Question: please give me accurate and correct answer. I recived all wrong answrs earlier. I will imidetly vote down if wrong and vote up if right.

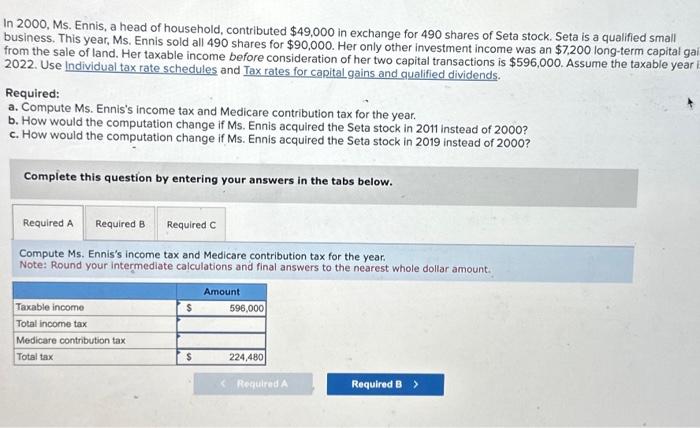

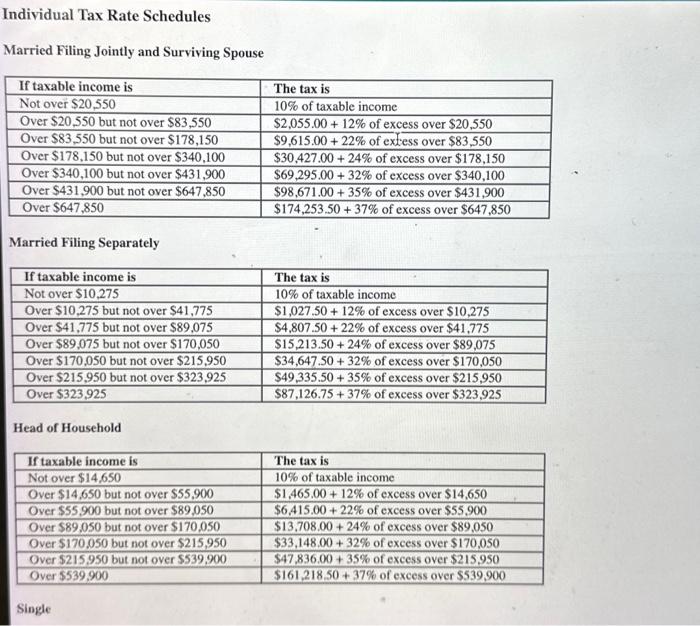

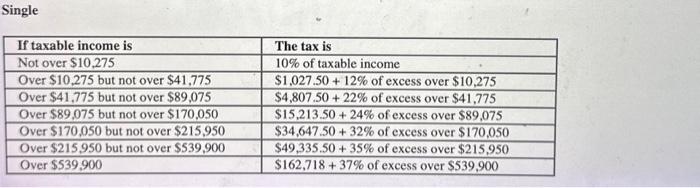

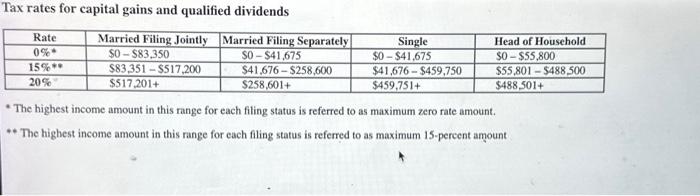

In 2000, Ms. Ennis, a head of household, contributed $49,000 in exchange for 490 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 490 shares for $90,000. Her only other investment income was an $7,200 long-term capital ga from the sale of land. Her taxable income before consideration of her two capital transactions is $596,000. Assume the taxable year 2022. Use individual tax rate schedules and Tax rates for capital gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Complete this question by entering your answers in the tabs below. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse Married Filing Separately Head of Household Single Tax rates for capital gains and qualified dividends - The highest income amount in this range for each filing status is referred to as maximum zero rate amount. ** The highest income amount in this range for each flling status is referred to as maximum 15-pereent amount In 2000, Ms. Ennis, a head of household, contributed $49,000 in exchange for 490 shares of Seta stock. Seta is a qualified small business. This year, Ms. Ennis sold all 490 shares for $90,000. Her only other investment income was an $7,200 long-term capital ga from the sale of land. Her taxable income before consideration of her two capital transactions is $596,000. Assume the taxable year 2022. Use individual tax rate schedules and Tax rates for capital gains and qualified dividends. Required: a. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. b. How would the computation change if Ms. Ennis acquired the Seta stock in 2011 instead of 2000 ? c. How would the computation change if Ms. Ennis acquired the Seta stock in 2019 instead of 2000 ? Complete this question by entering your answers in the tabs below. Compute Ms. Ennis's income tax and Medicare contribution tax for the year. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse Married Filing Separately Head of Household Single Tax rates for capital gains and qualified dividends - The highest income amount in this range for each filing status is referred to as maximum zero rate amount. ** The highest income amount in this range for each flling status is referred to as maximum 15-pereent amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts