Question: Please help 16. The Fama-French three-factor model Consider the following two statements and identify which model each describes: This model argues that the realized return

Please help

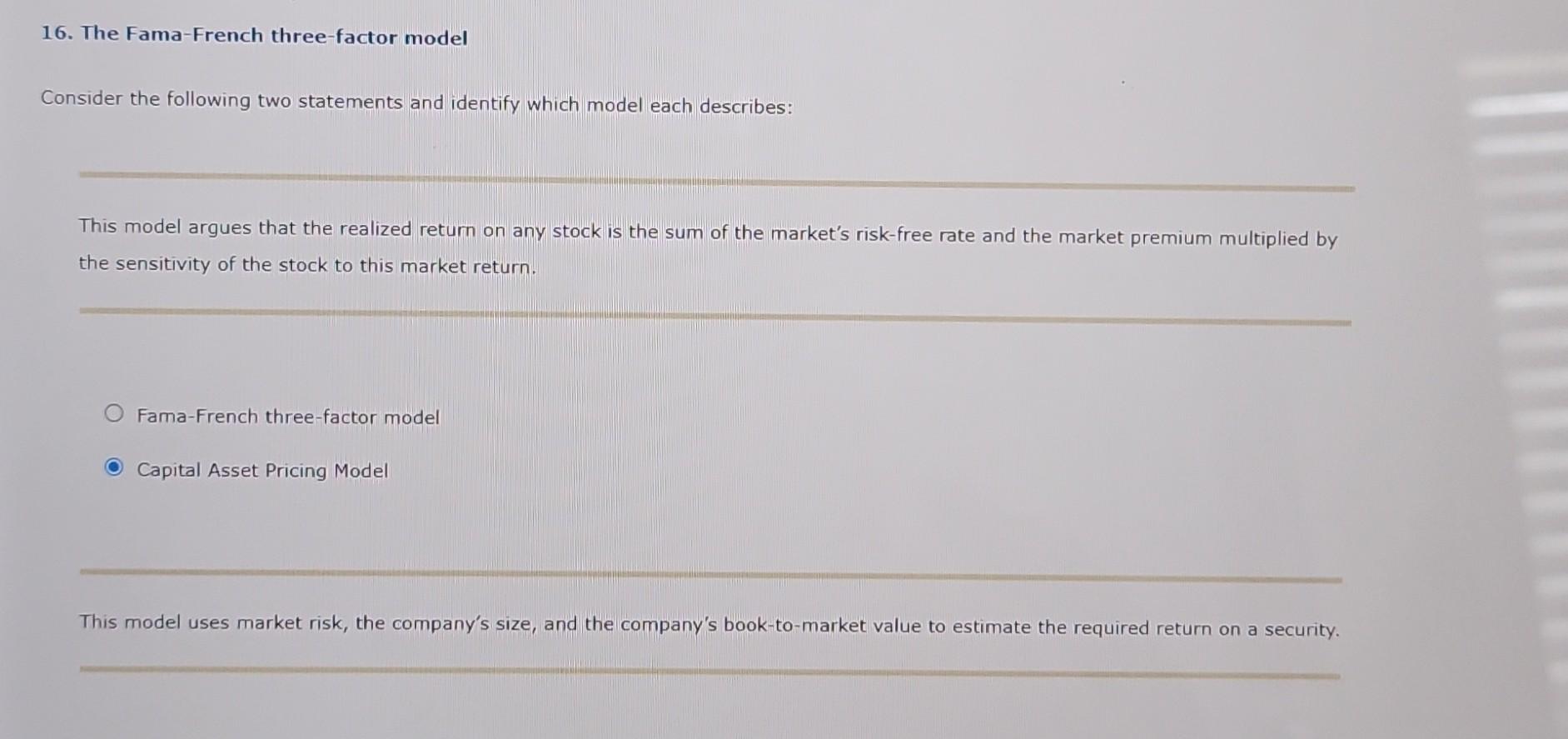

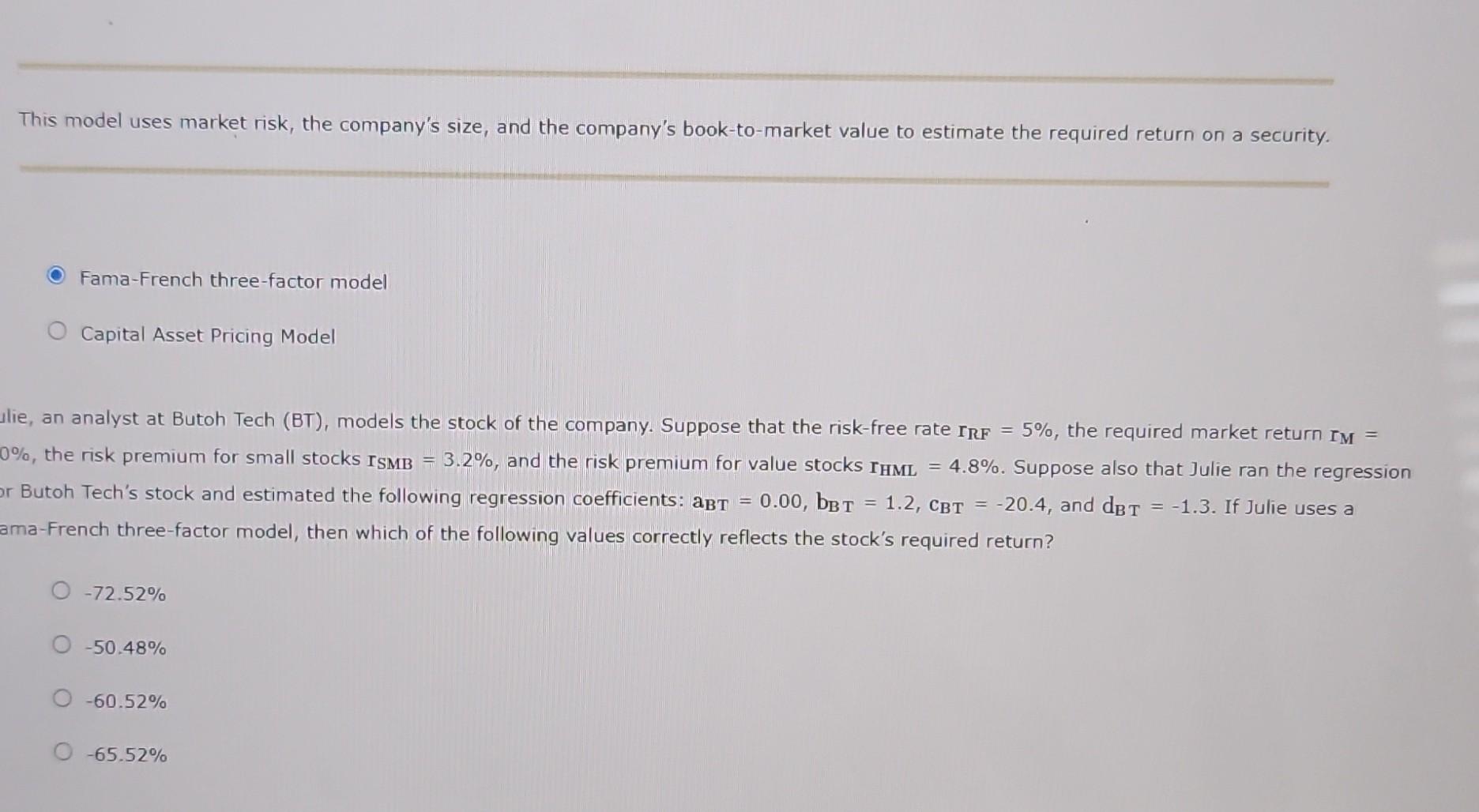

16. The Fama-French three-factor model Consider the following two statements and identify which model each describes: This model argues that the realized return on any stock is the sum of the market's risk-free rate and the market premium multiplied by the sensitivity of the stock to this market return. Fama-French three-factor model Capital Asset Pricing Model This model uses market risk, the company's size, and the company's book-to-market value to estimate the required return on a security. This model uses market risk, the company's size, and the company's book-to-market value to estimate the required return on a security. Fama-French three-factor model Capital Asset Pricing Model lie, an analyst at Butoh Tech (BT), models the stock of the company. Suppose that the risk-free rate rRF=5%, the required market return rM= %, the risk premium for small stocks ISMB=3.2%, and the risk premium for value stocks IHMLHM=4.8%. Suppose also that Julie ran the regression Butoh Tech's stock and estimated the following regression coefficients: aBT=0.00,bBT=1.2,cBT=20.4, and dBT=1.3. If Julie uses a ima-French three-factor model, then which of the following values correctly reflects the stock's required return? 72.52% 50.48% 60.52% 65.52%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts