Question: Please help 259 Employee Benefits b. $200,000 net defined benefit asset in noncurrent assets $200,000 net defined benefit liability in noncurrent liabilities d. p1M in

Please help

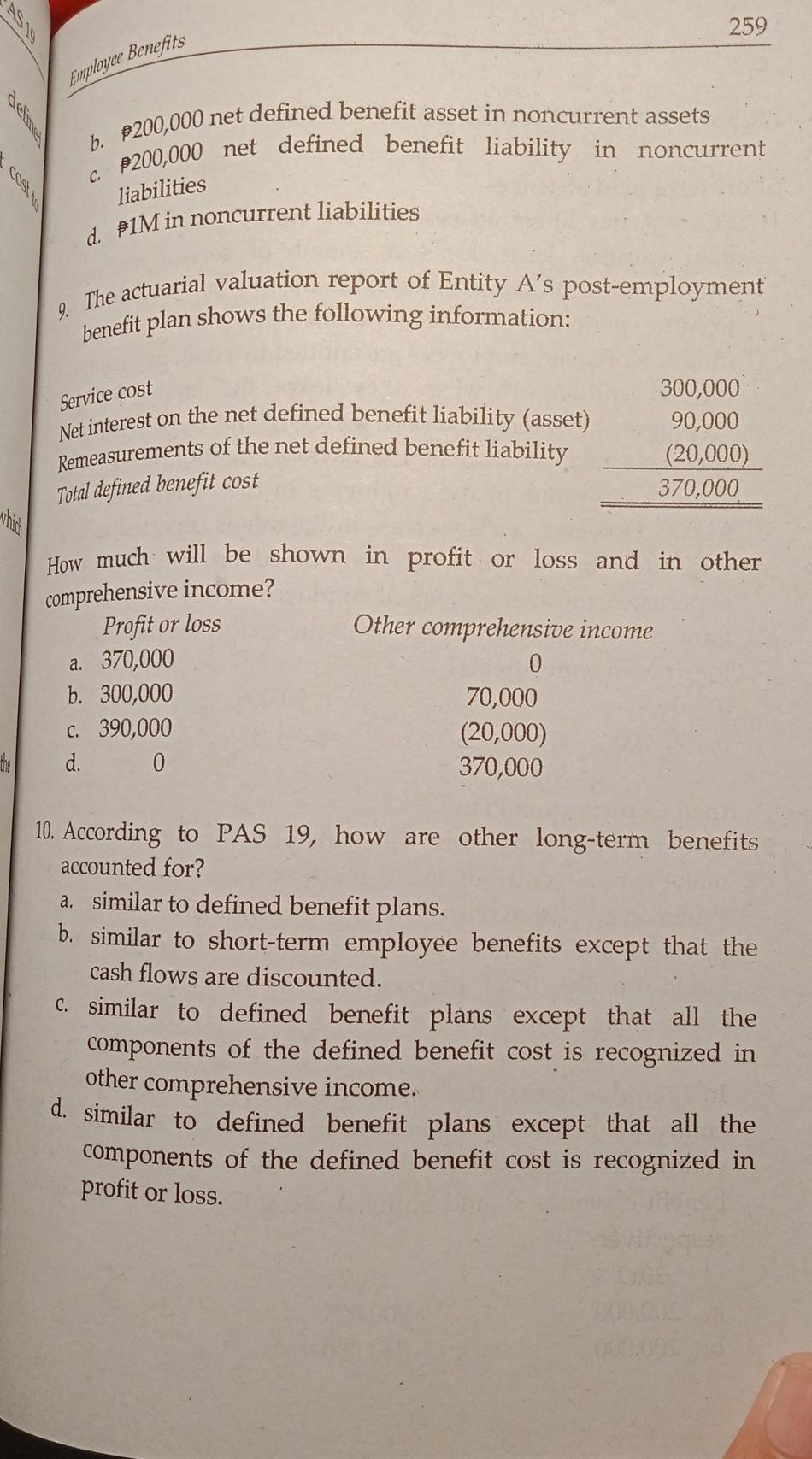

259 Employee Benefits b. $200,000 net defined benefit asset in noncurrent assets $200,000 net defined benefit liability in noncurrent liabilities d. p1M in noncurrent liabilities 9. The actuarial valuation report of Entity A's post-employment benefit plan shows the following information; Service cost Net interest on the net defined benefit liability (asset) Remeasurements of the net defined benefit liability 300,000 90,000 (20,000) 370,000 Total defined benefit cost which How much will be shown in profit or loss and in other comprehensive income? Profit or loss Other comprehensive income a. 370,000 0 b. 300,000 70,000 C. 390,000 (20,000) d. 0 370,000 10. According to PAS 19, how are other long-term benefits accounted for? a. similar to defined benefit plans. b. similar to short-term employee benefits except that the cash flows are discounted. C. similar to defined benefit plans except that all the components of the defined benefit cost is recognized in other comprehensive income. d. similar to defined benefit plans except that all the components of the defined benefit cost is recognized in profit or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts