Question: PLEASE GIVE SOLUTION IN THE SAME FORMAT AS THE IMAGE THANK YOU! On January 1, 2021, the Haskins Company adopted the dollar-value LIFO method for

PLEASE GIVE SOLUTION IN THE SAME FORMAT AS THE IMAGE THANK YOU!

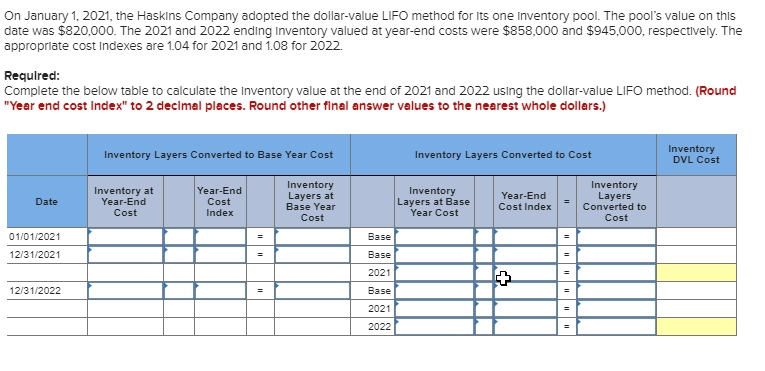

On January 1, 2021, the Haskins Company adopted the dollar-value LIFO method for Its one inventory pool. The pool's value on this date was $820,000. The 2021 and 2022 ending inventory valued at year-end costs were $858,000 and $945,000, respectively. The appropriate cost Indexes are 1.04 for 2021 and 1.08 for 2022. Required: Complete the below table to calculate the inventory value at the end of 2021 and 2022 using the dollar-value LIFO method. (Round "Year end cost index" to 2 decimal pleces. Round other final answer values to the nearest whole dollars.) Inventory DVL Cost Inventory Layers Converted to Base Year Cost Inventory Layers Converted to Cost Inventory Layers at Base Year Cost Inventory Layers Converted to Year-End Cost Inventory at Year-End Inventory Layers at Base Year Cost Year-End Date Cost Index Cost Index Cost 01/01/2021 Base 12/31/2021 Base 2021 12/31/2022 Base 2021 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts