Question: PLEASE HELP 1. 2. Firm E must choose between two alternative transactions. Transaction 1 requires a $11,100 cash outlay that would be nondeductible in the

PLEASE HELP

1.

2.

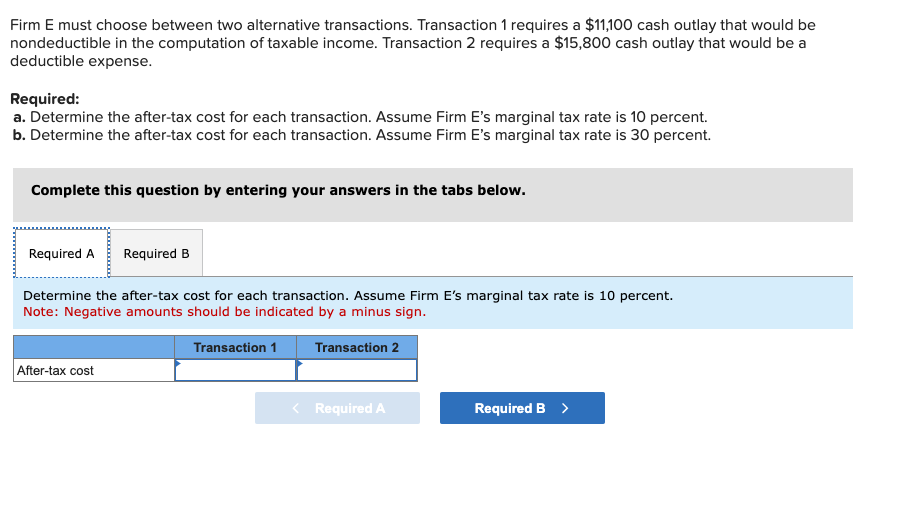

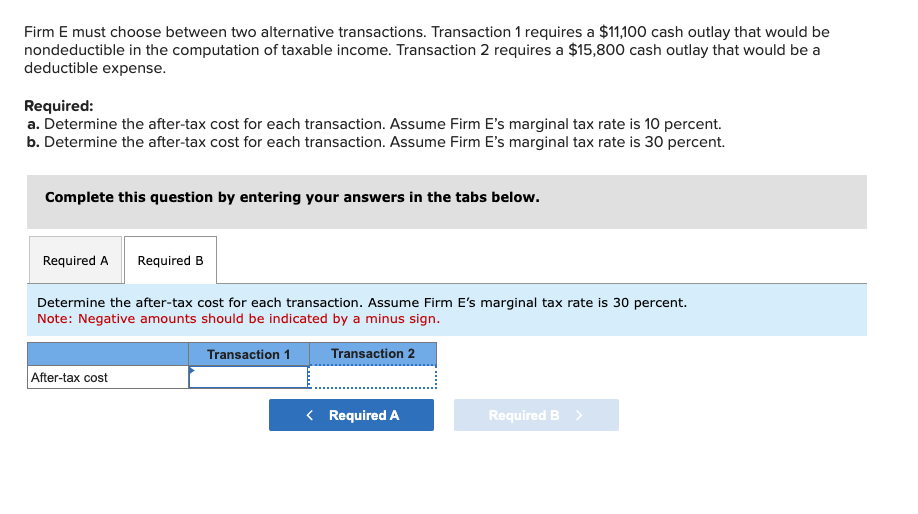

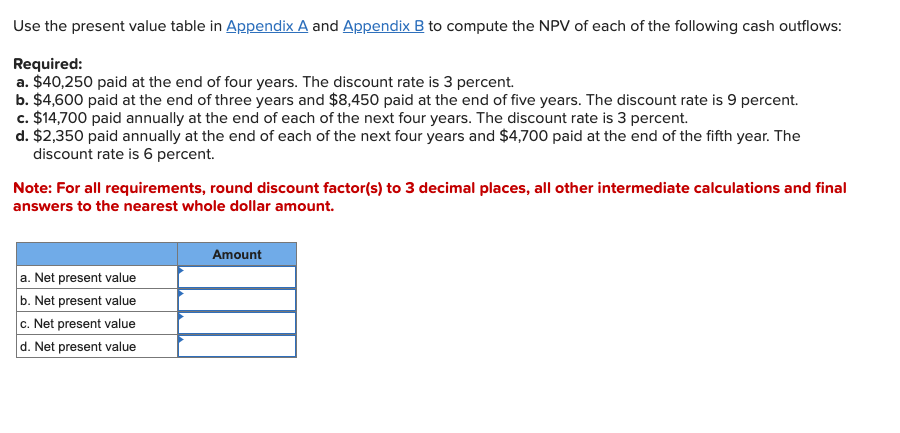

Firm E must choose between two alternative transactions. Transaction 1 requires a $11,100 cash outlay that would be nondeductible in the computation of taxable income. Transaction 2 requires a $15,800 cash outlay that would be a deductible expense. Required: a. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 10 percent. b. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 30 percent. Complete this question by entering your answers in the tabs below. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 10 percent. Note: Negative amounts should be indicated by a minus sign. Firm E must choose between two alternative transactions. Transaction 1 requires a $11,100 cash outlay that would be nondeductible in the computation of taxable income. Transaction 2 requires a $15,800 cash outlay that would be a deductible expense. Required: a. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 10 percent. b. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 30 percent. Complete this question by entering your answers in the tabs below. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 30 percent. Note: Negative amounts should be indicated by a minus sign. Required: a. $40,250 paid at the end of four years. The discount rate is 3 percent. b. $4,600 paid at the end of three years and $8,450 paid at the end of five years. The discount rate is 9 percent. c. $14,700 paid annually at the end of each of the next four years. The discount rate is 3 percent. d. $2,350 paid annually at the end of each of the next four years and $4,700 paid at the end of the fifth year. The discount rate is 6 percent. Note: For all requirements, round discount factor(s) to 3 decimal places, all other intermediate calculations and final answers to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts