Question: please help all the question, I marked some question but I am not sure, hope didn't Interfere with you B. Problems and Questions A landscaper

please help all the question, I marked some question but I am not sure, hope didn't Interfere with you

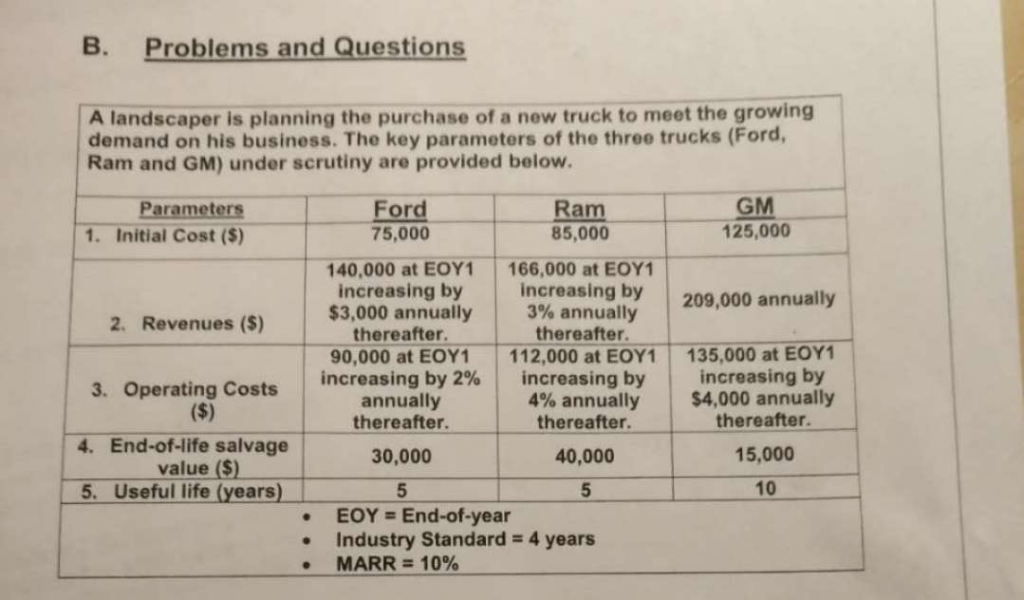

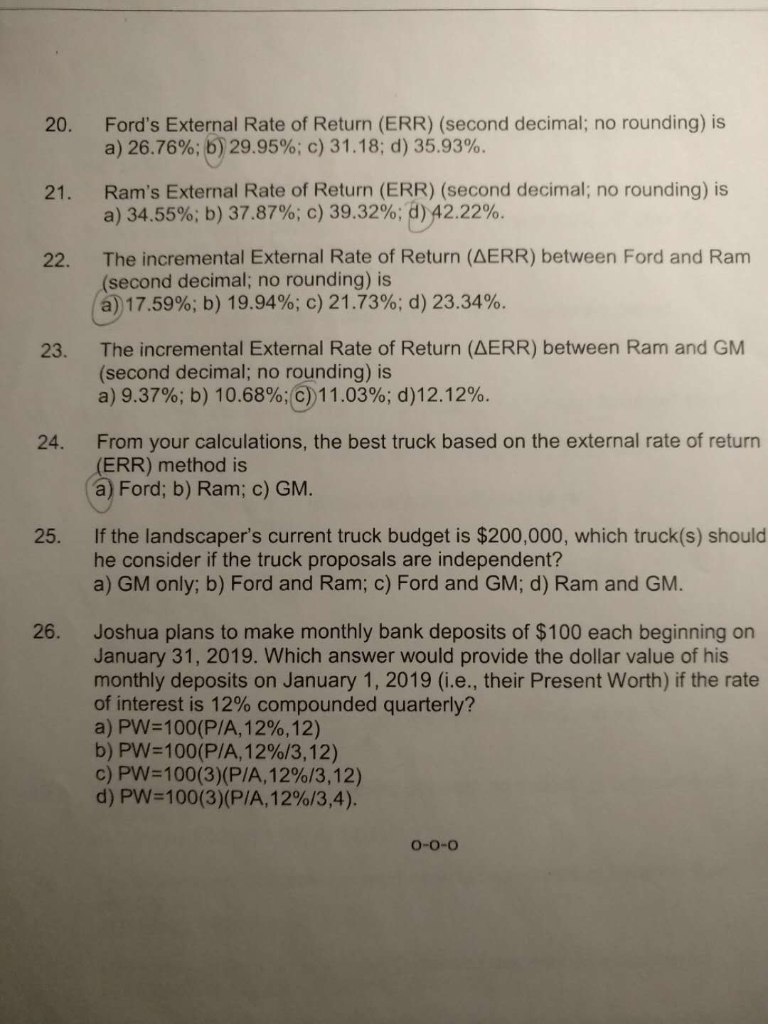

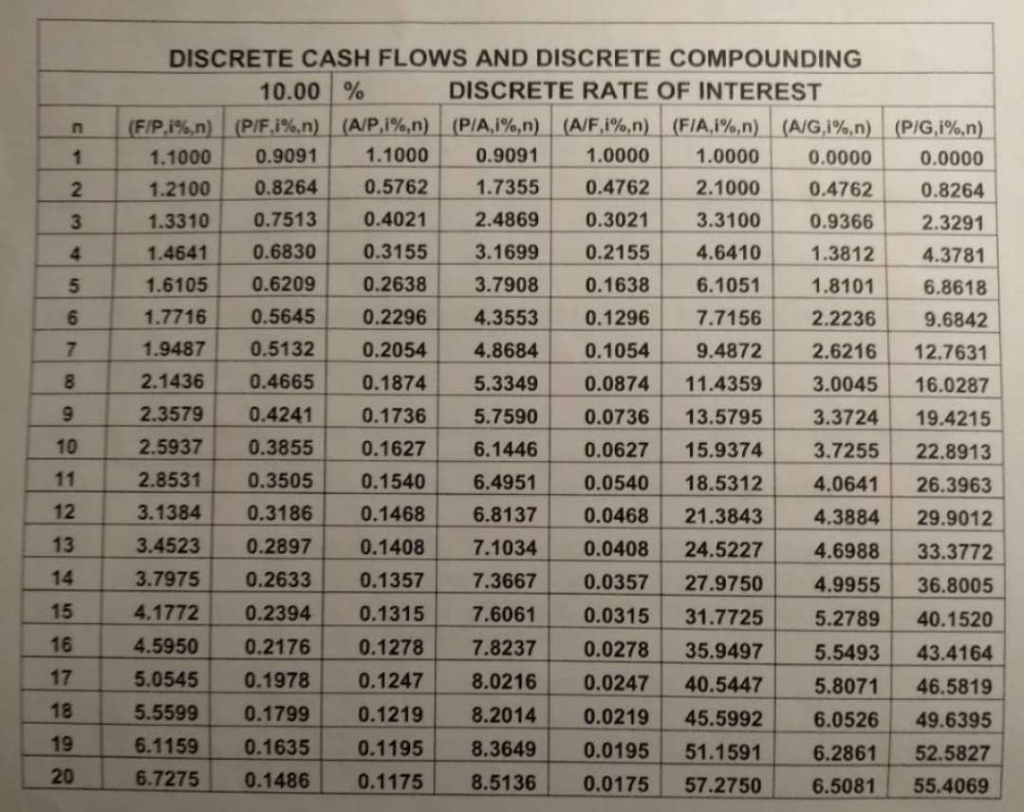

B. Problems and Questions A landscaper is planning the purchase of a new truck to meet the growing demand on his business. The key parameters of the three trucks (Ford, Ram and GM) under scrutiny are provided below. Parameters 1. Initial Cost ($) Ford 75,000 Ram 85,000 GM 125,000 140,000 at EOY1 166,000 at EOY1 increasing by 209,000 annually 3% annually thereafter. 90,000 at EOY1 112,000 at EOY1 135,000 at EOY1 increasing by $3,000 annually thereafter 2. Revenues ($) 3. Operating Costs | increasingby 2% increasingby | increasing $4,000 annually annually 4% annually thereafter 40,000 : End-of-life salvage value (S) 5. Useful life (years)5 thereafter. 30,000 5 thereafter. 15,000 10 5 EOY-End-of-year Industry Standard 4 years MARR 10% Ford's External Rate of Return (ERR) (second decimal; no rounding) is a) 26.76%; b) 29.95%; c) 31.18; d) 35.93%. 20. Ram's External Rate of Return (ERR) (second decimal; no rounding) is a) 34.55%; b) 37.87%, c) 39.32%; d) 42.22%. 21. 22. The incremental External Rate of Return (AERR) between Ford and Ram (second decimal; no rounding) is a)17.50% b) 19.94%; c) 21.73% d) 23.34%. 23. The incremental External Rate of Return (AERR) between Ram and GM (second decimal; no rounding) is a) 9.37%; b) 10.68%011.03%; d)12.12%. From your calculations, the best truck based on the external rate of return (ERR) method is a) Ford; b) Ram; c) GM 24. If the landscaper's current truck budget is $200,000, which truck(s) should he consider if the truck proposals are independent? a) GM only; b) Ford and Ram; c) Ford and GM; d) Ram and GM. 25. 26. Joshua plans to make monthly bank deposits of $100 each beginning orn January 31, 2019. Which answer would provide the dollar value of his monthly deposits on January 1, 2019 (i.e., their Present Worth) if the rate of interest is 12% compounded quarterly? a) PW-100(P/A,12%, 12) b) PW-100(P/A, 12%/3, 12) c) PW 100(3)(P/A,12%/312) d) PW 100(3)(P/A, 12%/3,4). 0-0-o DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING 10.00 | % DISCRETE RATE OF INTEREST 1.1000 0.9091 1.1000 0.9091 1.0000 1.0000 0.0000 0.0000 1.2100 : 0.3264 -0.5762-1.7355 + 0.4762/ -2.1000-0.4762: 0.8264 1.3310 0.7513 0.4021 2.4869 0.3021 3.3100 0.9366 2.3291 1.4641 0.6830 0.3155 3.1699 0.2155 4.6410 1.38124.3781 1.6105 0.6209 0.2638 3.7908 0.1638 6.1051 1.8101 6.8618 1.7716 0.5645 0.2296 4.3553 0.1296 7.71562.2236 9.6842 7 | 1.9487_-0.5132| 0.2054 | 4.8684| 0.1054" 9.48721-2.62 16112.7631 2.1436 0.4665 0.1874 5.3349 0.0874 11.4359 3.0045 16.0287 2.3579 0.4241 0.1736 5.7590 0.0736 13.57953.3724 19.4215 2.5937 0.3855 0.1627 6.1446 0.0627 15.9374 3.7255 22.8913 2.8531 0.3505 0.1540 6.4951 0.0540 18.5312 4.0641 26.3963 3.1384 0.3186 0.1468 6.8137 0.0468 21.3843 4.3884 29.9012 3.4523 0.2897 0.1408 7.1034 0.0408 24.5227 4.6988 33.3772 3.7975 0.2633 0.1357 7.3667 0.0357 27.9750 4.9955 36.8005 4.1772 0.2394 0.1315 7.6061 0.0315 31.7725 5.2789 40.1520 4.5950 0.2176 0.1278 7.8237 0.0278 35.9497 5.5493 43.4164 5.0545 0.1978 0.1247 8.0216 0.0247 40.5447 5.8071 46.5819 5.5599 0.1799-0.1219| 8.2014 | 0.0219 L 45.5992 | 6.0526-49.6395 6.1159 0.1635 0.1195 8.3649 0.0195 51.1591 6.2861 52.5827 6.7275 0.1486 0.1175 8.5136 0.0175 57.2750 6.5081 55.4069 2 5 6 10 12 13 14 15 16 17 18 19 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts