Question: Consider the following two statements and identify which model each describes: This model maintains that the only risk rewarded in the market with additional return

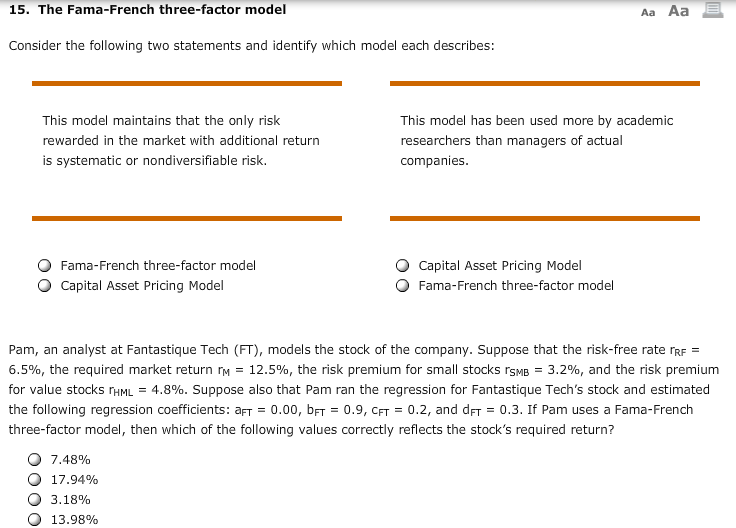

Consider the following two statements and identify which model each describes: This model maintains that the only risk rewarded in the market with additional return is systematic or nondiversifiable risk. This model has been used more by academic researchers than managers of actual companies. Fama-French three-factor model Capital Asset Pricing Model Capital Asset Pricing Model Fama-French three-factor model Pam, an analyst at Fantastique Tech (FT), models the stock of the company. Suppose that the risk-free rate rRF = 6.5%, the required market return rM = 12.5%, the risk premium for small stocks rsm = 3.2%, and the risk premium for value stocks rHMi_ = 4.8%. Suppose also that Pam ran the regression for Fantastique Tech's stock and estimated the following regression coefficients: an- = 0.00, bn- = 0.9, cft = 0.2, and dn- = 0.3. If Pam uses a Fama-French three-factor model, then which of the following values correctly reflects the stock's required return? 7.48% 17.94% 3.18% 13.98%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts