Question: please help 1&2 A lottery winner was offered a payment of $31,500 for 30 years or a lump-sum payment of 500,000 . She could invest

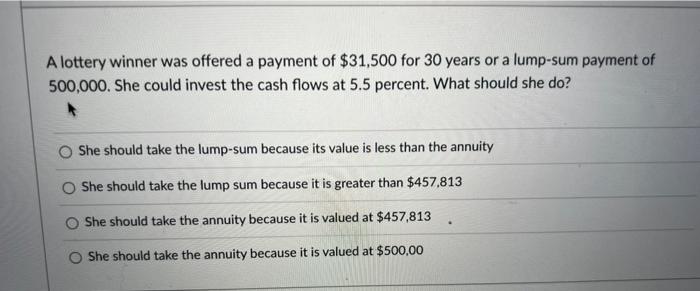

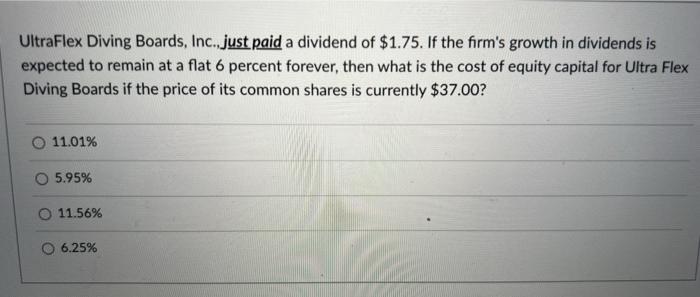

A lottery winner was offered a payment of $31,500 for 30 years or a lump-sum payment of 500,000 . She could invest the cash flows at 5.5 percent. What should she do? She should take the lump-sum because its value is less than the annuity She should take the lump sum because it is greater than $457.813 She should take the annuity because it is valued at $457,813 She should take the annuity because it is valued at $500,00 UltraFlex Diving Boards, Inc., just paid a dividend of $1.75. If the firm's growth in dividends is expected to remain at a flat 6 percent forever, then what is the cost of equity capital for Ultra Flex Diving Boards if the price of its common shares is currently $37.00 ? 11.01% 5.95% 11.56% 6.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts