Question: Please go into detail on how you got the answer! I am honestly lost on how to approach this question. Thank you in advance! X

Please go into detail on how you got the answer! I am honestly lost on how to approach this question. Thank you in advance!

Please go into detail on how you got the answer! I am honestly lost on how to approach this question. Thank you in advance!

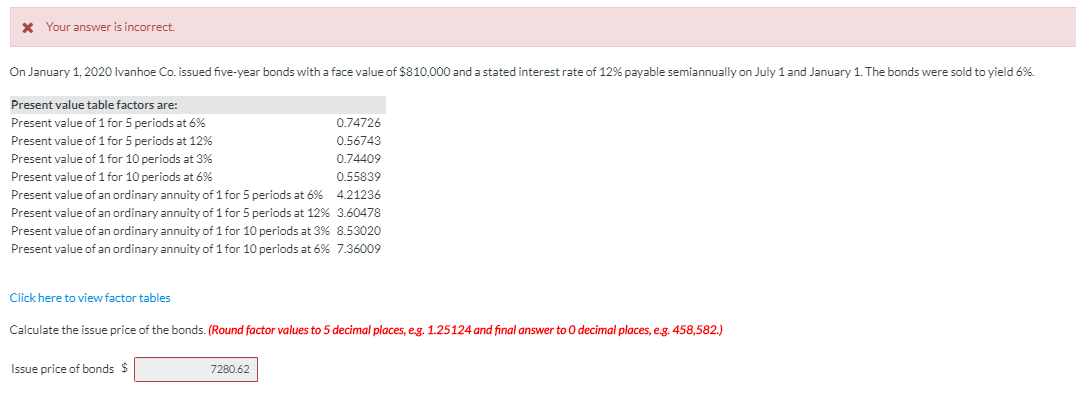

X Your answer is incorrect. On January 1, 2020 Ivanhoe Co. issued five-year bonds with a face value of $810,000 and a stated interest rate of 12% payable semiannually on July 1 and January 1. The bonds were sold to yield 6%. Present value table factors are: Present value of 1 for 5 periods at 6% 0.74726 Present value of 1 for 5 periods at 12% 0.56743 Present value of 1 for 10 periods at 3% 0.74409 Present value of 1 for 10 periods at 6% 0.55839 Present value of an ordinary annuity of 1 for 5 periods at 6% 4.21236 Present value of an ordinary annuity of 1 for 5 periods at 12% 3.60478 Present value of an ordinary annuity of 1 for 10 periods at 3% 8.53020 Present value of an ordinary annuity of 1 for 10 periods at 6% 7.36009 Click here to view factor tables Calculate the issue price of the bonds. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,582.) Issue price of bonds $ 7280.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts