Question: PLEASE HELP! 1. 2. A trader sells a strangle by selling a put option with a strike price of K1 = $40 for P=$4. and

PLEASE HELP!

1.

2.

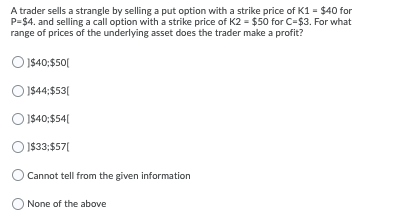

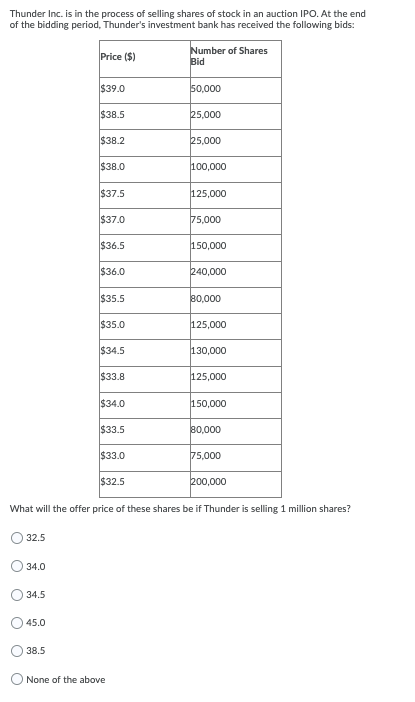

A trader sells a strangle by selling a put option with a strike price of K1 = $40 for P=$4. and selling a call option with a strike price of K2 = $50 for C=$3. For what range of prices of the underlying asset does the trader make a profit? O $40;$50 1$44:$53 $;$ O $40;$54 O 1$33:$571 Cannot tell from the given information None of the above Thunder Inc. is in the process of selling shares of stock in an auction IPO. At the end of the bidding period, Thunder's investment bank has received the following bids: Price (8) Number of Shares Bid $39.0 50,000 $38.5 25,000 $38.2 25,000 $38.0 100,000 $37.5 125,000 $37.0 75,000 $36.5 150,000 $36.0 240,000 $35.5 80,000 $35.0 125,000 $34.5 130,000 $33.8 125,000 $34.0 150,000 $33.5 80,000 $33.0 75,000 $32.5 200,000 What will the offer price of these shares be if Thunder is selling 1 million shares? 32.5 34.0 34.5 45.0 38.5 O None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts