Question: please give full answers not anything else.... 1. Which statement is TRUE? Regulation E's overdraft provisions: A. Place limits on the amount of fees that

please give full answers not anything else....

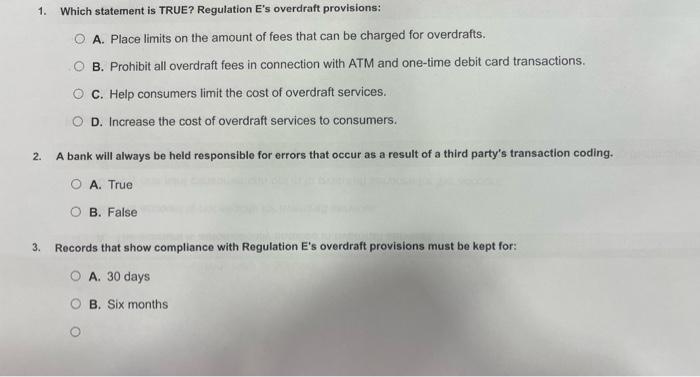

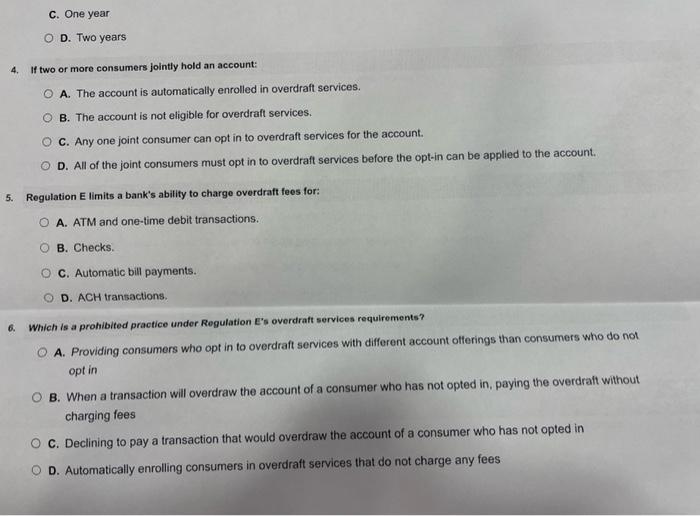

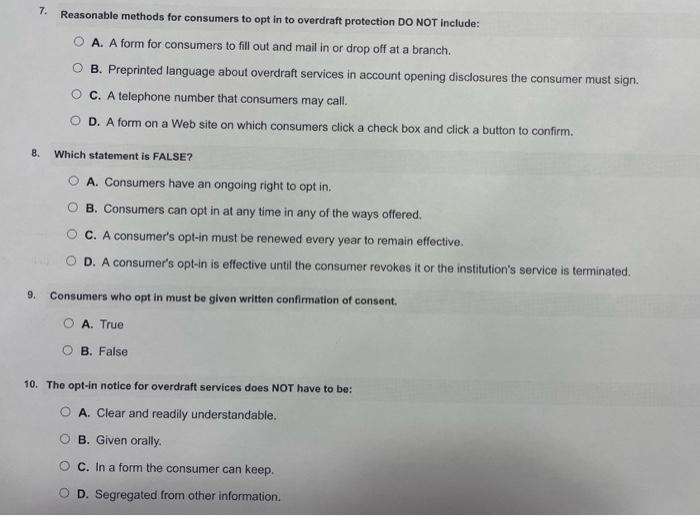

1. Which statement is TRUE? Regulation E's overdraft provisions: A. Place limits on the amount of fees that can be charged for overdrafts. B. Prohibit all overdraft fees in connection with ATM and one-time debit card transactions. C. Help consumers limit the cost of overdraft services. D. Increase the cost of overdraft services to consumers. 2. A bank will always be held responsible for errors that occur as a result of a third party's transaction coding. A. True B. False 3. Records that show compliance with Regulation E's overdraft provisions must be kept for: A. 30 days B. Six months 4. If two or more consumers jointly hold an account: A. The account is automatically enrolled in overdraft services. B. The account is not eligible for overdraft services. C. Any one joint consumer can opt in to overdraft services for the account. D. All of the joint consumers must opt in to overdraft services before the opt-in can be applied to the account. 5. Regulation E limits a bank's ability to charge overdraft fees for: A. ATM and one-time debit transactions. B. Checks. C. Automatic bill payments. D. ACH transactions. 6. Which is a prohibited practice under Regulation E's overdraft services requirements? A. Providing consumers who opt in to overdraft services with different account olferings than consumers who do not opt in B. When a transaction will overdraw the account of a consumer who has not opted in, paying the overdraft without charging fees C. Declining to pay a transaction that would overdraw the account of a consumer who has not opted in D. Automatically enrolling consumers in overdraft services that do not charge any fees 7. Reasonable mothods for consumers to opt in to overdraft protection DO NOT include: A. A form for consumers to fill out and mail in or drop off at a branch. B. Preprinted language about overdraft services in account opening disclosures the consumer must sign. C. A telephone number that consumers may call. D. A form on a Web site on which consumers click a check box and click a button to confirm. 8. Which statement is FALSE? A. Consumers have an ongoing right to opt in. B. Consumers can opt in at any time in any of the ways offered. C. A consumer's opt-in must be renewed every year to remain effective. D. A consumer's opt-in is effective until the consumer revokes it or the institution's service is terminated. 9. Consumers who opt in must be given written confirmation of consent. A. True B. False 10. The opt-in notice for overdraft services does NOT have to be: A. Clear and readily understandable. B. Given orally. C. In a form the consumer can keep. D. Segregated from other information

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock