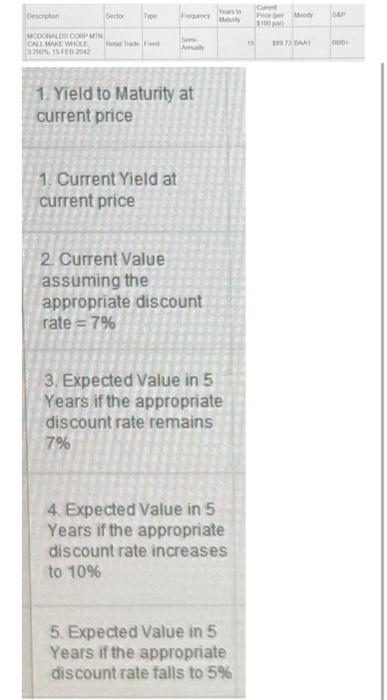

Question: please help 2. Current Value assuming the appropriate discount rate =7% 3. Expected Value in 5 Years if the appropriate discount rate remains 7% 4.

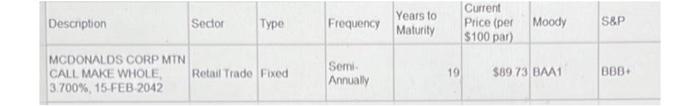

2. Current Value assuming the appropriate discount rate =7% 3. Expected Value in 5 Years if the appropriate discount rate remains 7% 4. Expected Value in 5 Years if the appropriate discount rate increases to 10% 5. Expected Value in 5 Years if the appropriate discount rate falls to 5% \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline Description & Sector & Type & Frequency & \begin{tabular}{l} Years to \\ Maturity \end{tabular} & \begin{tabular}{l} Current \\ Price (per \\ \$100 par) \end{tabular} & Moody & S8P \\ \hline \begin{tabular}{l} MCDONALDS CORP MTN \\ CALL MAKE WHOLE, \\ 3.700%,15FEB.2042 \end{tabular} & Retail Trade & Fixed & \begin{tabular}{l} Semi. \\ Annualy \end{tabular} & 19 & $8973 BAM1 & B8B. \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts