Question: Please help A convertble bond is a bond that can be corwerted into a specified number of shares of stock at the option of the

Please help

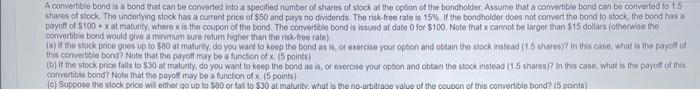

A convertble bond is a bond that can be corwerted into a specified number of shares of stock at the option of the bondholder, Assume that a convertible bond can be converted to t.5 payolf of $100+x at maturity, where x is the coupon of the bond. The comertiolo bond is issuod at date 0 for $100. Note that x carnot be larger than $15 dollars (otherwise the converible bond would give a minimum sure return higher than the risk.free rale) inis conversble bond? Note that the payct may be a tuncton of x ( 5 points) (b) If the stock price falis to $30 at matuity, do you want to keep the bond as is, or exerose your option and obtain the stock instead (1 5 shares)? in this case, what is the payct of this convertible bond? Note that the payct may be a function of x. ( 5 points) (c) Suppose the stock price will either go up to $90 or toll to $30 at maturity. What is the no-arbitrace value of the coupon of this convertiblo bond? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts