Question: urgent 1. Explain the difference between a put option and a short position in a futures contract. (1 Point) 2. Which security should sell at

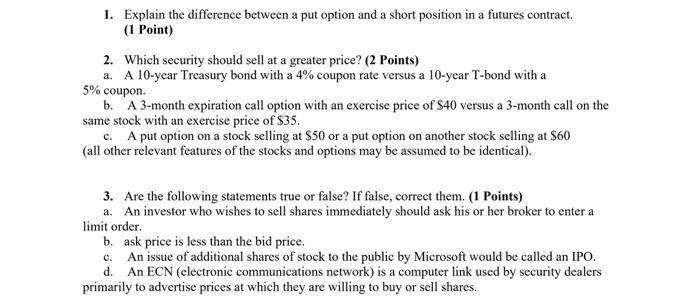

1. Explain the difference between a put option and a short position in a futures contract. (1 Point) 2. Which security should sell at a greater price? (2 Points) a. A 10-year Treasury bond with a 4% coupon rate versus a 10-year T-bond with a 5% coupon. b. A 3-month expiration call option with an exercise price of $40 versus a 3-month call on the same stock with an exercise price of $35. c. A put option on a stock selling at $50 or a put option on another stock selling at $60 (all other relevant features of the stocks and options may be assumed to be identical). 3. Are the following statements true or false? If false, correct them. (1 Points) a. An investor who wishes to sell shares immediately should ask his or her broker to enter a limit order. b. ask price is less than the bid price. c. An issue of additional shares of stock to the public by Microsoft would be called an IPO. d. An ECN (electronic communications network) is a computer link used by security dealers primarily to advertise prices at which they are willing to buy or sell shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts