Question: Step 1 The Chart of Accounts includes all of the accounts that you can use to solve your case. You may want to print the

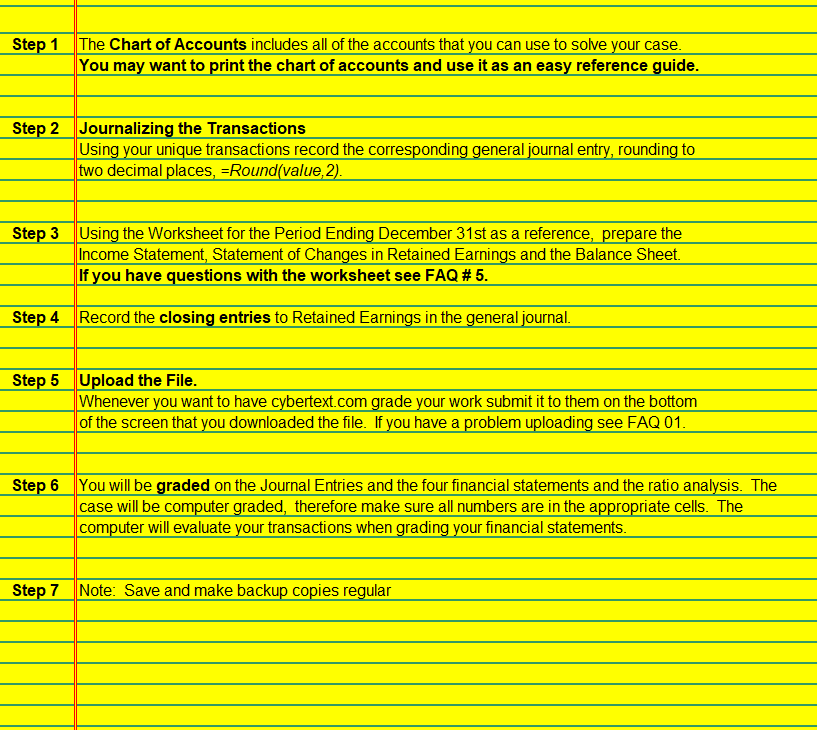

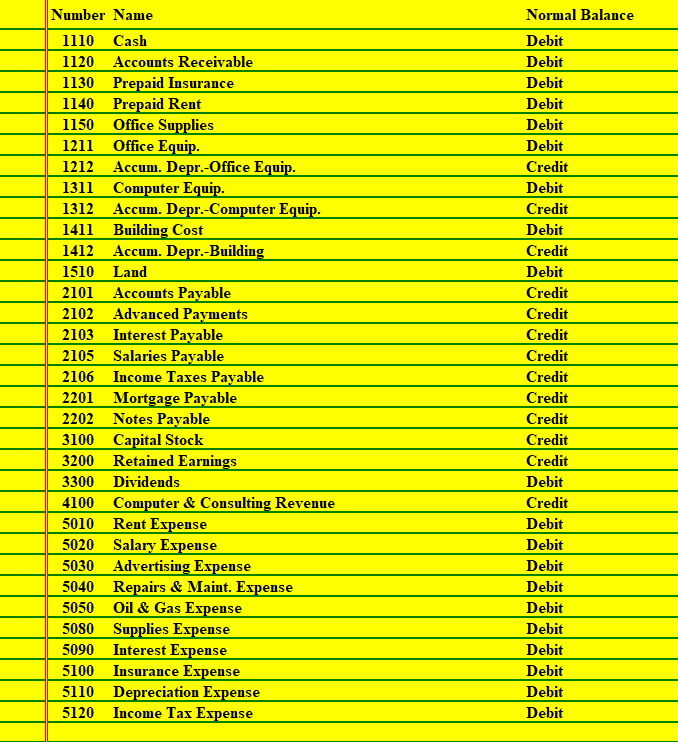

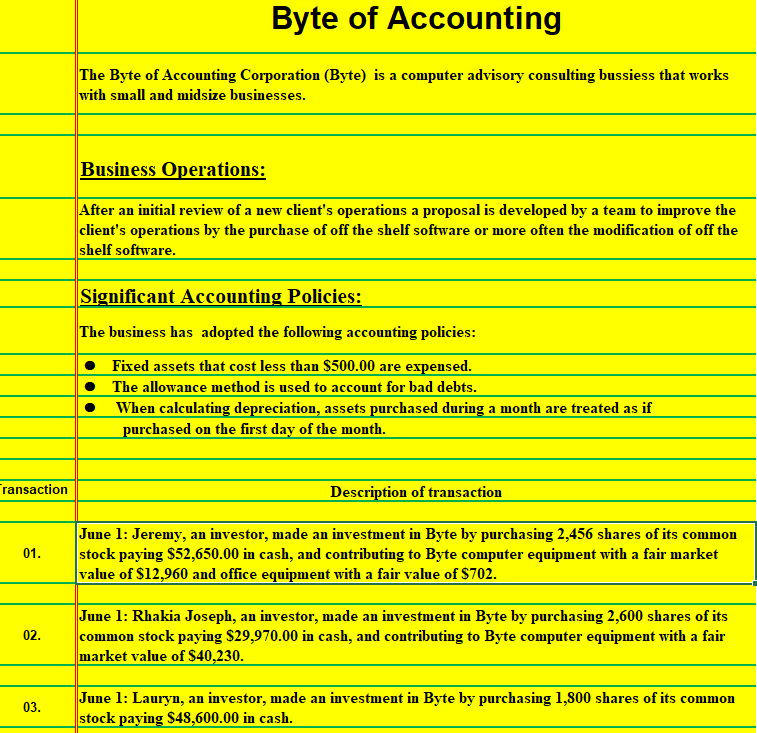

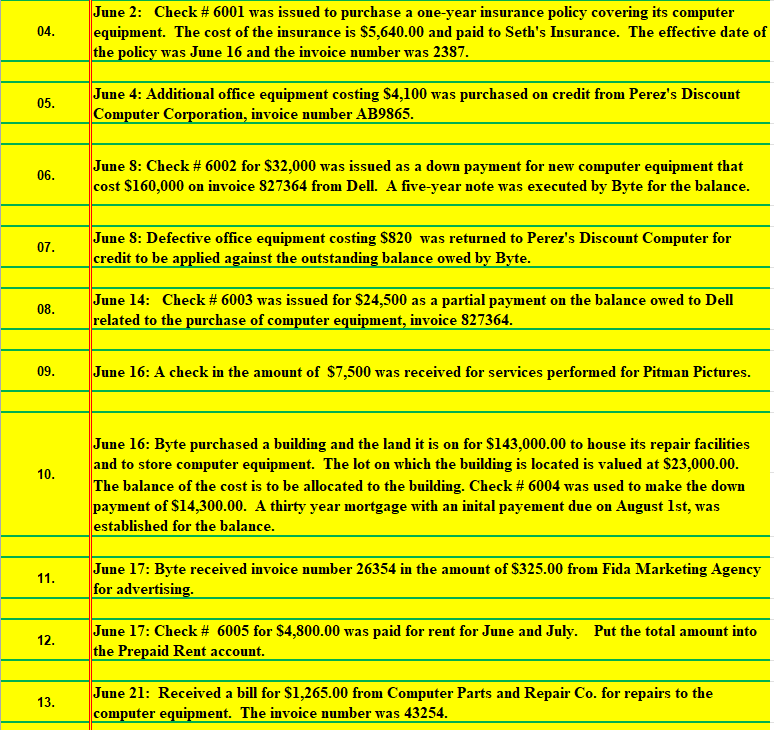

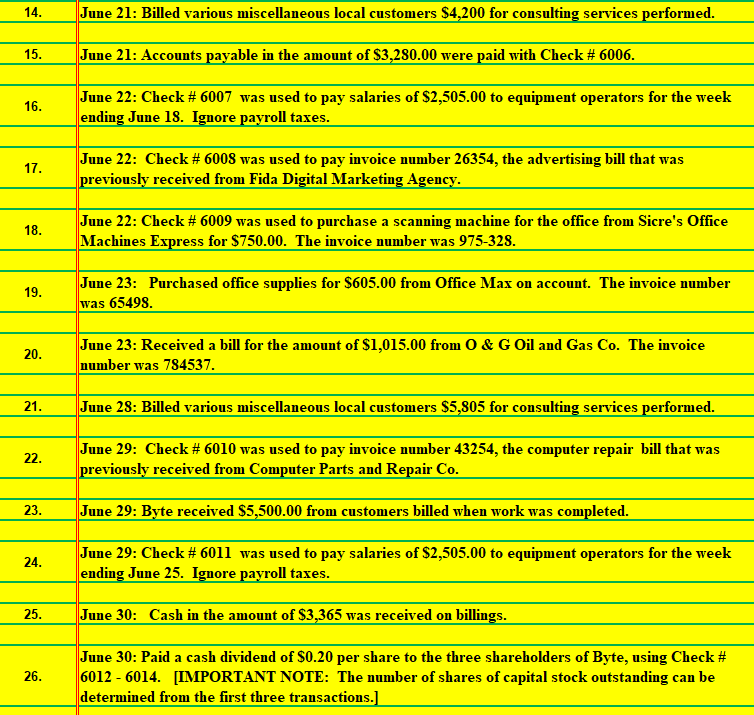

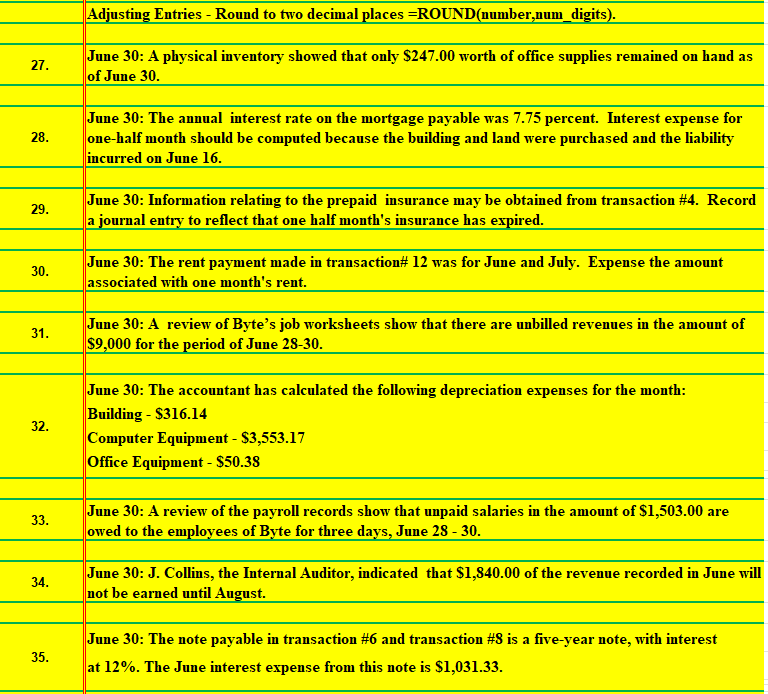

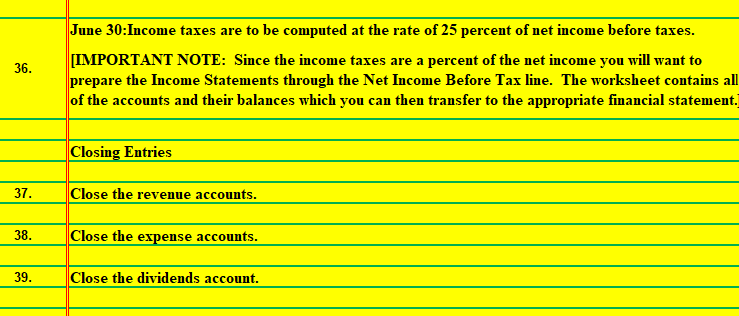

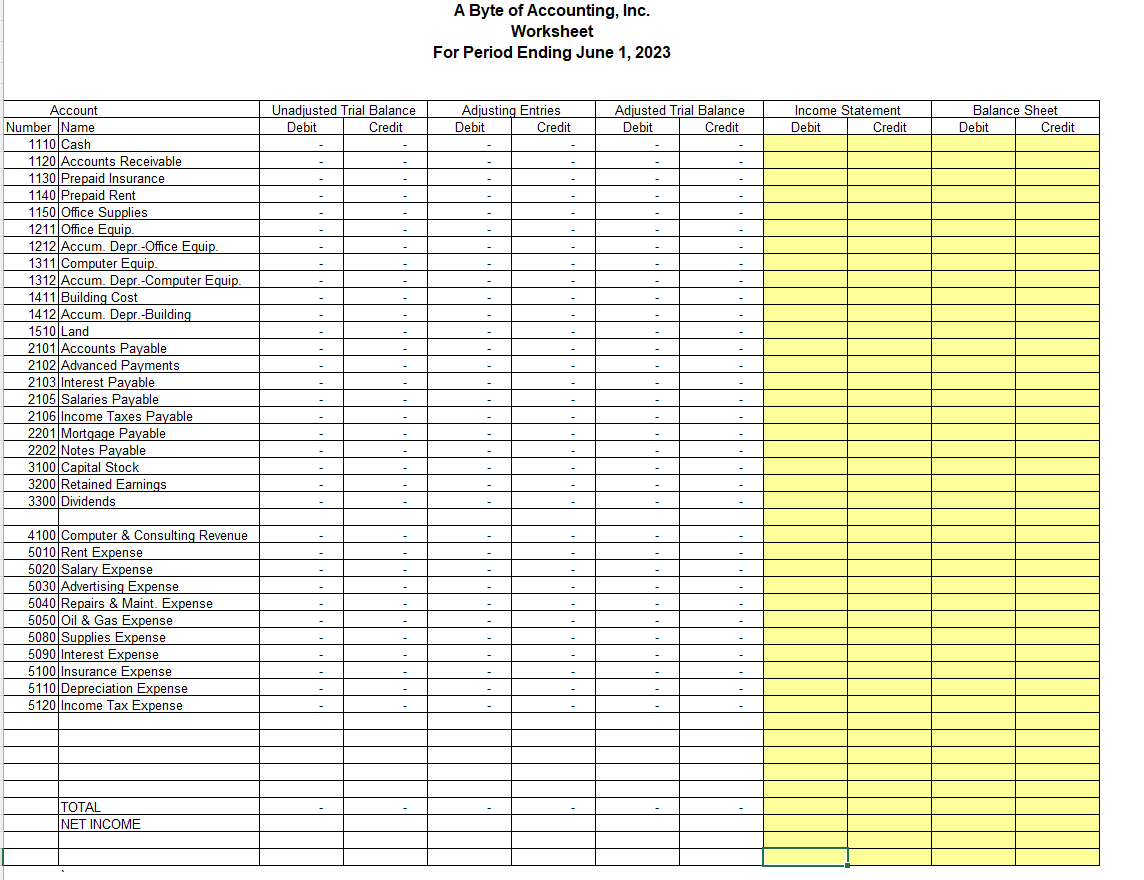

Step 1 The Chart of Accounts includes all of the accounts that you can use to solve your case. You may want to print the chart of accounts and use it as an easy reference guide. Step 2 Journalizing the Transactions Using your unique transactions record the corresponding general journal entry, rounding to two decimal places, = Round ( value, 2). Step 3 Using the Worksheet for the Period Ending December 31st as a reference, prepare the Income Statement, Statement of Changes in Retained Earnings and the Balance Sheet. If you have questions with the worksheet see FAQ \# 5. Step 4 Record the closing entries to Retained Earnings in the general journal. Step 5 Upload the File. Whenever you want to have cybertext.com grade your work submit it to them on the bottom of the screen that you downloaded the file. If you have a problem uploading see FAQ 01. Step 6 You will be graded on the Journal Entries and the four financial statements and the ratio analysis. The case will be computer graded, therefore make sure all numbers are in the appropriate cells. The computer will evaluate your transactions when grading your financial statements. Step 7 Note: Save and make backup copies regular Byte of Accounting The Byte of Accounting Corporation (Byte) is a computer advisory consulting bussiess that works with small and midsize businesses. Business Operations: After an initial review of a new client's operations a proposal is developed by a team to improve the client's operations by the purchase of off the shelf software or more often the modification of off the shelf software. Significant Accounting Policies: The business has adopted the following accounting policies: - Fixed assets that cost less than $500.00 are expensed. - The allowance method is used to account for bad debts. - When calculating depreciation, assets purchased during a month are treated as if purchased on the first day of the month. June 1: Jeremy, an investor, made an investment in Byte by purchasing 2,456 shares of its common 01. stock paying $52,650.00 in cash, and contributing to Byte computer equipment with a fair market value of $12,960 and office equipment with a fair value of $702. June 1: Rhakia Joseph, an investor, made an investment in Byte by purchasing 2,600 shares of its 02. common stock paying $29,970.00 in cash, and contributing to Byte computer equipment with a fair market value of $40,230. 03. June 1: Lauryn, an investor, made an investment in Byte by purchasing 1,800 shares of its common stock paying $48,600.00 in cash. June 30:Income taxes are to be computed at the rate of 25 percent of net income before taxes. 36. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement. Closing Entries 37. Close the revenue accounts. 38. Close the expense accounts. 39. Close the dividends account. A Byte of Accounting, Inc. Worksheet For Period Ending June 1, 2023 Step 1 The Chart of Accounts includes all of the accounts that you can use to solve your case. You may want to print the chart of accounts and use it as an easy reference guide. Step 2 Journalizing the Transactions Using your unique transactions record the corresponding general journal entry, rounding to two decimal places, = Round ( value, 2). Step 3 Using the Worksheet for the Period Ending December 31st as a reference, prepare the Income Statement, Statement of Changes in Retained Earnings and the Balance Sheet. If you have questions with the worksheet see FAQ \# 5. Step 4 Record the closing entries to Retained Earnings in the general journal. Step 5 Upload the File. Whenever you want to have cybertext.com grade your work submit it to them on the bottom of the screen that you downloaded the file. If you have a problem uploading see FAQ 01. Step 6 You will be graded on the Journal Entries and the four financial statements and the ratio analysis. The case will be computer graded, therefore make sure all numbers are in the appropriate cells. The computer will evaluate your transactions when grading your financial statements. Step 7 Note: Save and make backup copies regular Byte of Accounting The Byte of Accounting Corporation (Byte) is a computer advisory consulting bussiess that works with small and midsize businesses. Business Operations: After an initial review of a new client's operations a proposal is developed by a team to improve the client's operations by the purchase of off the shelf software or more often the modification of off the shelf software. Significant Accounting Policies: The business has adopted the following accounting policies: - Fixed assets that cost less than $500.00 are expensed. - The allowance method is used to account for bad debts. - When calculating depreciation, assets purchased during a month are treated as if purchased on the first day of the month. June 1: Jeremy, an investor, made an investment in Byte by purchasing 2,456 shares of its common 01. stock paying $52,650.00 in cash, and contributing to Byte computer equipment with a fair market value of $12,960 and office equipment with a fair value of $702. June 1: Rhakia Joseph, an investor, made an investment in Byte by purchasing 2,600 shares of its 02. common stock paying $29,970.00 in cash, and contributing to Byte computer equipment with a fair market value of $40,230. 03. June 1: Lauryn, an investor, made an investment in Byte by purchasing 1,800 shares of its common stock paying $48,600.00 in cash. June 30:Income taxes are to be computed at the rate of 25 percent of net income before taxes. 36. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement. Closing Entries 37. Close the revenue accounts. 38. Close the expense accounts. 39. Close the dividends account. A Byte of Accounting, Inc. Worksheet For Period Ending June 1, 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts