Question: Firm E must choose between two alternative transactions. Transaction 1 requires a $13,650 cash outlay that would be nondeductible in the computation of taxable income.

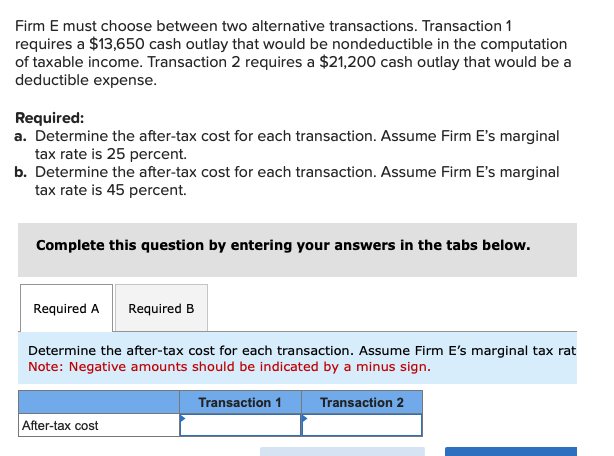

Firm E must choose between two alternative transactions. Transaction 1 requires a $13,650 cash outlay that would be nondeductible in the computation of taxable income. Transaction 2 requires a $21,200 cash outlay that would be a deductible expense. Required: a. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 25 percent. b. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 45 percent. Complete this question by entering your answers in the tabs below. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rat Note: Negative amounts should be indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts