Question: PLEASE GIVE SOLUTION IN THE SAME FORMAT AS THE IMAGE THANK YOU! Carswell Electronics adopted the dollar-value LIFO method on January 1, 2021, when the

PLEASE GIVE SOLUTION IN THE SAME FORMAT AS THE IMAGE THANK YOU!

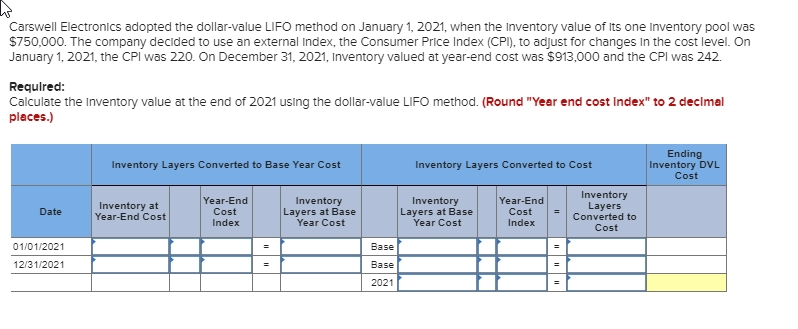

Carswell Electronics adopted the dollar-value LIFO method on January 1, 2021, when the inventory value of Its one Inventory pool was $750,000. The company decided to use an external Index, the Consumer Price Index (CPI), to adjust for changes in the cost level. On January 1, 2021, the CPI was 220. On December 31, 2021, Inventory valued at year-end cost was $913,000 and the CPI was 242. Required: Calculate the Inventory value at the end of 2021 using the dollar-value LIFO method. (Round "Year end cost Index" to 2 decimal places.) Inventory Layers Converted to Base Year Cost Inventory Layers Converted to Cost onverted to Cost Ending Inventory DVL Cost Date Inventory at Year-End Cost Year-End Cost Index Inventory Layers at Base Year Cost Inventory Layers at Base Year Cost Year-End Cost Index Inventory Layers Converted to Cost 01/01/2021 12/31/2021 Base Base 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts