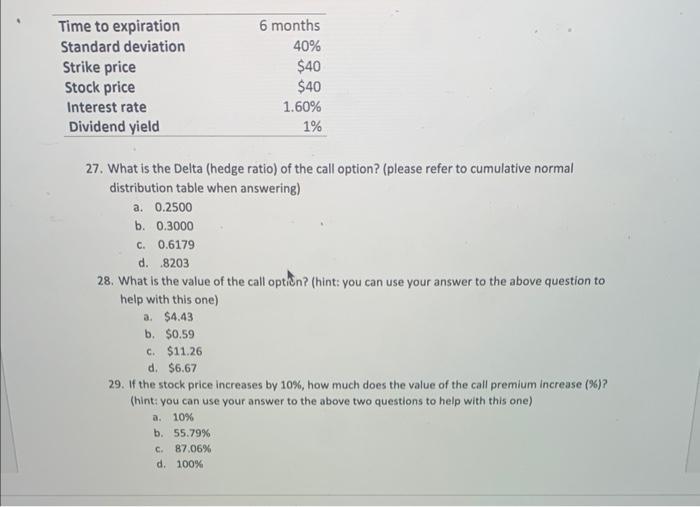

Question: Time to expiration Standard deviation Strike price Stock price Interest rate Dividend yield 6 months 40% $40 $40 1.60% 1% 27. What is the

Time to expiration Standard deviation Strike price Stock price Interest rate Dividend yield 6 months 40% $40 $40 1.60% 1% 27. What is the Delta (hedge ratio) of the call option? (please refer to cumulative normal distribution table when answering) a. 0.2500 b. 0.3000 C. 0.6179 d. 8203 28. What is the value of the call option? (hint: you can use your answer to the above question to help with this one) a. $4.43 b. $0.59 c. $11.26 d. $6.67 29. If the stock price increases by 10%, how much does the value of the call premium increase (%)? (hint: you can use your answer to the above two questions to help with this one) a. 10 % b. 55.79% C. 87.06% d. 100 %

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Q27 c 06179 The delta of a call option is equal to the cumulative normal distribution of the standar... View full answer

Get step-by-step solutions from verified subject matter experts