Question: please help! 5) A financial manager must choose between four alternative Assets: 1, 2, 3, and 4. The risk- free rate is 7.5%. Each asset

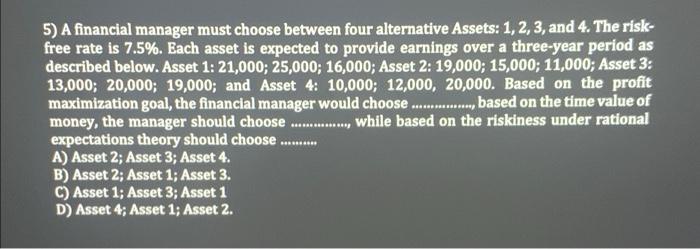

5) A financial manager must choose between four alternative Assets: 1, 2, 3, and 4. The risk- free rate is 7.5%. Each asset is expected to provide earnings over a three-year period as described below. Asset 1: 21,000; 25,000; 16,000; Asset 2: 19,000; 15,000; 11,000; Asset 3: 13,000; 20,000; 19,000; and Asset 4: 10,000; 12,000, 20,000. Based on the profit maximization goal, the financial manager would choose ..... based on the time value of money, the manager should choose ............, while based on the riskiness under rational expectations theory should choose A) Asset 2; Asset 3; Asset 4. B) Asset 2; Asset 1; Asset 3. C) Asset 1; Asset 3; Asset 1 D) Asset 4; Asset 1; Asset 2. SS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts