Question: please give me answer for this question. kindly write complete answer otherwise, other questions won't open. Question 3 of 3 0.18/5 Additional information and adjustment

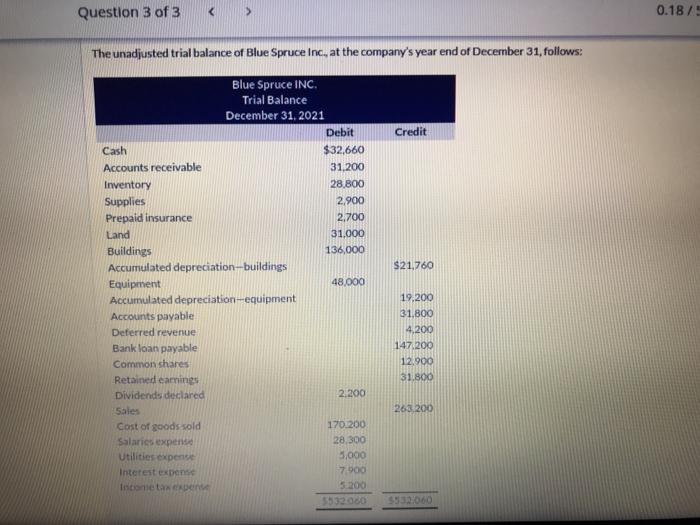

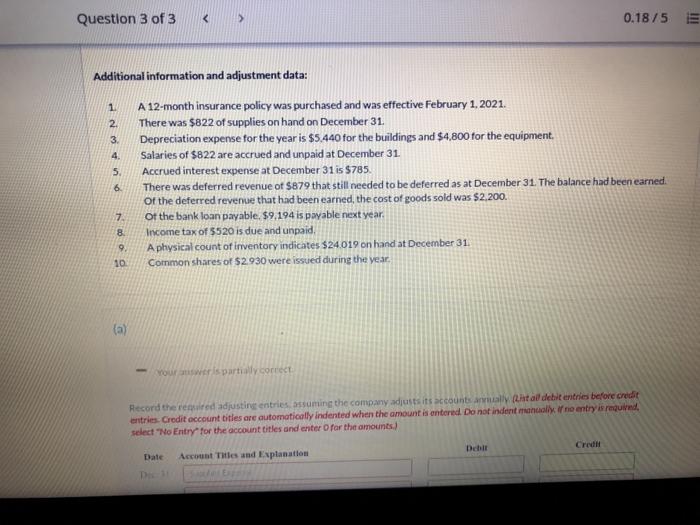

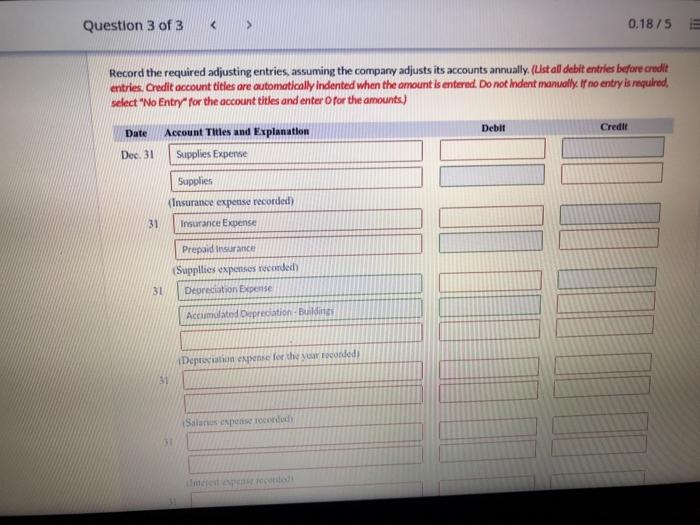

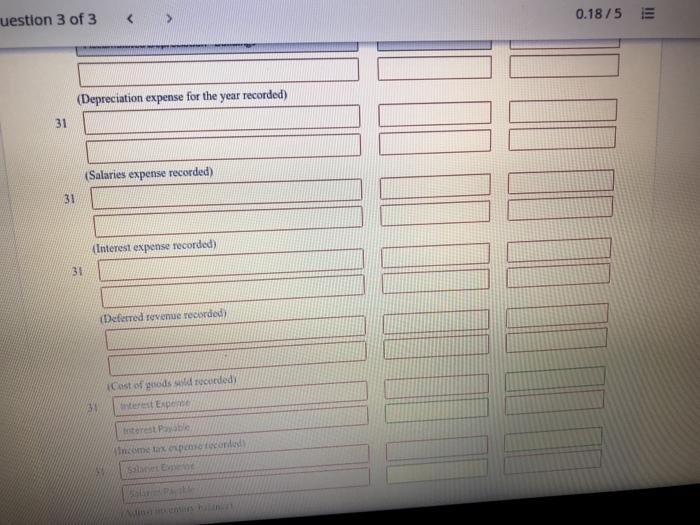

Question 3 of 3 0.18/5 Additional information and adjustment data: 1 2. 3 4. 5. 6 A 12- month insurance policy was purchased and was effective February 1, 2021. There was $822 of supplies on hand on December 31 Depreciation expense for the year is $5.440 for the buildings and $4,800 for the equipment Salaries of $822 are accrued and unpaid at December 31. Accrued interest expense at December 31 is $785. There was deferred revenue of $879 that still needed to be deferred as at December 31. The balance had been earned of the deferred revenue that had been earned, the cost of goods sold was $2.200. of the bank loan payable. $9.194 is payable next year. Income tax of 5520 is due and unpaid. A physical count of inventory indicates $24019 on hand at December 31. Common shares of $2.930 were issued during the year. 7. 8 19 10 (a) Your wer is partially correct Record the resulted adjusting entries, assuming the company adjusts its accounts rally tail debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually if no entry is required. select "No Entry for the account titles and enter for the amounts) Dehl Credit Date Account Titles and Explanation Question 3 of 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts