Question: please help. 2 problems A company issues bonds with a par value of $400,000 on their issue date. The bonds mature in 10 years and

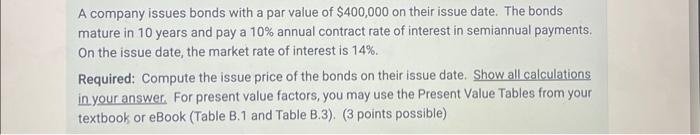

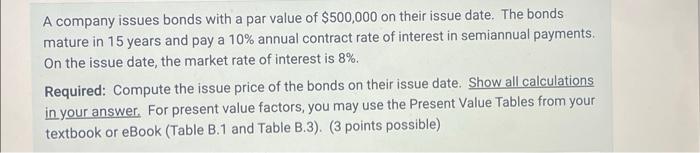

A company issues bonds with a par value of $400,000 on their issue date. The bonds mature in 10 years and pay a 10% annual contract rate of interest in semiannual payments. On the issue date, the market rate of interest is 14%. Required: Compute the issue price of the bonds on their issue date. Show all calculations in your answer. For present value factors, you may use the Present Value Tables from your textbook or eBook (Table B.1 and Table B.3). (3 points possible) A company issues bonds with a par value of $500,000 on their issue date. The bonds mature in 15 years and pay a 10% annual contract rate of interest in semiannual payments. On the issue date, the market rate of interest is 8%. Required: Compute the issue price of the bonds on their issue date. Show all calculations in your answer. For present value factors, you may use the Present Value Tables from your textbook or eBook (Table B.1 and Table B.3). (3 points possible)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts