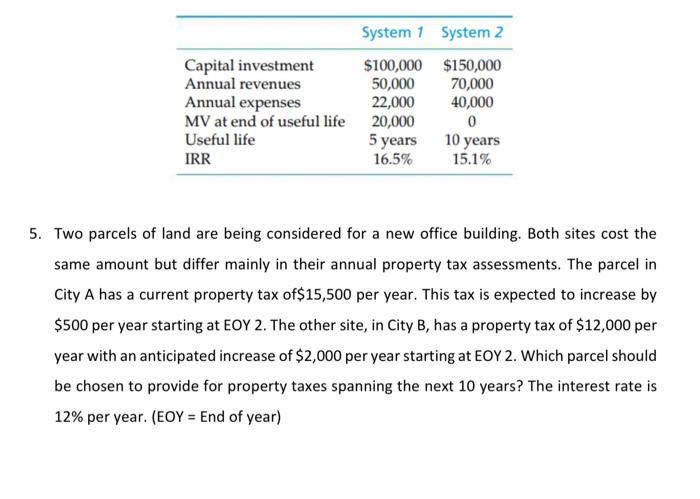

1. A certain fluidized-bed combustion vessel has an investment cost of $100,000, a life of 10 years, and negligible market (resale) value. Annual costs of materials, maintenance, and electric power for the vessel are expected to total $10,000. A major relining of the combustion vessel will occur during the fifth year at a cost of $30,000. If the interest rate is 15% per year, what is the lump-sum equivalent cost of this project at the present time? 2. A simple, direct space heating system is currently being used in a professional medical office complex. An upgraded "variable air-volume system" retrofit can be purchased and installed for $200,000 (investment cost). Its power savings in the future will be 500,000 kilo-Watt hours per year over its estimated life of 8 years. The cost of electricity is $0.10 per kilo-Watt hour. If the firm's cost of capital is 12% per year and the residual value of the system in 8 years is $20,000, should the new system be purchased? Use the present worth method. 3. A 50 -kilowatt gas turbine has an investment cost of $40,000, it costs another $14,000 for shipping, insurance, site preparation, fuel lines, and fuel storage tanks. The operation and maintenance expense for this turbine is $450 per year. Additionally, the hourly fuel expense for running the turbine is $7.50 per hour, and the turbine is expected to operate GEB2082/GDB2083 Asset Management in Malaysia 3,000 hours each year. The cost of dismantling and disposing of the turbine at the end of its 8 -year life is $8,000. a. If the MARR is 15% per year, what is the annual equivalent life-cycle cost of the gas turbine? b. What percent of annual life-cycle cost is related to fuel? 4. Potable water is in short supply in many countries. To address this need, two mutually exclusive water purification systems are being considered for implementation in China. Doing nothing is not an option. Refer to the data below and state your key assumptions in working this problem. a. Use the PW method to determine which system should be selected when MARR =8% per year. b. Which system should be selected when MARR=15% per year? 5. Two parcels of land are being considered for a new office building. Both sites cost the same amount but differ mainly in their annual property tax assessments. The parcel in City A has a current property tax of $15,500 per year. This tax is expected to increase by $500 per year starting at EOY 2 . The other site, in City B, has a property tax of $12,000 per year with an anticipated increase of $2,000 per year starting at EOY 2 . Which parcel should be chosen to provide for property taxes spanning the next 10 years? The interest rate is 12% per year. (EOY= End of year )

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock