Question: please help 1. Explain the difference between a put option and a short position in a futures contract. (1 Point) 2. Which security should sell

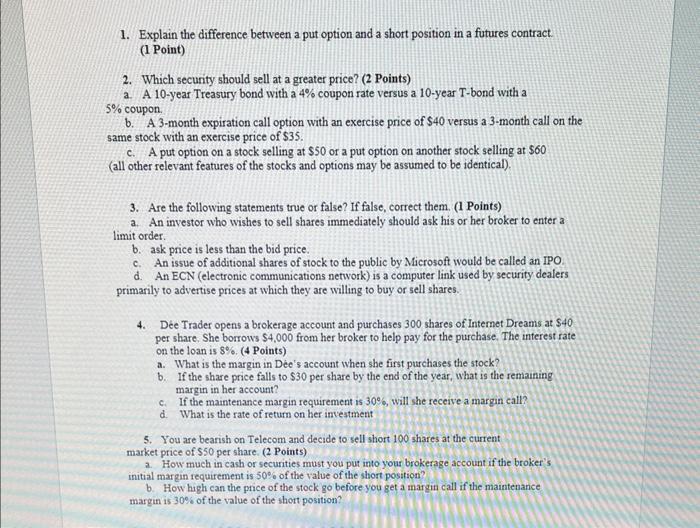

1. Explain the difference between a put option and a short position in a futures contract. (1 Point) 2. Which security should sell at a greater price? (2 Points) a. A 10 -year Treasury bond with a 4% coupon rate versus a 10 -year T-bond with a 5% coupon. b. A 3-month expiration call option with an exercise price of $40 versus a 3-month call on the same stock with an exercise price of $35. c. A put option on a stock selling at $50 or a put option on another stock selling at $60 (all other relevant features of the stocks and options may be assumed to be identical). 3. Are the following statements true or false? If false, correct them. (1 Points) a. An investor who wishes to sell shares immediately should ask his or her broker to enter a limit order. b. ask price is less than the bid price. c. An issue of additional shares of stock to the public by Microsoft would be called an IPO. d. An ECN (electronic communications network) is a computer link used by security dealers primarily to advertise prices at which they are willing to buy or sell shares. 4. Dee Trader opens a brokerage account and purchases 300 shares of Intemet Dreams at $40 per share. She borrows $4,000 from her broker to help pay for the purchase. The interest rate on the loan is 8%. (4 Points) a. What is the margin in Dee's account when she first purchases the stock? b. If the share price falls to $30 per share by the end of the year, what is the remaining margin in her account? c. If the maintenance margin requirement is 30%, will she receive a margin call? d. What is the rate of return on her imvestment 5. You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. (2 Points) a. How much in cash or securities must you put imto your brokerage account if the broker's initial margin requirement is 50% of the value of the short position? b. How high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the shot position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts