Question: Please help 24 25 Step 1 - The Chart of Accounts 26 The chart of accounts includes all of the accounts that you can use

Please help

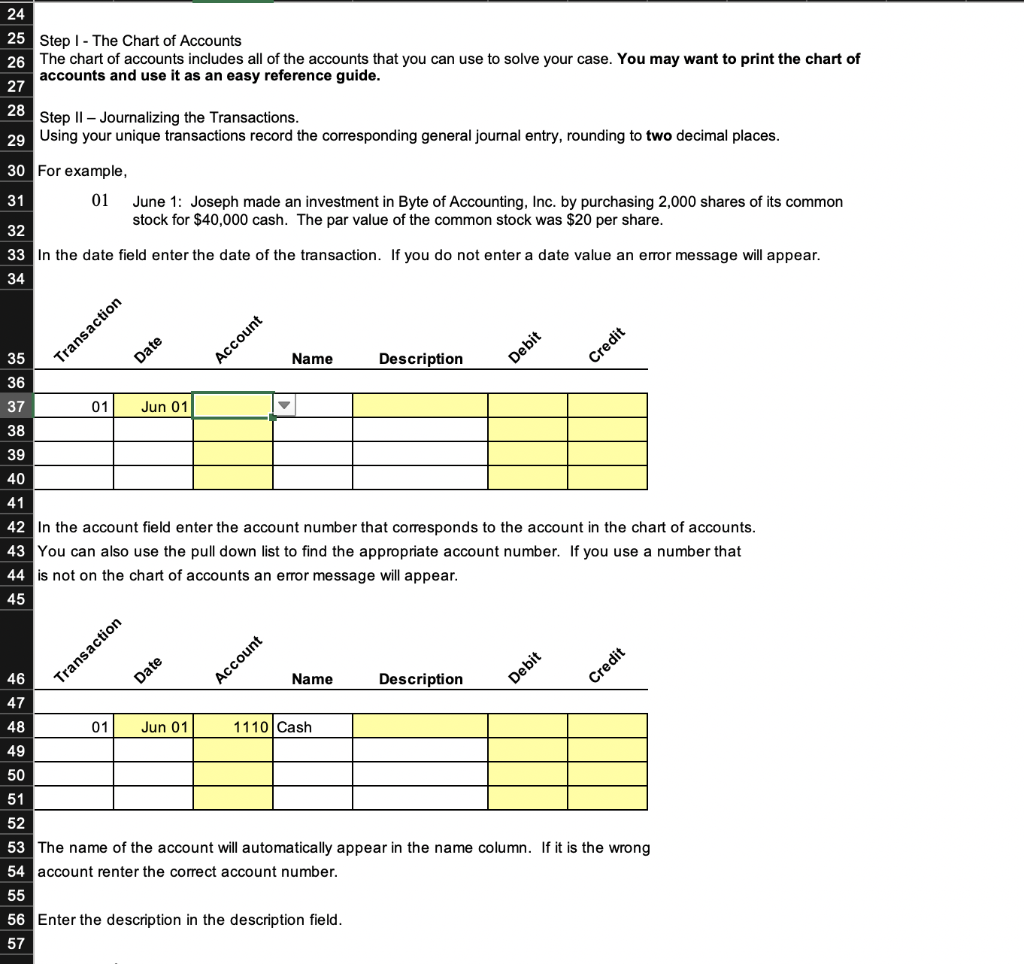

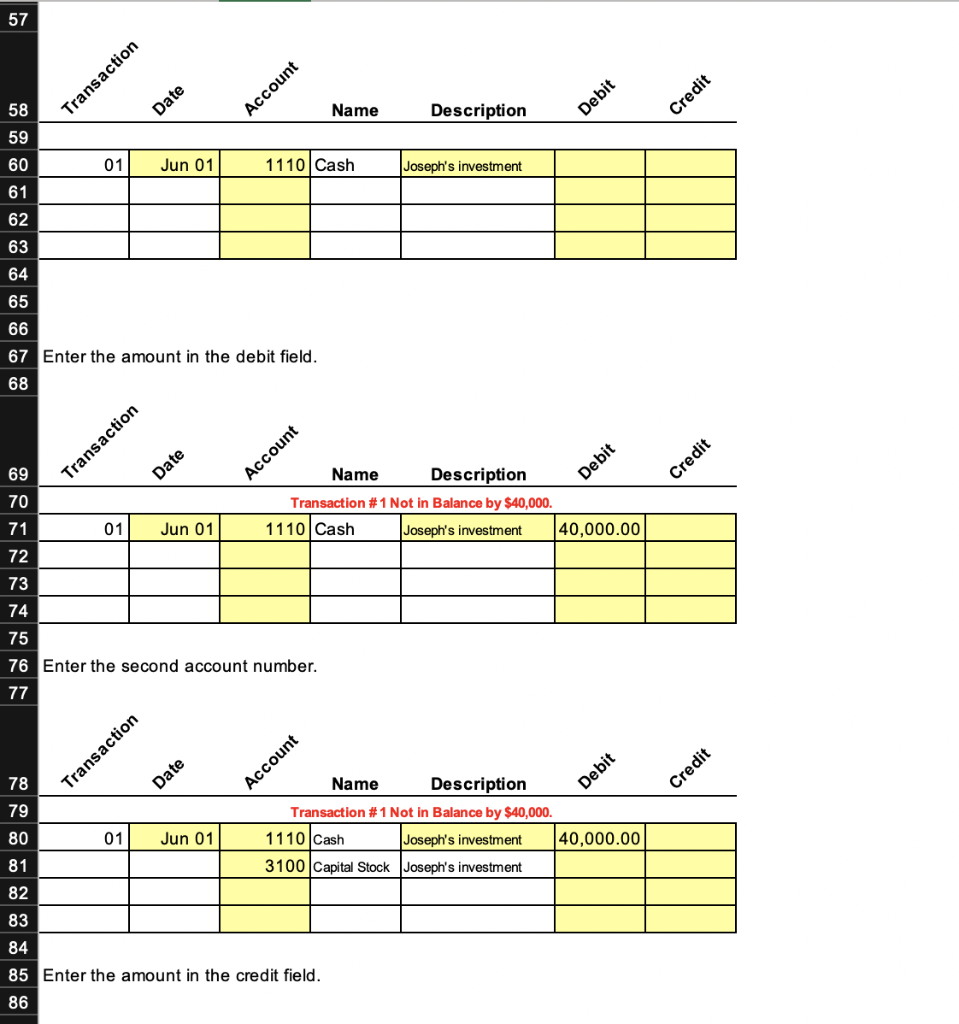

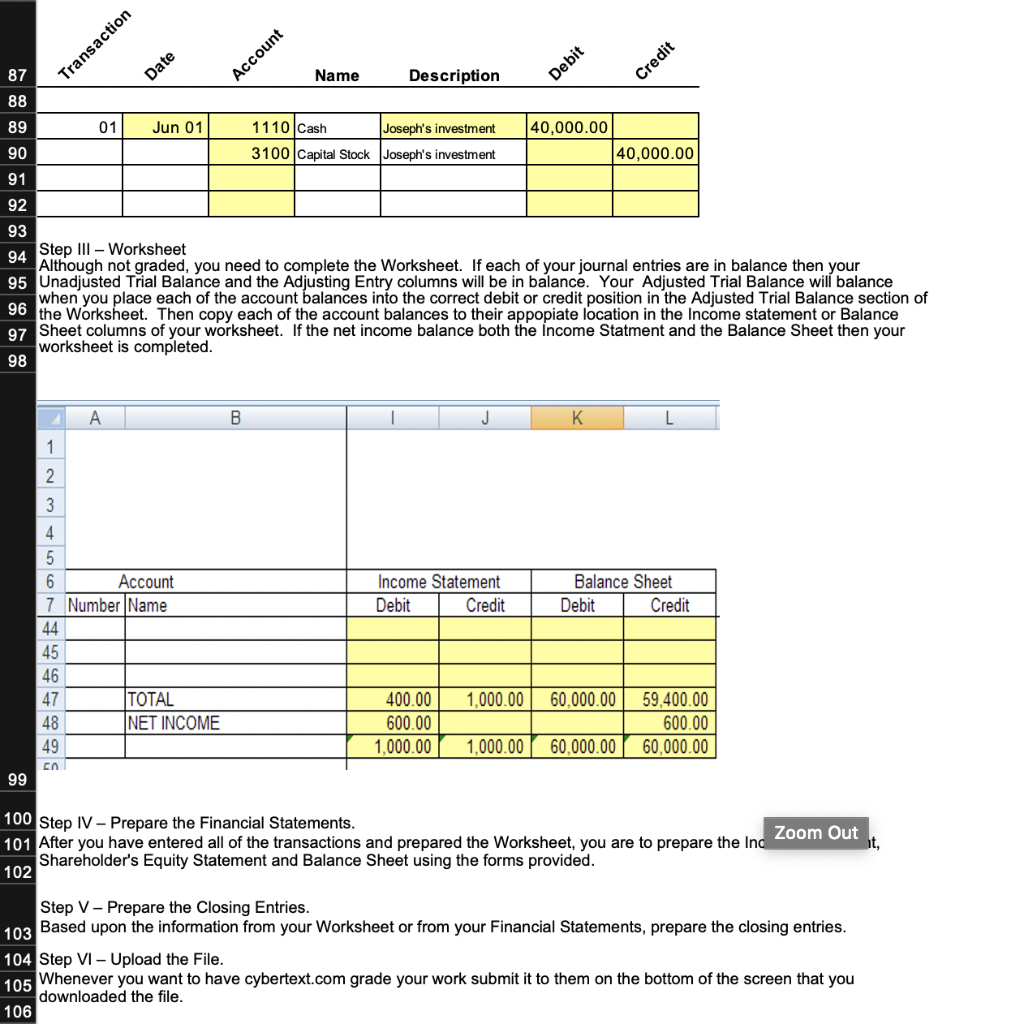

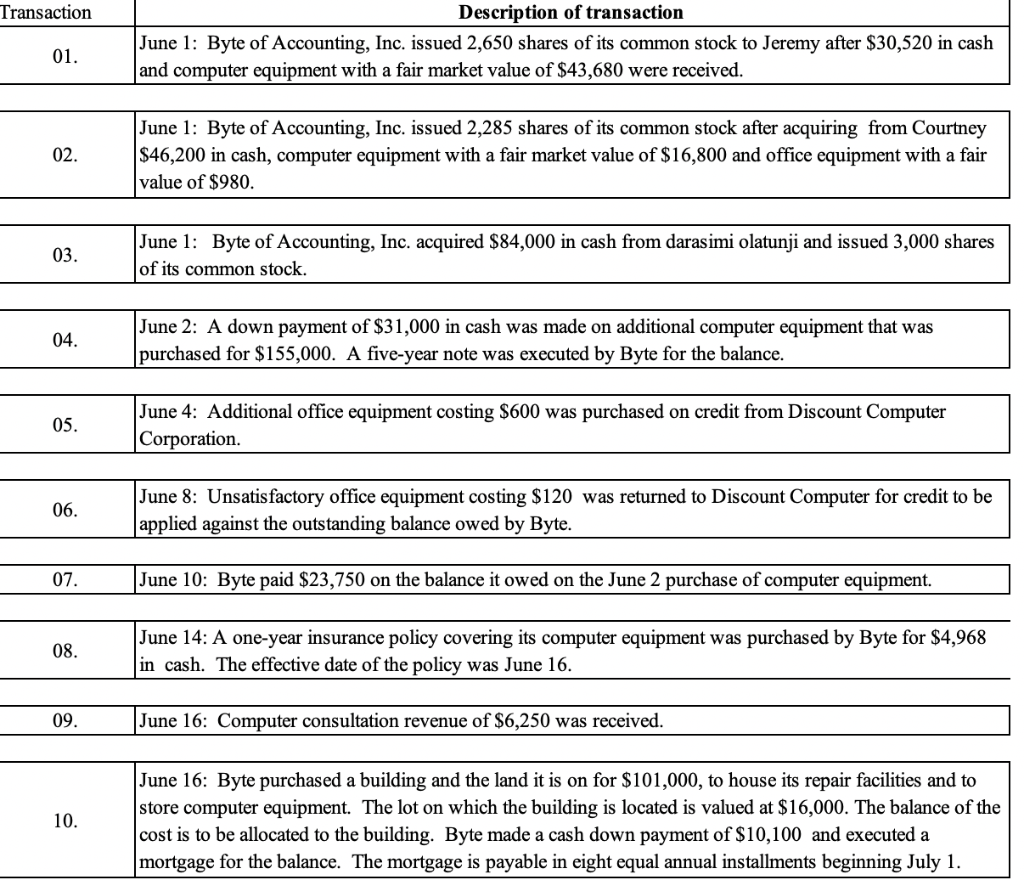

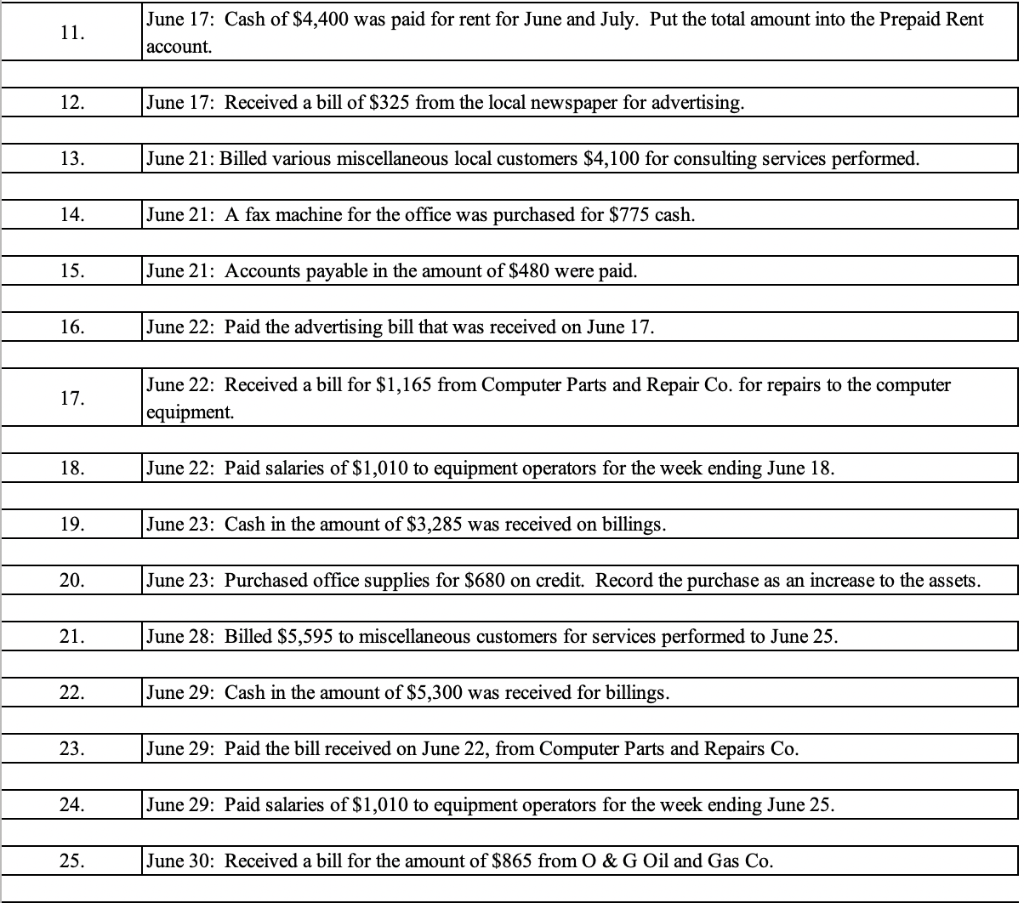

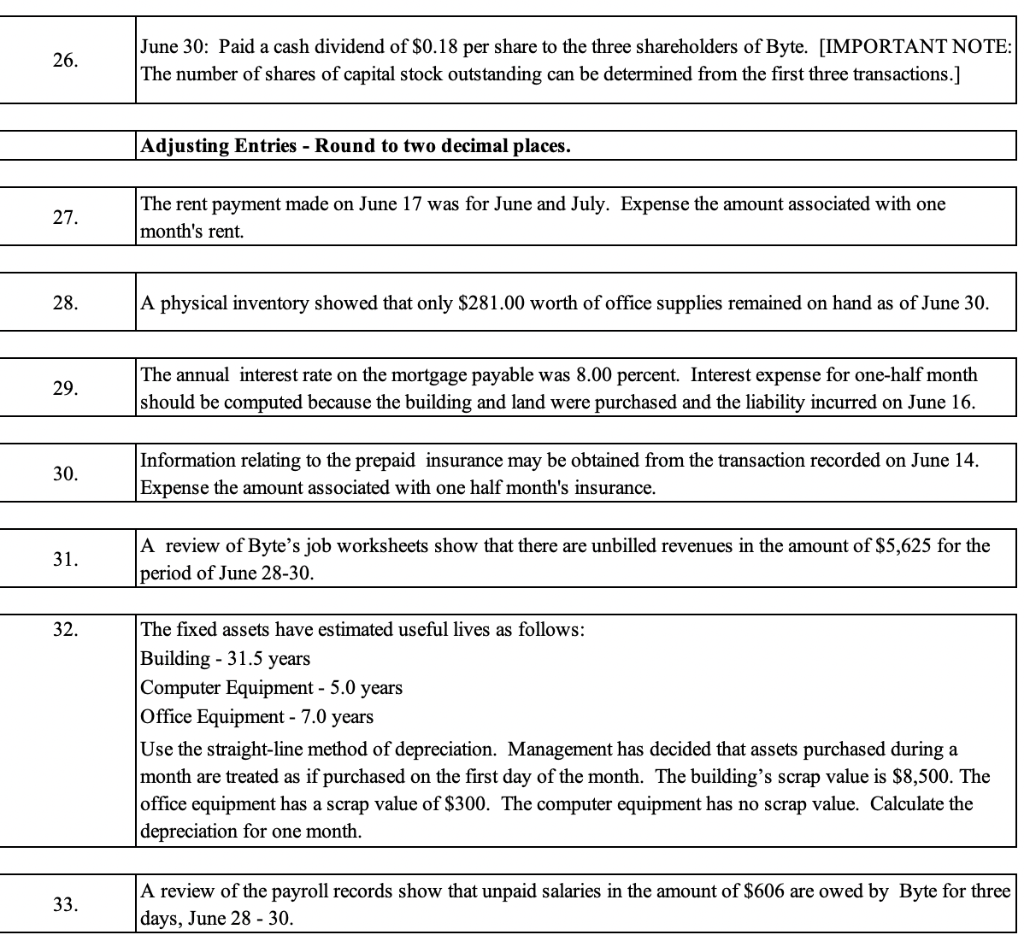

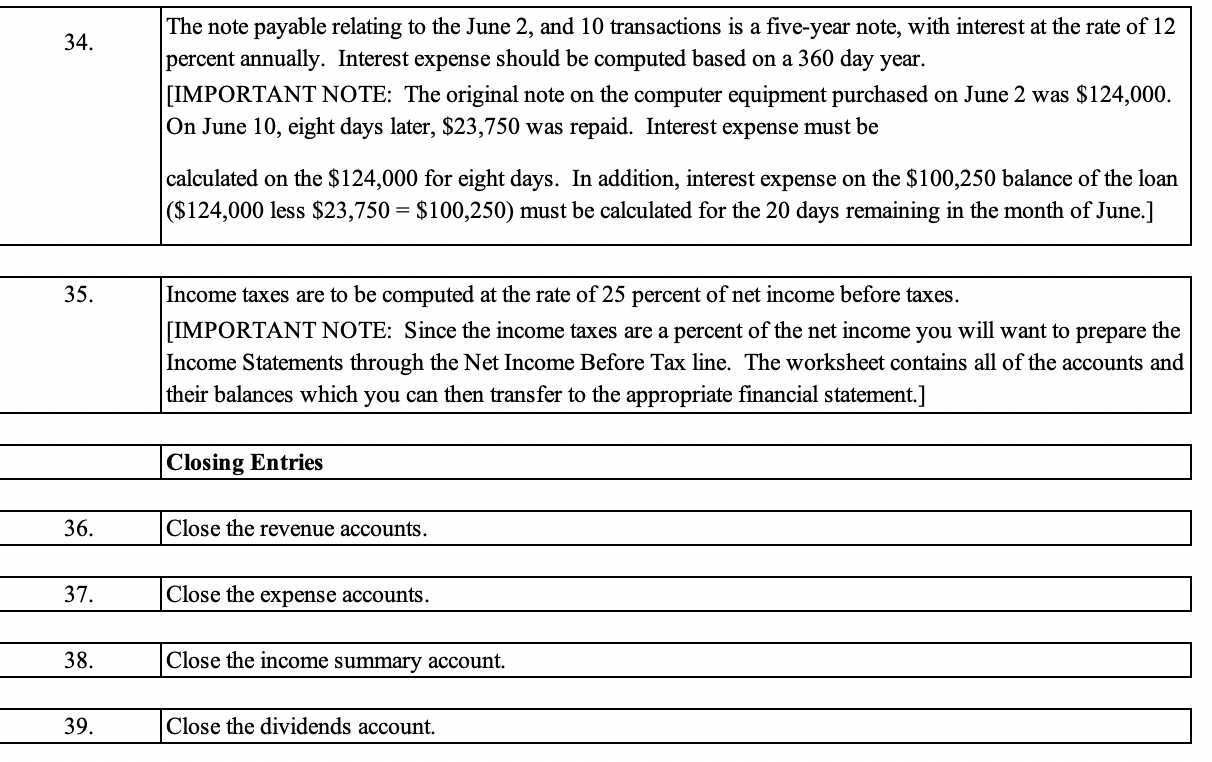

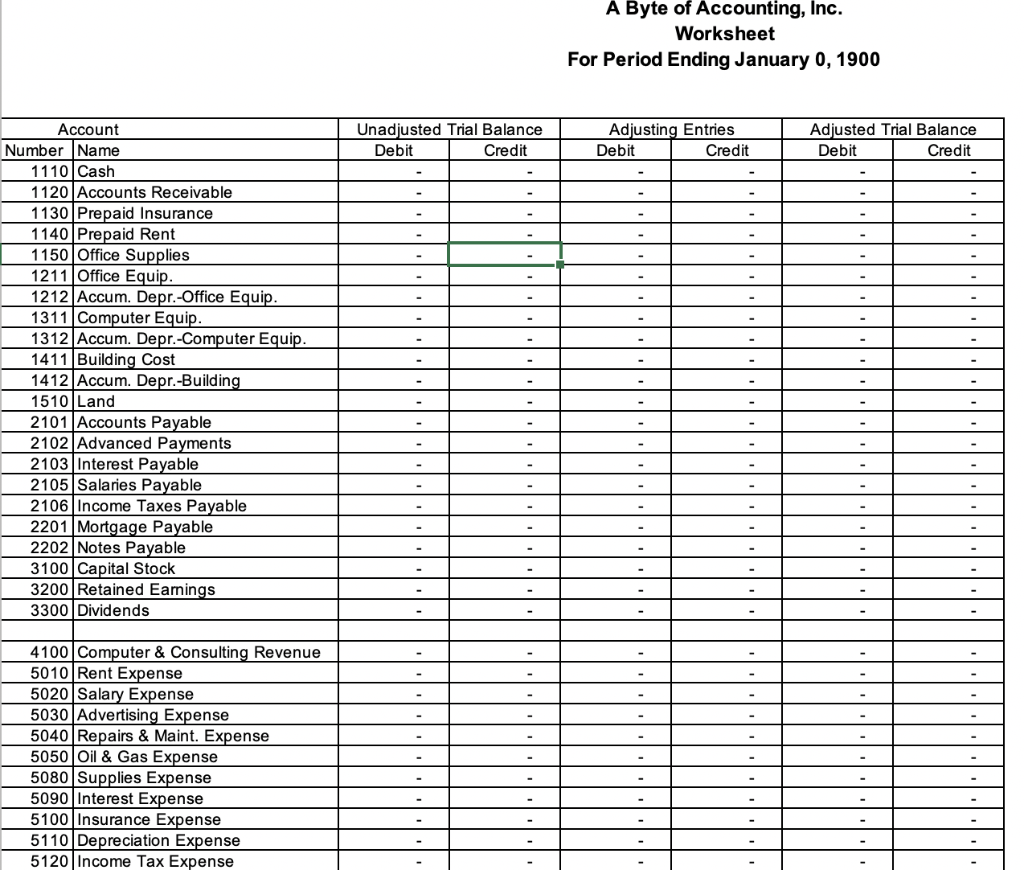

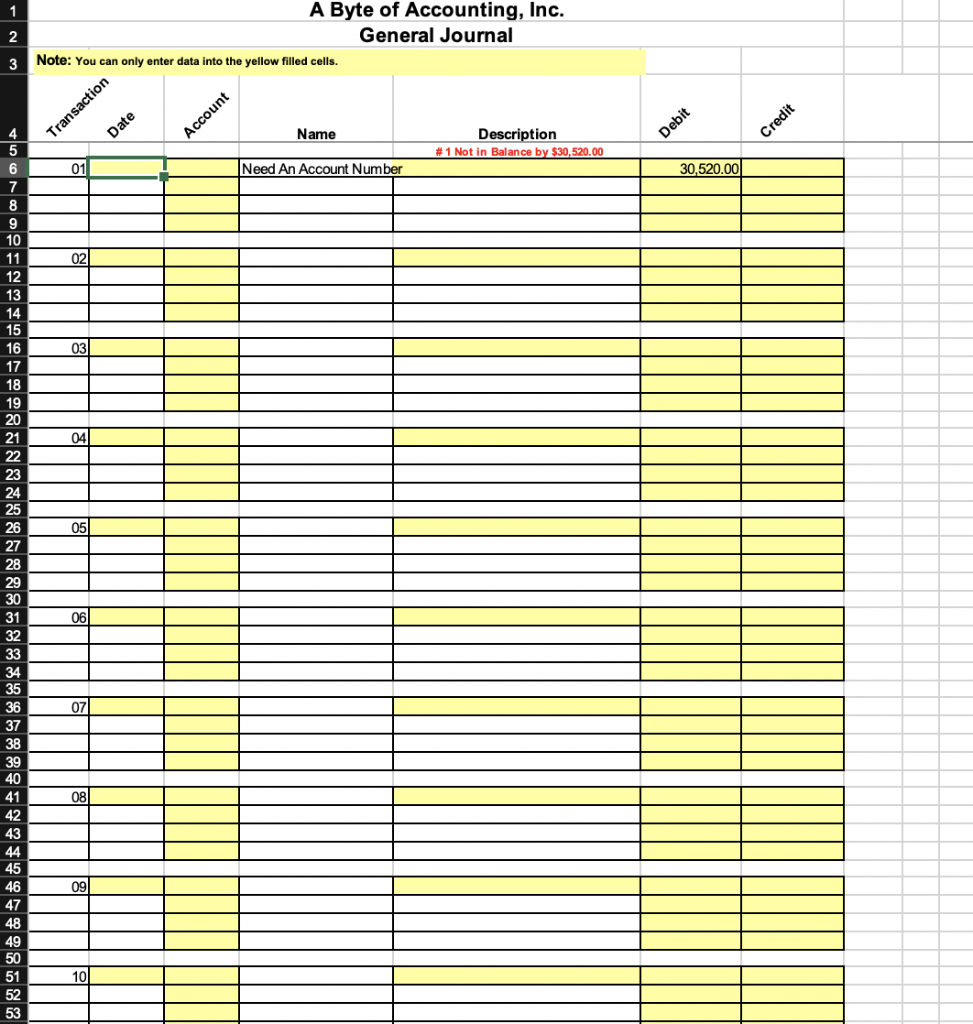

24 25 Step 1 - The Chart of Accounts 26 The chart of accounts includes all of the accounts that you can use to solve your case. You may want to print the chart of accounts and use it as an easy reference guide. 27 28 Step || - Journalizing the Transactions. 29 Using your unique transactions record the corresponding general journal entry, rounding to two decimal places. 30 For example, 31 01 June 1: Joseph made an investment in Byte of Accounting, Inc. by purchasing 2,000 shares of its common stock for $40,000 cash. The par value of the common stock was $20 per share. 32 33 In the date field enter the date of the transaction. If you do not enter a date value an error message will appear. 34 35 Transaction Date Name Account Description Debit Credit 36 37 01 Jun 01 38 39 40 41 42 In the account field enter the account number that corresponds to the account in the chart of accounts. 43 You can also use the pull down list to find the appropriate account number. If you use a number that 44 is not on the chart of accounts an error message will appear. 45 Date count Transaction Accou Debit Credit 46 Name Description 47 48 01 Jun 01 1110 Cash 49 50 51 52 53 The name of the account will automatically appear in the name column. If it is the wrong 54 account renter the correct account number. 55 56 Enter the description in the description field. 57 57 Credit 58 Transaction Date Account Name Description Debit 01 Jun 01 1110 Cash Joseph's investment 59 60 61 62 63 64 65 66 67 Enter the amount in the debit field. 68 69 Transaction Date Account Debit Credit Name Description Transaction #1 Not in Balance by $40,000. 1110 Cash Joseph's investment 40,000.00 01 Jun 01 70 71 72 73 74 75 76 Enter the second account number. 77 Debit Date Transaction Account Credit 78 79 80 81 82 Name Description Transaction #1 Not in Balance by $40,000. 1110 Cash Joseph's investment 40,000.00 3100 Capital Stock Joseph's investment 01 Jun 01 83 84 85 Enter the amount in the credit field. 86 87 Transaction Account Name Date Description Debit Credit 88 01 Jun 01 89 90 1110 Cash Joseph's investment 3100 Capital Stock Joseph's investment 40,000.00 40,000.00 91 92 93 Worksheet 94 Although not graded, you need to complete the Worksheet. If each of your journal entries are in balance then your 95 Unadjusted Trial Balance and the Adjusting Entry columns will be in balance. Your Adjusted Trial Balance will balance when you place each of the account balances into the correct debit or credit position in the Adjusted Trial Balance section of 96 the Worksheet. Then copy each of the account balances to their appopiate location in the Income statement or Balance 97 Sheet columns of your worksheet. If the net income balance both the income Statment and the Balance Sheet then your worksheet is completed. 98 A B J K. L 1 2 3 Income Statement Debit Credit Balance Sheet Debit Credit 4 5 6 Account 7 Number Name 44 45 46 47 TOTAL 48 NET INCOME 49 . 1,000.00 60,000.00 400.00 600.00 1,000.00 59,400.00 600.00 60,000.00 1,000.00 60,000.00 99 100 Step IV - Prepare the Financial Statements. Zoom Out ht, 101 After you have entered all of the transactions and prepared the Worksheet, you are to prepare the ind Shareholder's Equity Statement and Balance Sheet using the forms provided. 102 Step V - Prepare the Closing Entries. 103 Based upon the information from your Worksheet or from your Financial Statements, prepare the closing entries. 104 Step VI - Upload the File. 105 Whenever you want to have cybertext.com grade your work submit it to them on the bottom of the screen that you downloaded the file. 106 Transaction Description of transaction June 1: Byte of Accounting, Inc. issued 2,650 shares of its common stock to Jeremy after $30,520 in cash and computer equipment with a fair market value of $43,680 were received. 01. 02. June 1: Byte of Accounting, Inc. issued 2,285 shares of its common stock after acquiring from Courtney $46,200 in cash, computer equipment with a fair market value of $16,800 and office equipment with a fair value of $980. 03. June 1: Byte of Accounting, Inc. acquired $84,000 in cash from darasimi olatunji and issued 3,000 shares of its common stock. 04. June 2: A down payment of $31,000 in cash was made on additional computer equipment that was purchased for $155,000. A five-year note was executed by Byte for the balance. 05. June 4: Additional office equipment costing $600 was purchased on credit from Discount Computer Corporation. 06. June 8: Unsatisfactory office equipment costing $120 was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte. 07. June 10: Byte paid $23,750 on the balance it owed on the June 2 purchase of computer equipment. 08. June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $4,968 in cash. The effective date of the policy was June 16. 09. June 16: Computer consultation revenue of $6,250 was received. 10. June 16: Byte purchased a building and the land it is on for $101,000, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $ 16,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of $10,100 and executed a mortgage for the balance. The mortgage is payable in eight equal annual installments beginning July 1. 11. June 17: Cash of $4,400 was paid for rent for June and July. Put the total amount into the Prepaid Rent account. 12. June 17: Received a bill of $325 from the local newspaper for advertising. 13. June 21: Billed various miscellaneous local customers $4,100 for consulting services performed. 14. June 21: A fax machine for the office was purchased for $775 cash. 15. June 21: Accounts payable in the amount of $480 were paid. 16. June 22: Paid the advertising bill that was received on June 17. 17. June 22: Received a bill for $1,165 from Computer Parts and Repair Co. for repairs to the computer equipment. 18. June 22: Paid salaries of $1,010 to equipment operators for the week ending June 18. 19. June 23: Cash in the amount of $3,285 was received on billings. 20. June 23: Purchased office supplies for $680 on credit. Record the purchase as an increase to the assets. 21. June 28: Billed $5,595 to miscellaneous customers for services performed to June 25. 22. June 29: Cash in the amount of $5,300 was received for billings. 23. 23 June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 24. June 29: Paid salaries of $1,010 to equipment operators for the week ending June 25. 25. June 30: Received a bill for the amount of $865 from O&G Oil and Gas Co. 26. June 30: Paid a cash dividend of $0.18 per share to the three shareholders of Byte. [IMPORTANT NOTE: The number of shares of capital stock outstanding can be determined from the first three transactions.] Adjusting Entries - Round to two decimal places. 27. The rent payment made on June 17 was for June and July. Expense the amount associated with one month's rent. 28. A physical inventory showed that only $281.00 worth of office supplies remained on hand as of June 30. 29. The annual interest rate on the mortgage payable was 8.00 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,625 for the period of June 28-30. 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $8,500. The office equipment has a scrap value of $300. The computer equipment has no scrap value. Calculate the depreciation for one month. 33. A review of the payroll records show that unpaid salaries in the amount of $606 are owed by Byte for three days, June 28 - 30. 34. The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $124,000. On June 10, eight days later, $23,750 was repaid. Interest expense must be calculated on the $ 124,000 for eight days. In addition, interest expense on the $100,250 balance of the loan ($124,000 less $23,750 = $100,250) must be calculated for the 20 days remaining in the month of June.] 35. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] Closing Entries 36. Close the revenue accounts. 37. Close the expense accounts. 38. Close the income summary account. 39. Close the dividends account. A Byte of Accounting, Inc. Worksheet For Period Ending January 0, 1900 Unadjusted Trial Balance Debit Credit Adjusting Entries Debit Credit Adjusted Trial Balance Debit Credit Account Number Name 1110 Cash 1120 Accounts Receivable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip. 1311 Computer Equip. 1312 Accum. Depr.-Computer Equip. 1411 Building Cost 1412 | Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3200 Retained Earnings 3300 Dividends 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 Oil & Gas Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Income Tax Expense w Na 2 3 A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Credit Transaction Date Name Account Description # 1 Not in Balance by $30,520.00 Debit 011 Need An Account Number 30,520.00) 02 031 04 051 gugaasaa SOS NESSE RECOMA 061 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 07 08 09 10 24 25 Step 1 - The Chart of Accounts 26 The chart of accounts includes all of the accounts that you can use to solve your case. You may want to print the chart of accounts and use it as an easy reference guide. 27 28 Step || - Journalizing the Transactions. 29 Using your unique transactions record the corresponding general journal entry, rounding to two decimal places. 30 For example, 31 01 June 1: Joseph made an investment in Byte of Accounting, Inc. by purchasing 2,000 shares of its common stock for $40,000 cash. The par value of the common stock was $20 per share. 32 33 In the date field enter the date of the transaction. If you do not enter a date value an error message will appear. 34 35 Transaction Date Name Account Description Debit Credit 36 37 01 Jun 01 38 39 40 41 42 In the account field enter the account number that corresponds to the account in the chart of accounts. 43 You can also use the pull down list to find the appropriate account number. If you use a number that 44 is not on the chart of accounts an error message will appear. 45 Date count Transaction Accou Debit Credit 46 Name Description 47 48 01 Jun 01 1110 Cash 49 50 51 52 53 The name of the account will automatically appear in the name column. If it is the wrong 54 account renter the correct account number. 55 56 Enter the description in the description field. 57 57 Credit 58 Transaction Date Account Name Description Debit 01 Jun 01 1110 Cash Joseph's investment 59 60 61 62 63 64 65 66 67 Enter the amount in the debit field. 68 69 Transaction Date Account Debit Credit Name Description Transaction #1 Not in Balance by $40,000. 1110 Cash Joseph's investment 40,000.00 01 Jun 01 70 71 72 73 74 75 76 Enter the second account number. 77 Debit Date Transaction Account Credit 78 79 80 81 82 Name Description Transaction #1 Not in Balance by $40,000. 1110 Cash Joseph's investment 40,000.00 3100 Capital Stock Joseph's investment 01 Jun 01 83 84 85 Enter the amount in the credit field. 86 87 Transaction Account Name Date Description Debit Credit 88 01 Jun 01 89 90 1110 Cash Joseph's investment 3100 Capital Stock Joseph's investment 40,000.00 40,000.00 91 92 93 Worksheet 94 Although not graded, you need to complete the Worksheet. If each of your journal entries are in balance then your 95 Unadjusted Trial Balance and the Adjusting Entry columns will be in balance. Your Adjusted Trial Balance will balance when you place each of the account balances into the correct debit or credit position in the Adjusted Trial Balance section of 96 the Worksheet. Then copy each of the account balances to their appopiate location in the Income statement or Balance 97 Sheet columns of your worksheet. If the net income balance both the income Statment and the Balance Sheet then your worksheet is completed. 98 A B J K. L 1 2 3 Income Statement Debit Credit Balance Sheet Debit Credit 4 5 6 Account 7 Number Name 44 45 46 47 TOTAL 48 NET INCOME 49 . 1,000.00 60,000.00 400.00 600.00 1,000.00 59,400.00 600.00 60,000.00 1,000.00 60,000.00 99 100 Step IV - Prepare the Financial Statements. Zoom Out ht, 101 After you have entered all of the transactions and prepared the Worksheet, you are to prepare the ind Shareholder's Equity Statement and Balance Sheet using the forms provided. 102 Step V - Prepare the Closing Entries. 103 Based upon the information from your Worksheet or from your Financial Statements, prepare the closing entries. 104 Step VI - Upload the File. 105 Whenever you want to have cybertext.com grade your work submit it to them on the bottom of the screen that you downloaded the file. 106 Transaction Description of transaction June 1: Byte of Accounting, Inc. issued 2,650 shares of its common stock to Jeremy after $30,520 in cash and computer equipment with a fair market value of $43,680 were received. 01. 02. June 1: Byte of Accounting, Inc. issued 2,285 shares of its common stock after acquiring from Courtney $46,200 in cash, computer equipment with a fair market value of $16,800 and office equipment with a fair value of $980. 03. June 1: Byte of Accounting, Inc. acquired $84,000 in cash from darasimi olatunji and issued 3,000 shares of its common stock. 04. June 2: A down payment of $31,000 in cash was made on additional computer equipment that was purchased for $155,000. A five-year note was executed by Byte for the balance. 05. June 4: Additional office equipment costing $600 was purchased on credit from Discount Computer Corporation. 06. June 8: Unsatisfactory office equipment costing $120 was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte. 07. June 10: Byte paid $23,750 on the balance it owed on the June 2 purchase of computer equipment. 08. June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $4,968 in cash. The effective date of the policy was June 16. 09. June 16: Computer consultation revenue of $6,250 was received. 10. June 16: Byte purchased a building and the land it is on for $101,000, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $ 16,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of $10,100 and executed a mortgage for the balance. The mortgage is payable in eight equal annual installments beginning July 1. 11. June 17: Cash of $4,400 was paid for rent for June and July. Put the total amount into the Prepaid Rent account. 12. June 17: Received a bill of $325 from the local newspaper for advertising. 13. June 21: Billed various miscellaneous local customers $4,100 for consulting services performed. 14. June 21: A fax machine for the office was purchased for $775 cash. 15. June 21: Accounts payable in the amount of $480 were paid. 16. June 22: Paid the advertising bill that was received on June 17. 17. June 22: Received a bill for $1,165 from Computer Parts and Repair Co. for repairs to the computer equipment. 18. June 22: Paid salaries of $1,010 to equipment operators for the week ending June 18. 19. June 23: Cash in the amount of $3,285 was received on billings. 20. June 23: Purchased office supplies for $680 on credit. Record the purchase as an increase to the assets. 21. June 28: Billed $5,595 to miscellaneous customers for services performed to June 25. 22. June 29: Cash in the amount of $5,300 was received for billings. 23. 23 June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 24. June 29: Paid salaries of $1,010 to equipment operators for the week ending June 25. 25. June 30: Received a bill for the amount of $865 from O&G Oil and Gas Co. 26. June 30: Paid a cash dividend of $0.18 per share to the three shareholders of Byte. [IMPORTANT NOTE: The number of shares of capital stock outstanding can be determined from the first three transactions.] Adjusting Entries - Round to two decimal places. 27. The rent payment made on June 17 was for June and July. Expense the amount associated with one month's rent. 28. A physical inventory showed that only $281.00 worth of office supplies remained on hand as of June 30. 29. The annual interest rate on the mortgage payable was 8.00 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,625 for the period of June 28-30. 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $8,500. The office equipment has a scrap value of $300. The computer equipment has no scrap value. Calculate the depreciation for one month. 33. A review of the payroll records show that unpaid salaries in the amount of $606 are owed by Byte for three days, June 28 - 30. 34. The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $124,000. On June 10, eight days later, $23,750 was repaid. Interest expense must be calculated on the $ 124,000 for eight days. In addition, interest expense on the $100,250 balance of the loan ($124,000 less $23,750 = $100,250) must be calculated for the 20 days remaining in the month of June.] 35. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] Closing Entries 36. Close the revenue accounts. 37. Close the expense accounts. 38. Close the income summary account. 39. Close the dividends account. A Byte of Accounting, Inc. Worksheet For Period Ending January 0, 1900 Unadjusted Trial Balance Debit Credit Adjusting Entries Debit Credit Adjusted Trial Balance Debit Credit Account Number Name 1110 Cash 1120 Accounts Receivable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip. 1311 Computer Equip. 1312 Accum. Depr.-Computer Equip. 1411 Building Cost 1412 | Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3200 Retained Earnings 3300 Dividends 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 Oil & Gas Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Income Tax Expense w Na 2 3 A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Credit Transaction Date Name Account Description # 1 Not in Balance by $30,520.00 Debit 011 Need An Account Number 30,520.00) 02 031 04 051 gugaasaa SOS NESSE RECOMA 061 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 07 08 09 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts