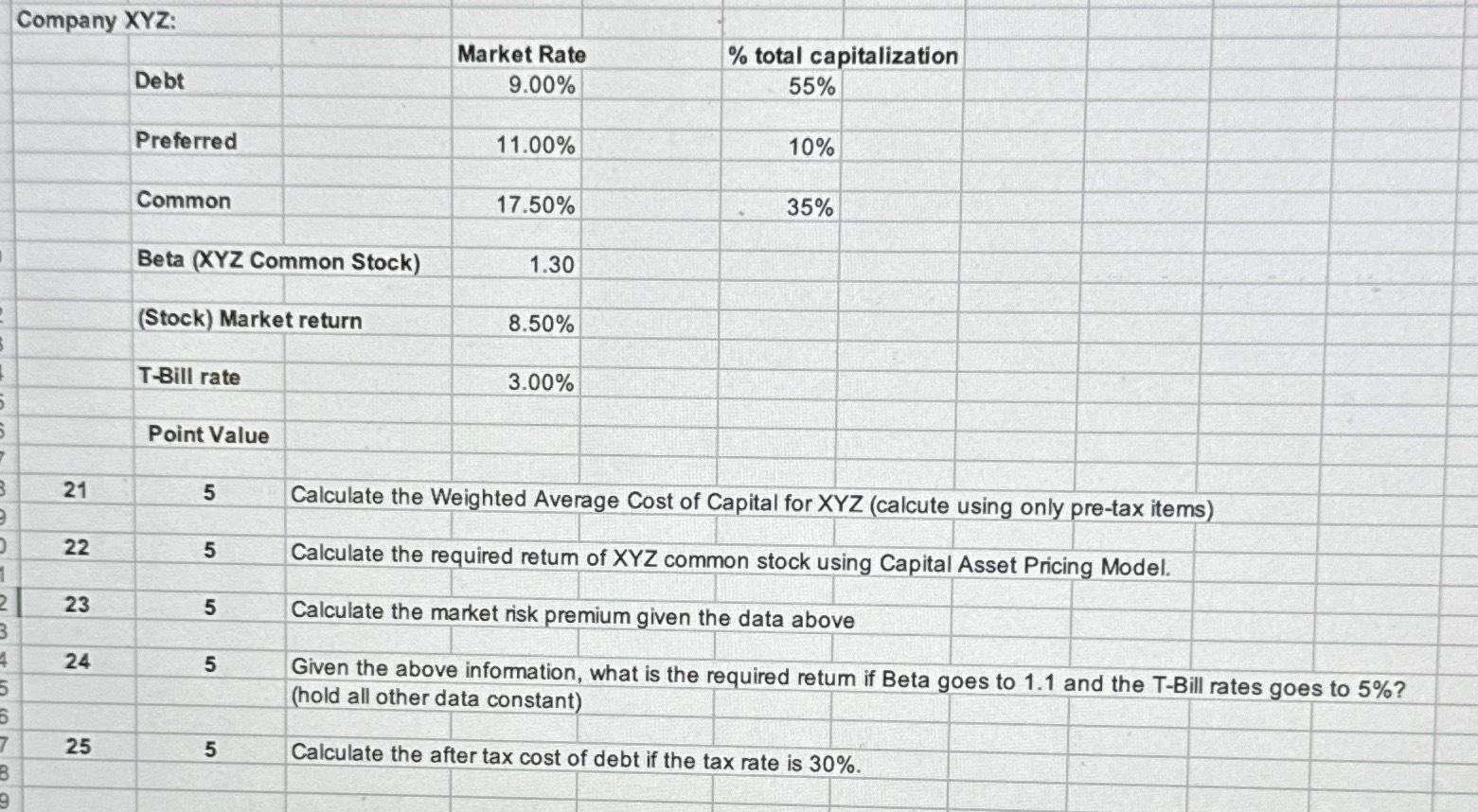

Question: Please help Company XYZ: Debt Preferred Common Beta (XYZ Common Stock) (Stock) Market return rate Point Value Market Rate 9.00% 11.00% 17.50% 1.30 8.50% 3.00%

Company XYZ: Debt Preferred Common Beta (XYZ Common Stock) (Stock) Market return rate Point Value Market Rate 9.00% 11.00% 17.50% 1.30 8.50% 3.00% % total capitalization 55% 10% 35% 21 22 23 24 25 5 5 5 5 5 Calculate the Cost of Capital for XYZ calpute usin on re-tax items Calculate the re uired retum of XYZ common stock using Capital Asset Pricin Model. Calculate the rrerket risk remium given the data above Given the above infomation, what is the requirpdrptyrn if Beta oes to 1.1 and the T-Bill rates oes to 5%? old all other data constant Calculate the after tax cost of debt if the tax rate is 30%.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts