Question: Please Help. 7. Suppose a bank is faced with two types of borrowers a high risk borrower that should be charged an interest rate of

Please Help.

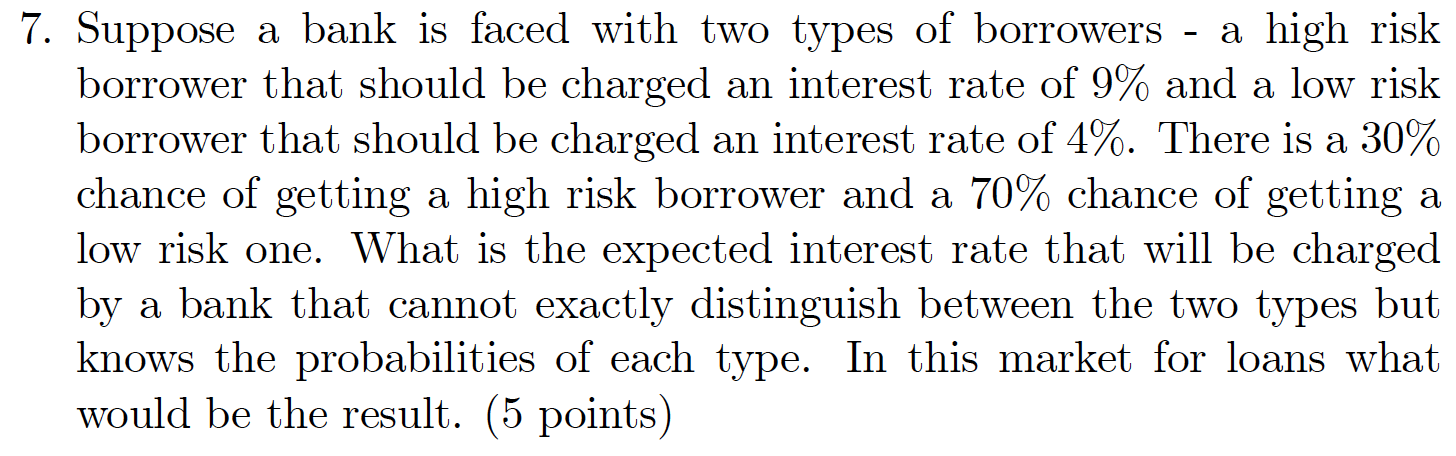

7. Suppose a bank is faced with two types of borrowers a high risk borrower that should be charged an interest rate of 9% and a low risk borrower that should be charged an interest rate of 4%. There is a 30% chance of getting a high risk borrower and a 70% chance of getting a low risk one. What is the expected interest rate that will be charged by a bank that cannot exactly distinguish between the two types but knows the probabilities of each type. In this market for loans what would be the result. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts