Question: q5 please 9 13 9 - vum. (c) Question 5C. A financial manager must choose between four alternative Assets: 1, 2, 3, and 4. The

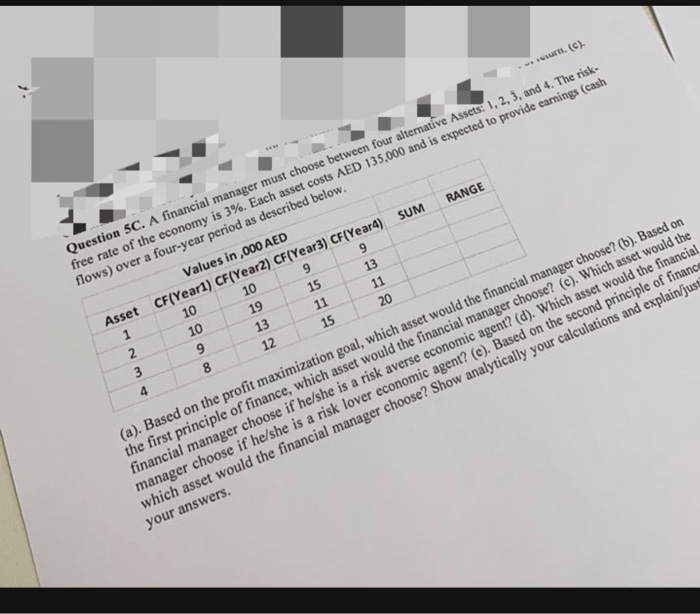

9 13 9 - vum. (c) Question 5C. A financial manager must choose between four alternative Assets: 1, 2, 3, and 4. The risk- free rate of the economy is 3%. Each asset costs AED 135,000 and is expected to provide earnings (cash flows) over a four-year period as described below. Values in ,000 AED Asset CF(Yearl) CF(Year2) CF(Year3) CF(Year4) SUM RANGE 10 10 19 10 13 11 12 15 (a). Based on the profit maximization goal, which asset would the financial manager choose? (b). Based on the first principle of finance, which asset would the financial manager choose? (C). Which asset would the financial manager choose if he/she is a risk averse economic agent? (d). Which asset would the financial manager choose if he/she is a risk lover economic agent? (e). Based on the second principle of finance which asset would the financial manager choose? Show analytically your calculations and explain/just your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts