Question: please help!! A non-deliverable forward contract on KRW5,000,000 has a current price of F(KRW/USD) = 1,150.00. If the spot rate at maturity is S(KRW/USD) =

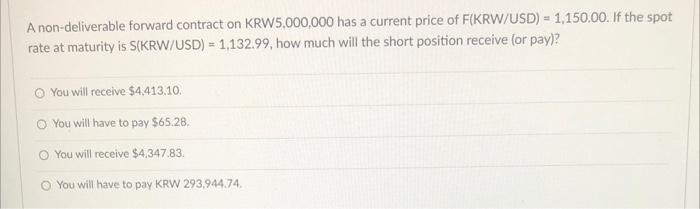

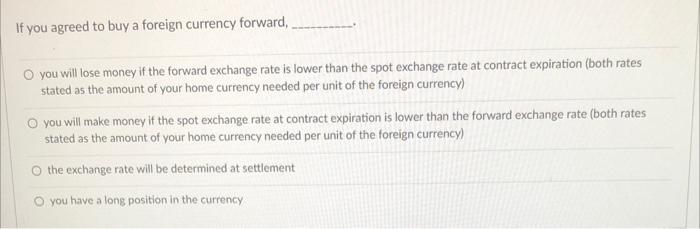

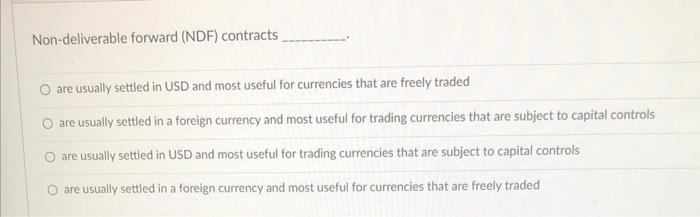

A non-deliverable forward contract on KRW5,000,000 has a current price of F(KRW/USD) = 1,150.00. If the spot rate at maturity is S(KRW/USD) = 1,132.99, how much will the short position receive (or pay)? You will receive $4,413.10. You will have to pay $65.28. You will receive $4,347.83. You will have to pay KRW 293,944.74 If you agreed to buy a foreign currency forward, O you will lose money if the forward exchange rate is lower than the spot exchange rate at contract expiration (both rates stated as the amount of your home currency needed per unit of the foreign currency) O you will make money if the spot exchange rate at contract expiration is lower than the forward exchange rate (both rates stated as the amount of your home currency needed per unit of the foreign currency) O the exchange rate will be determined at settlement O you have a long position in the currency Non-deliverable forward (NDF) contracts are usually settled in USD and most useful for currencies that are freely traded O are usually settled in a foreign currency and most useful for trading currencies that are subject to capital controls O are usually settled in USD and most useful for trading currencies that are subject to capital controls are usually settled in a foreign currency and most useful for currencies that are freely traded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts