Question: please help 1-15 will like! Darwin, age 23, graduated with a B.S. from SDSU in Fall 2021. He currently earns $50,000 per year as a

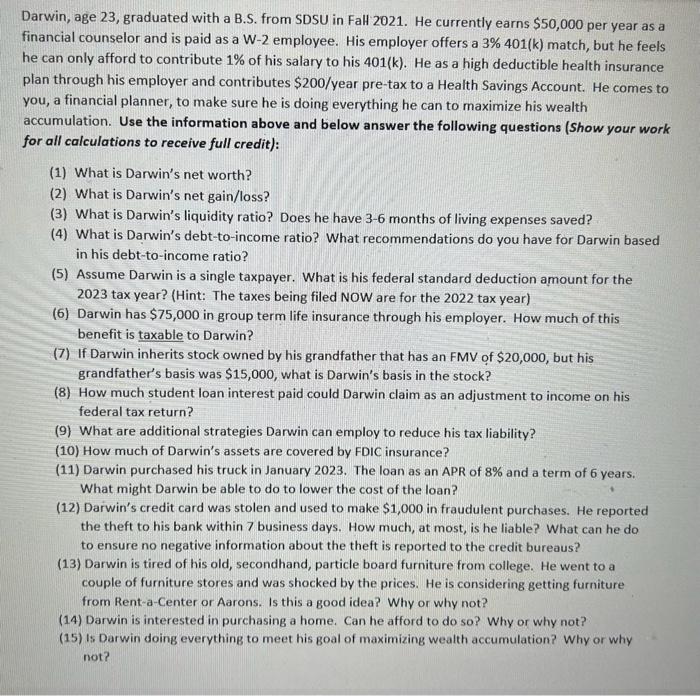

Darwin, age 23, graduated with a B.S. from SDSU in Fall 2021. He currently earns $50,000 per year as a financial counselor and is paid as a W2 employee. His employer offers a 3%401(k) match, but he feels he can only afford to contribute 1% of his salary to his 401(k). He as a high deductible health insurance plan through his employer and contributes \$200/year pre-tax to a Health Savings Account. He comes to you, a financial planner, to make sure he is doing everything he can to maximize his wealth accumulation. Use the information above and below answer the following questions (Show your work for all calculations to receive full credit): (1) What is Darwin's net worth? (2) What is Darwin's net gain/loss? (3) What is Darwin's liquidity ratio? Does he have 3-6 months of living expenses saved? (4) What is Darwin's debt-to-income ratio? What recommendations do you have for Darwin based in his debt-to-income ratio? (5) Assume Darwin is a single taxpayer. What is his federal standard deduction amount for the 2023 tax year? (Hint: The taxes being filed NOW are for the 2022 tax year) (6) Darwin has $75,000 in group term life insurance through his employer. How much of this benefit is taxable to Darwin? (7) If Darwin inherits stock owned by his grandfather that has an FMV of $20,000, but his grandfather's basis was $15,000, what is Darwin's basis in the stock? (8) How much student loan interest paid could Darwin claim as an adjustment to income on his federal tax return? (9) What are additional strategies Darwin can employ to reduce his tax liability? (10) How much of Darwin's assets are covered by FDIC insurance? (11) Darwin purchased his truck in January 2023. The loan as an APR of 8% and a term of 6 years. What might Darwin be able to do to lower the cost of the loan? (12) Darwin's credit card was stolen and used to make $1,000 in fraudulent purchases. He reported the theft to his bank within 7 business days. How much, at most, is he liable? What can he do to ensure no negative information about the theft is reported to the credit bureaus? (13) Darwin is tired of his old, secondhand, particle board furniture from college. He went to a couple of furniture stores and was shocked by the prices. He is considering getting furniture from Rent-a-Center or Aarons. Is this a good idea? Why or why not? (14) Darwin is interested in purchasing a home. Can he afford to do so? Why or why not? (15) Is Darwin doing everything to meet his goal of maximizing wealth accumulation? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts