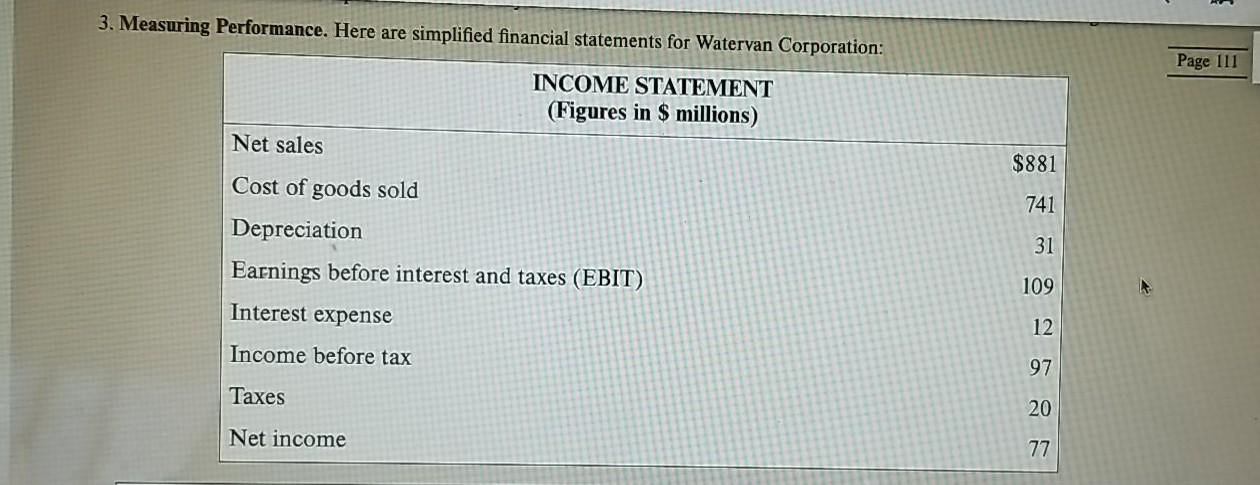

Question: please help 3. Measuring Performance. Here are simplified financial statements for Watervan Corporation: Page 111 INCOME STATEMENT (Figures in $ millions) Net sales $881 741

please help

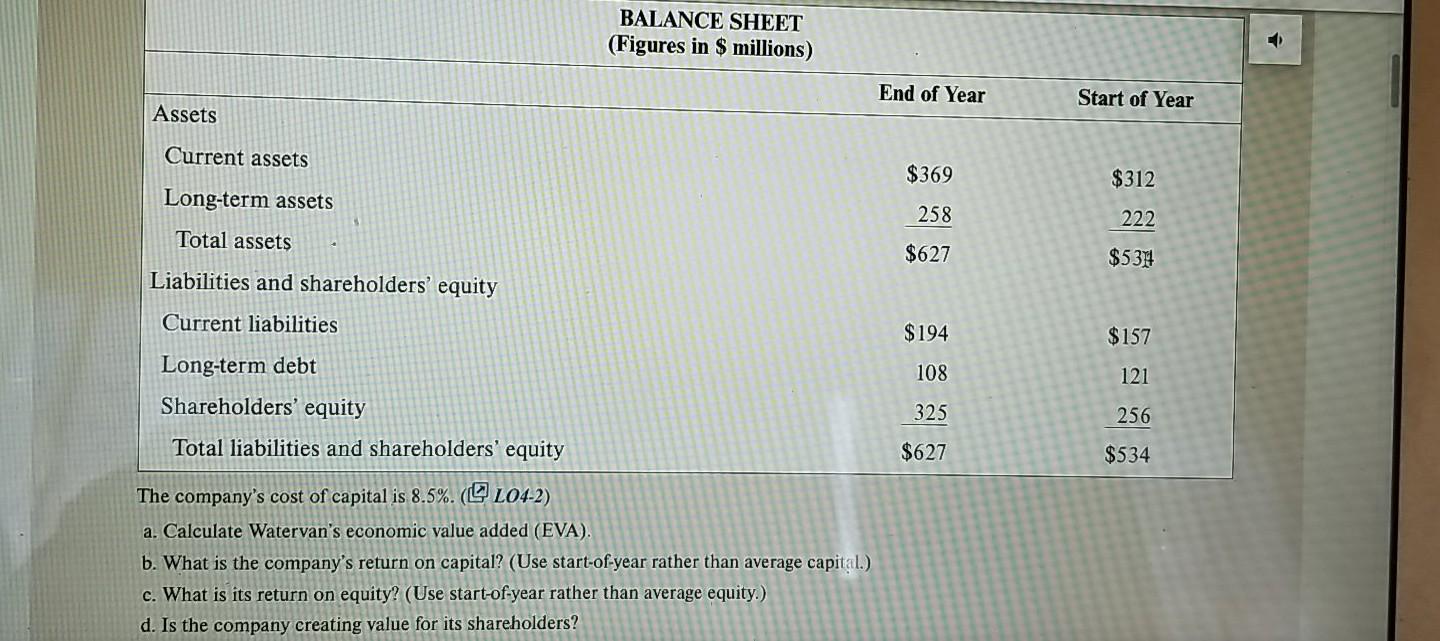

3. Measuring Performance. Here are simplified financial statements for Watervan Corporation: Page 111 INCOME STATEMENT (Figures in $ millions) Net sales $881 741 Cost of goods sold Depreciation Earnings before interest and taxes (EBIT) 31 109 Interest expense 12 Income before tax 97 Taxes 20 Net income 77 BALANCE SHEET (Figures in $ millions) End of Year Start of Year Assets Current assets $369 $312 Long-term assets 258 222 Total assets $627 $538 Liabilities and shareholders' equity Current liabilities $194 $157 108 121 Long-term debt Shareholders' equity Total liabilities and shareholders' equity 325 256 $627 $534 The company's cost of capital is 8.5%. (L04-2) a. Calculate Watervan's economic value added (EVA). b. What is the company's return on capital? (Use start-of-year rather than average capital.) c. What is its return on equity? (Use start-of-year rather than average equity.) d. Is the company creating value for its shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts